Trump swipes at Powell, dollar sinks, gold soars.

Truth Social Rip

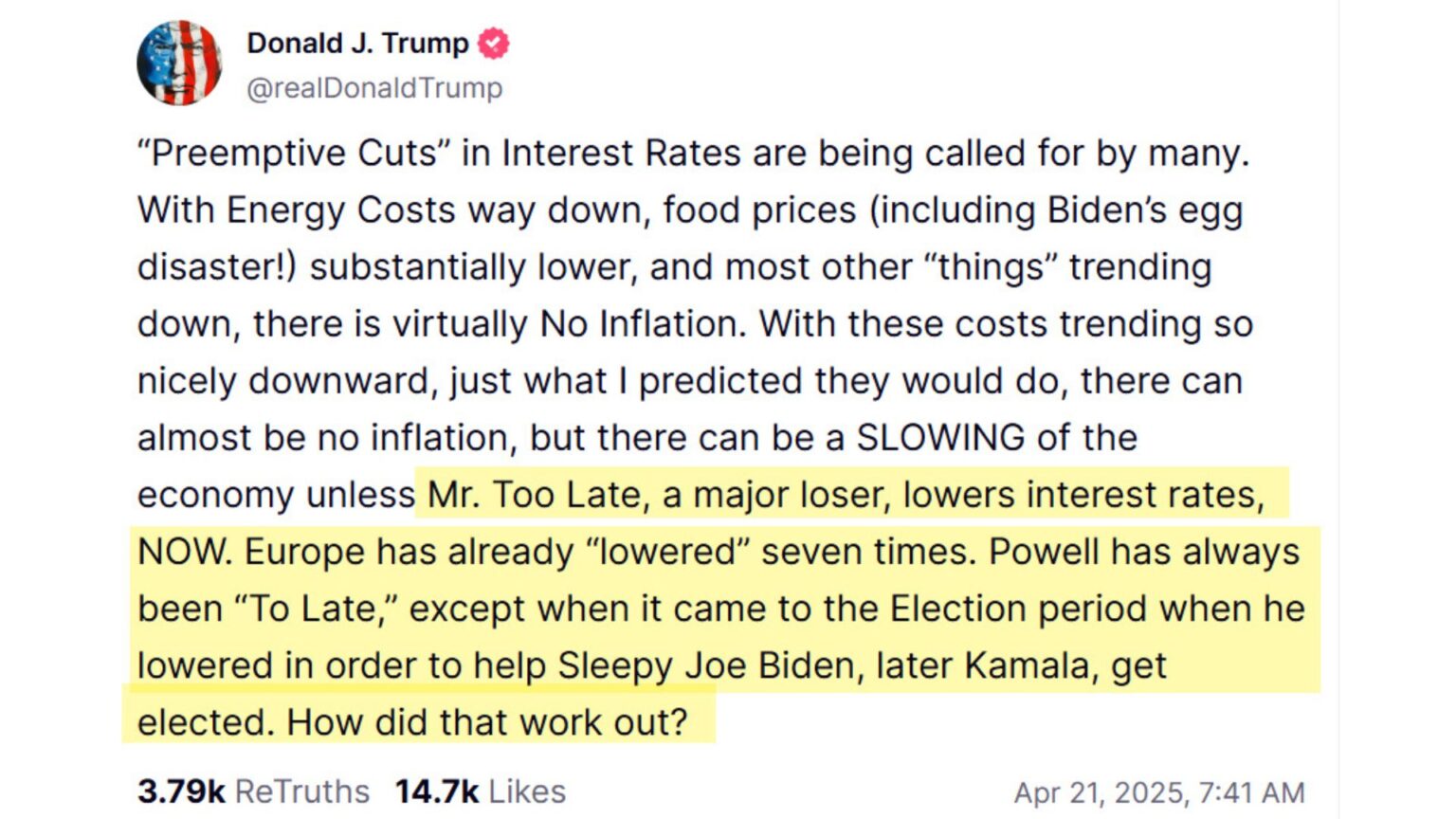

Truth Social Link: “Preemptive Cuts” in Interest Rates are being called for by many. With Energy Costs way down, food prices (including Biden’s egg disaster!) substantially lower, and most other “things” trending down, there is virtually No Inflation. With these costs trending so nicely downward, just what I predicted they would do, there can almost be no inflation, but there can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW. Europe has already “lowered” seven times. Powell has always been “To Late,” except when it came to the Election period when he lowered in order to help Sleepy Joe Biden, later Kamala, get elected. How did that work out?

Trump Rattles the Markets

CNBC reports Trump demands ‘loser’ Fed chair lower rates ‘NOW’

Trump’s latest salvo against Powell — whom he appointed during his first administration — came as the president and his team are studying whether they can legally fire the central bank leader before his term expires in May 2026.

Powell has flatly stated that the president cannot remove him under the law.

Any attempt by Trump to fire Powell would likely trigger a steep sell off in U.S. equity markets, Evercore ISI Vice President Krishna Guha told CNBC on Monday.

“If you start to raise questions about Federal Reserve independence, you are raising the bar for the Federal Reserve to cut. If you actually did try to remove the Federal Reserve chairman, I think you would see a severe reaction in markets with yields higher, dollars lower and equities selling off,” Guha said on “Squawk Box.”

