As a financial advisor, I have set my eyes on thousands of portfolios—but none as compelling or meaningful as the one Dr. Meir Statman described to me. In our recent conversation to discuss his newest book, A Wealth of Well-Being, the behavioral finance professor at Santa Clara University referenced a portfolio not simply consisting of financial assets, but a portfolio of life.

Is it time for you to rebalance?

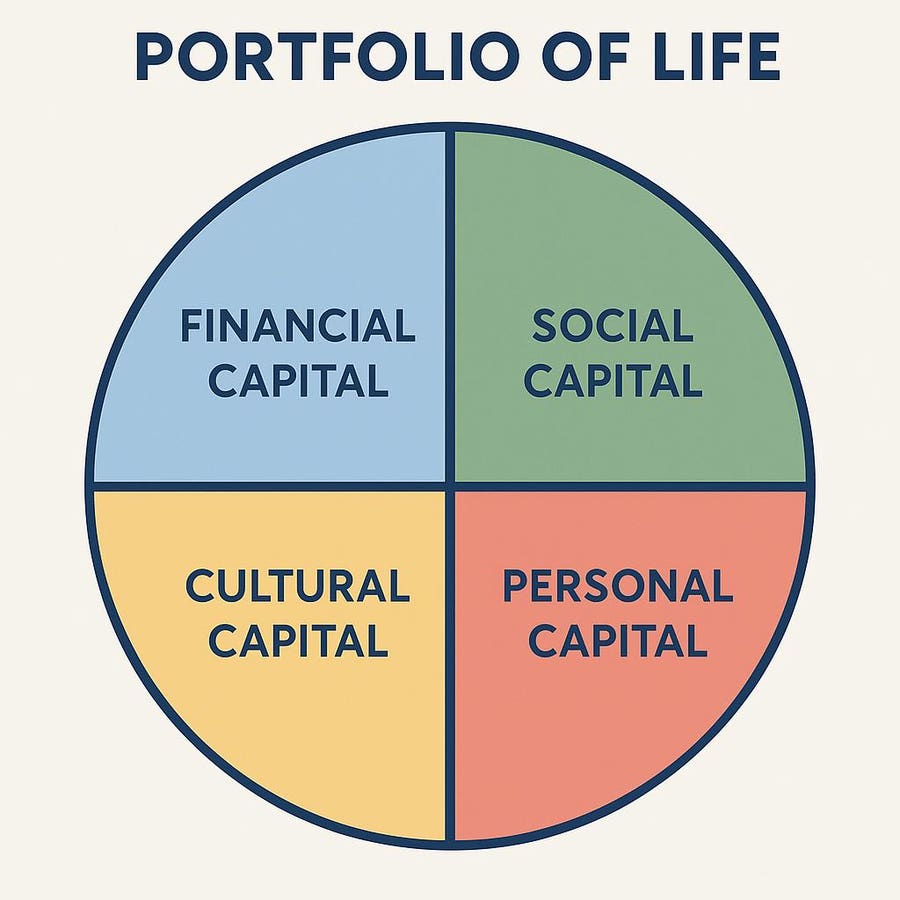

Tim MaurerLike any good portfolio, it is purposefully diversified, but the asset classes are far broader than those we typically think of populating a 401(k) account. The portfolio of life consists of four types of capital:

- Financial Capital

- Social Capital

- Cultural Capital

- Personal Capital

Let’s discuss each and consider its significance.

Financial Capital

“Financial capital consists of income and wealth and their utilitarian, expressive, and emotional benefits,” writes Dr. Statman. Our income, money, assets, and other tangible resources all fit into this slice of the portfolio pie, along with their accompanying benefits, which immediately signal Statman’s behavioral finance thought leadership.

The easiest way to explain the three benefits is through an example familiar to most of us—a car. The utilitarian benefit of the car is that it gets us where we need to go. The expressive benefit is that our car does say something about who we are as a person—or, at least, we may hope it does. And the emotional benefit is about how the car makes us feel.

You may drive a Porsche to work (utilitarian) so that you can feel the rumble of the flat-six engine when you start it up (emotional) and because you don’t mind turning a couple heads (expressive) when you pull into the office. Statman drives a Subaru because he doesn’t need to impress his students with anything but his empathy and intellect (expressive), he loves the safety features (emotional), and he prefers a more frugal mode of transportation (utilitarian).

