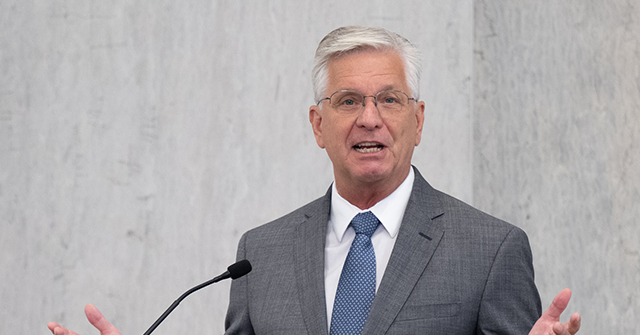

Federal Reserve Governor Christopher Waller on Wednesday laid out a pro-market vision for modernizing U.S. payments that echoes the Trump administration’s call to “re-privatize” the economy, urging that private firms take the lead on innovation while the Fed focuses on keeping the financial system’s plumbing safe and efficient.

Speaking at the Wyoming Blockchain Symposium, Waller said the payments system is in the midst of a “technology-driven revolution,” with smart contracts, tokenization and distributed ledgers representing new ways to transfer and record ownership. “There is nothing to be afraid of,” he said.

Waller emphasized that payments progress follows two models: private-sector innovation by default, and public-sector platforms only when markets cannot provide. He likened stablecoins to earlier waves of card-network innovation and argued they could improve cross-border payments and “maintain and extend the role of the dollar internationally.”

The policy backdrop has moved in his favor. President Donald Trump in July signed the GENIUS Act, the first federal framework for payment stablecoins, which aims to give issuers clear rules while embedding them in the regulated financial system. Treasury Secretary Scott Bessent has described the administration’s broader agenda as an effort to revive private-sector dynamism—through tax policy, deregulation, and market-driven reforms—rather than rely on government expansion.

Artificial intelligence is emerging as another pillar, Waller said, noting that payment companies have used machine learning for decades to detect fraud and that newer generative and “agentic” systems are being deployed to reconcile transactions and strengthen compliance.

The Fed’s role, he added, is to keep upgrading its own rails—from telegraph-era Fedwire to today’s instant payment systems—while researching whether tokenization and AI can make settlement faster and more resilient. That limited scope, he suggested, allows private players to push the frontier while the central bank provides modern infrastructure.

Waller is the leading contender to replace Fed chairman Jerome Powell if Trump makes his pick from current Fed governors, which could be necessary if Powell decides to hold on to his seat on the board of governors after his tenure as chair expires in May.

Read the full article here