Can Trump Fire Powell?

Bloomberg asks Can Trump Fire Powell?

President Donald Trump is again raising questions about whether he will seek to limit the Federal Reserve’s independence, as new tensions flare in his contentious relationship with the central bank.

A president can’t dismiss a Fed chair easily, legal scholars say. Section 10 of the Federal Reserve Act says members of the Fed’s Board of Governors, of which the chair is one, can be “removed for cause by the president.” Legal scholars have generally interpreted “cause” to mean serious misconduct or abuse of power.

Whether a president can strip a governor of the chairmanship is more ambiguous because the law doesn’t explicitly provide the “for cause” protection for that role, said Peter Conti-Brown, a professor and Fed historian at the Wharton School of the University of Pennsylvania. Regardless, because of the “for cause” protections for governors, stripping a Fed chair of that title might mean the individual could remain on the board. It also might not remove such an individual from another powerful perch: head of the Federal Open Market Committee, or FOMC, the policymaking group that sets interest rates. Its members, not the president, choose who leads it.

Powell’s term as chair is set to expire in 2026, while his 14-year term as a governor is scheduled to end in 2028. That presents Trump with one of two scheduled opportunities to name appointees to the Fed board. Another is set to come in January 2026, when Fed Governor Adriana Kugler’s term expires.

But those positions represent a small slice of the Fed’s 19 policymakers — all the Fed governors and the presidents of the 12 regional Federal Reserve banks. The regional presidents are selected not by the president, but by directors of the individual banks, subject to the approval of the Fed’s Board of Governors.

Is Trump Foolish Enough to Push the Envelope?

Of course. The law has little meaning to Trump. This is proven.

But “yes” does not imply that I believe he will.

Polymarket thinks there is only a 20 percent chance for 2025. That is likely as good a guess as any, and better than most.

Trump is a bully who backs down when punched. And Powell has announced he will not go if trump tries to fire him. This is why the odds are only 20 percent.

Nor will Powell be intimidated by Trump into cutting rates. But Trump can easily do anything on a whim or out of anger, so firing Powell is definitely possible.

Case for a Free Market

There should not be a Fed. The free market would do a far better job setting rates than the Fed.

But the Fed is far better than political hacks taking over things. Trump has no idea of the damage he is causing.

Q&A on Inflation and Trump

Q: Have we seen a rise in inflation yet?

A: No, because all importers font ran the tariffs

Q: So there might be a lag in inflation due to tariffs?

A: Yes, and the data collection itself lags.

Q: What about declining oil prices?

A: That is probably Trump’s strongest point. It’s very disinflationary.

Q: Food?

A: Farm labor deportations and tariffs are a positive push on food inflation.

Q: What about rare earth elements?

A: Trump is playing with fire. China controls about 50 percent of supply and 90 percent of processing. We should not be in this position but we are. Even in a sinking economy prices could jump dramatically.

Q: What about Technology?

A: You tell me. Tariffs are on again, off again.

Q: Does anyone have any idea what Trump will do with reciprocal tariffs?

A: Of course not. Trump could back down further or totally disrupt supply chains where importers cannot get much of anything at any price.

New York Fed President Expects Tariffs to Boost Inflation

On April 11, I noted New York Fed President John Williams Expects Tariffs to Boost Inflation

I now expect real GDP growth will slow considerably from last year’s pace, likely to somewhat below 1 percent. With this downshift in the pace of growth, I expect the unemployment rate to rise from its current level of 4.2 percent to between 4-1/2 and 5 percent over the next year. I expect increased tariffs to boost inflation this year to somewhere between 3-1/2 and 4 percent.

China Halts Rare Earth Exports Desperately Needed by the US

On April 13, 2025, I commented China Halts Rare Earth Exports Desperately Needed by the US

I have been warning about this for years. It’s now happening.

Fed Chair Powell Warns of Higher Inflation and Slower Growth Due to Tariffs

On April 16, I commented Fed Chair Powell Warns of Higher Inflation and Slower Growth Due to Tariffs

The level of the tariff increases announced so far is significantly larger than anticipated. The same is likely to be true of the economic effects, which will include higher inflation and slower growth.

Tariffs are highly likely to generate at least a temporary rise in inflation. The inflationary effects could also be more persistent. Avoiding that outcome will depend on the size of the effects, on how long it takes for them to pass through fully to prices.

Final Q&A (One Repeat Q)

Q: Does anyone have any idea what Trump will do with reciprocal tariffs?

A: Of course not. Trump could back down further or totally disrupt supply chains where importers cannot get much of anything at any price.

Q: Given the above, plus known reporting lags, plus uncertainty over the meaning and timing of reciprocal tariffs, what should the Fed do?

A: Wait

There is a significant chance of stagflation even if it’s not the base case.

And if the market senses a premature or unwarranted cut, yields on the long end of the curve will soar.

I am not a Fed apologist. But I am not a Trump apologist either. What the Fed does not want to do is make an error in either direction and have to reverse it.

This post originated on MishTalk.Com

Thanks for Tuning In!

Mish

Read the full article here