Here’s the key, though: Our financial capital is NOT the most important, but it supports all the other types. “We need financial well-being to enjoy life well-being,” as Dr. Statman says, “but it is life well-being that we seek.”

- Question: Are your finances designed and dedicated to enhance your life well-being—or have you sacrificed your life well-being in favor of your net worth statement?

Social Capital

Here’s where things start to get a bit more opaque, but this is also where the real wisdom of this framework is illuminated. In A Wealth of Well-Being, social capital is defined as centered on “social networks of people supporting one another by acceptance, trust, and cooperation.”

Social capital can be as narrow as our family or as broad as an international constituency. For most of us, it also includes our friends, co-workers, neighbors, associations, and yes, even our LinkedIn network. In fact, as Statman writes, “An experiment using LinkedIn data found that relatively weak ties in a broad social network were more helpful in finding jobs than strong ties in a narrow social network.”

And as you can likely see, while we are well served to attend to these broad life portfolio categories, each individual asset class can—and optimally will be—further diversified. In this case, we’re well served to recognize that our social capital is enriched by diversifying across those deeper, fewer connections as well as the more numerous casual relationships that often have an outsized positive impact when activated at the right time.

- Question: What is your natural strength—fewer deeper relationships or more social relationships—and which one could be enhanced?

Cultural Capital

Cultural capital is more easily felt than counted. It consists of our values, knowledge, education, and tradition. On an individual or family level, it is the exploration, discernment, and clear articulation of what is most important to us that guides how we date, marry, raise children, worship, and celebrate—and it is also a clear understanding of these priorities that is the optimal guide for our financial planning. When we know what’s most important to us in life, while rarely easy, our financial decisions at least become simpler.

Cultural consistency is also an imperative in our companies, while cultural conflicts can be problematic. “Companies’ stock prices increase when information indicates high cultural fit,” Statman writes, while “companies that hire culturally disruptive managers suffer lower future market values and performance.”

It’s one of the reasons my company publishes our core values—greatness, growth, gratitude, grace, grit, and generosity—and yes, we use them for hiring, firing, and employee development decisions.

- Question: Have you explored, discerned, and articulated your core values and how they can be activated through your wealth management?

Personal Capital

Our personal capital includes physical and mental features, health, resilience, and emotional stability. Executive coach John Ott says that in corporate leadership only 23% of leadership effectiveness is about what you do—with 77% coming down to who you are. The who we are is powered by two traits, being:

- Inwardly sound

- Others focused

And I’d argue these are the two traits that also predict our effectiveness in every other area of life. What marital, parenting, or other relational challenges, for example, would not benefit from a greater dose of inward soundness—supported by sleep, diet, exercise, and spiritual practices—and being more inquisitive about and compassionate toward the others with whom we interact?

And could there be a better reinvestment of our financial capital than into our personal capital bucket?

- Question: Is there a particular financial investment you could make in yourself right now—your education, health, or inward soundness?

Rebalancing Our Portfolio Of Life

The natural state of any diversified portfolio is that it will quickly be out of balance. That’s actually the whole point—that while one area excels, another is often struggling. The question, therefore, is not if, but how and when, does your life portfolio need to be rebalanced?

As you review the four capitals (and accompanying questions) above—financial, social, cultural, and personal—where are you currently excelling, and where are you struggling? Where can you reinvest your time, influence, money, energy, or relationships to balance your life portfolio better?

The Role Of Financial Advisors In Client Well-Being

And financial advisors, much as Dr. Richard Thaler, the Nobel prize-winning behavioral economist, implored that we must attend to the qualitative aspects of our work at least as much as the quantitative, Dr. Statman echoes this sentiment:

The difference between good and excellent advisors is the same as with physicians. Technical skill is expected, but the ones who make the lasting impact are the ones who know you and care about you.

As advisors, we likely dedicate too much attention to our clients’ financial capital when it is rendered almost useless in the case of a job hunt (social capital) or a crisis of faith (cultural), and I believe there is likely no better reinvestment of money than in one’s personal capital.

It’s hard—I know—to become students of humanity and to navigate the nuanced landscape of that which cannot be seen in a spreadsheet, but while a good advisor may help someone pile up a mountain of money and tax-efficiently distribute it, I believe an excellent advisor will be more focused on a wealth of well-being.

Read the full article here