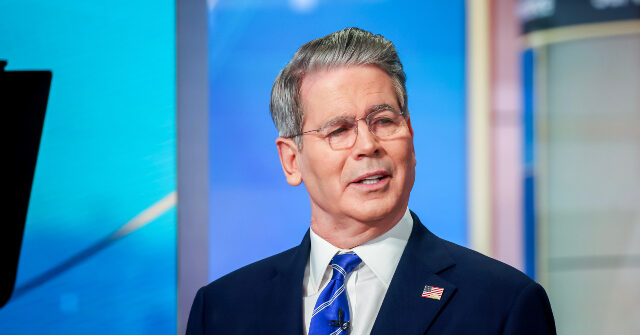

Treasury Secretary Scott Bessent had his first meeting with the Internal Revenue Service (IRS) as the Trump administration seeks to revamp the agency.

Bessent visited the IRS for the first time since he began serving as the acting commissioner after replacing Billy Long the prior week.

During the meeting, Secretary Bessent reiterated his three priorities for the IRS: revenue collections, privacy, and customer service.

Critics of the president have said that the administration’s efforts to modernize the IRS would result in decreased revenue, but tax receipts increased by 14.7 percent in May. Through the tax filing season, the agency brought in $2.04 trillion, an increase of $100 billion compared to last year. April receipts were also up 9.5 percent compared to 2024.

Since the IRS reprioritized customer service, the agency has processed 141 million individual tax returns and doled out $253 billion in individual refunds, which is up 3.2 percent compared to last year. IRS taxpayer services fielded 8.9 million calls, which had an average wait time of three minutes.

Notably, the agency managed to boost its customer service output while reducing operational costs and infrastructure technology spending by $2 trillion. The IRS has cancelled or modified 400 contracts at the agency, which resulted in a savings of roughly $500 million.

Prior to the start of the Trump administration, the IRS released software updates every two to three months; now, the agency updates software every two to three days.

The updates and modernization remain a critical mission of the IRS as it seeks to implement the reforms in the One Big Beautiful Bill. The Big Beautiful Bill contains over 100 new provisions affecting taxes, including no tax on tips, no tax on overtime, tax cuts for seniors, and auto loan interest deductibility.

The agency has sought to create the “most efficient” service while also protecting taxpayers’ data, a source familiar with the matter told Breitbart News in April.

A spokesperson for the U.S. Treasury Department said in a statement:

The Treasury Department is pleased to have gathered a team of long-time IRS engineers who have been identified as the most talented technical personnel. Through this coalition, they will streamline IRS systems to create the most efficient service for the American taxpayer.

“This week, the team will be participating in the IRS Roadmapping Kickoff, a seminar of various strategy sessions, as they work diligently to create efficient systems,” the spokesperson continued. “This new leadership and direction will maximize their capabilities and serve as the tech-enabled force multiplier that the IRS has needed for decades.”

Read the full article here