Treasury Secretary Scott Bessent declared that the Trump administration “won’t negotiate” with China in response to stock market volatility, but because “we are doing what is best economically for the U.S.” after the Wall Street Journal reported otherwise.

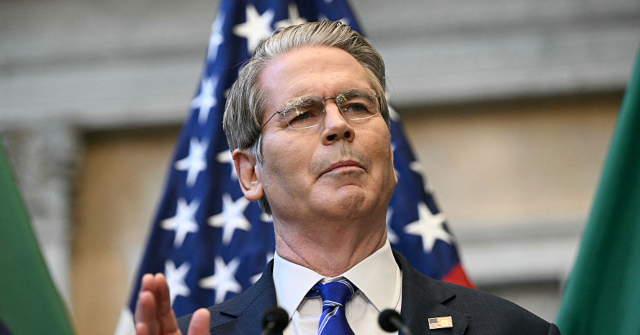

Speaking Wednesday morning at CNBC’s Invest in America Forum in Washington, D.C., Bessent pushed back on a Tuesday Journal report claiming that China “expects that the prospect of another market meltdown ultimately will force [President Donald Trump] to negotiate.”

Chinese President Xi Jinping is “betting that the U.S. economy can’t absorb a prolonged trade conflict” with his country, the Journal reported.

When the secretary said Trump is still set to meet with Xi later this month and stated that the two leaders have “an excellent relationship,” CNBC host Sara Eisen asked, “Is it also because the market clearly does not want to see things get worse?”

“I mean, we saw a big slide on Friday,” she remarked.

Bessent shot back, calling the WSJ article a “terrible” narrative that took “dictation” from the Chinese Communist Party (CCP):

Yeah. I think this narrative, terrible Wall Street Journal today article… they’re taking CCP dictation that, you know, President Trump, he likes a high stock market — but he, like me, believes that the high stock market is a result of good policies and it’s the policies that we’re talking about here today in terms of this CapEx boom. And you know, so the stock market is a result… if we have to take strong measures against the Chinese, it won’t be because the stock or we won’t negotiate because the stock market’s going down. We will negotiate because we are doing what is best economically for the U.S.

The secretary’s appearance at CNBC’s forum came after stocks fell on Friday following Trump’s threat of an additional 100 percent tariff on Chinese imports and new export controls on critical software in response to China’s announcement of stringent new restrictions on rare earth minerals, Breitbart News reported.

“Trump appeared to soften his tone over the weekend, spurring a market rebound on Monday,” CNBC reported Wednesday. “Major stock indexes bounced around in volatile trading Tuesday; the S&P 500 took a dive before the session close after Trump issued yet another trade threat against China, this one accusing Beijing of economic hostility for not buying U.S. soybeans.”

Olivia Rondeau is a politics reporter for Breitbart News based in Washington, DC. Find her on X/Twitter and Instagram.

Read the full article here