The BLS has come out with another huge rug-pull on its nonfarm payroll count. And also, predictably, this has triggered loud blathering from both Wall Street and the White House on behalf of exactly the wrong conclusion.

To wit, we don’t need any more Fed rate cuts! And we don’t need a new eruption of money-printing, either, because the real cost of debt is already dirt cheap.

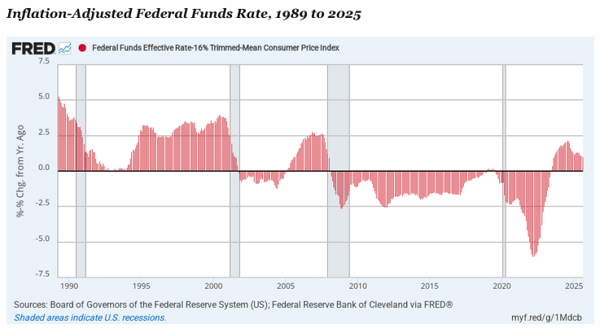

For instance, here is the inflation-adjusted Fed funds rate over the last four decades:

Since the turn of the century, the geniuses on the FOMC have pegged the real Fed Funds Rate at negative levels nearly 80% of the time. And even as of July 2025—three years after allegedly pivoting to inflation-fighting—the real Fed funds rate is only positive by 110 basis points. That’s far below real rates of 250 to 500 basis points, which prevailed before Greenspan went all in on money-printing in response to the dot-com bust.

Still, based on the blatant noise in the BLS’s “useless” jobs numbers, as they were described by even JD Vance, the rate cut chorus implies that the current skinny 110 basis points of positive return to savers and depositors is way too much.

Supposedly, the dire economic weakness implied by the BLS error confession means that the real cost of overnight money for gambling and other short-term purposes should be shoved back below the zero bound yet again in order to keep the economy from tumbling into the recessionary drink.

To be sure, another recessionary spell may well be underway. But for crying out loud—it’s not due to high interest rates. To the contrary, it is the easy-money fostered mountain of public and private debt—now totaling $103 trillion—that has ground economic expansion to a halt.

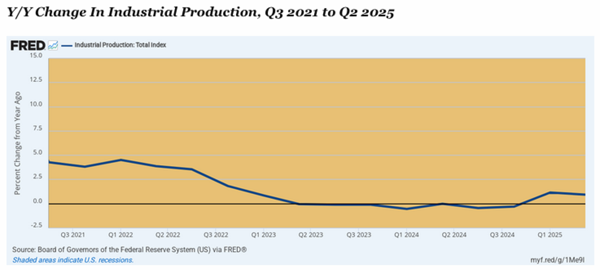

And we do mean a near halt. Industrial production, for instance, has been essentially flatlining since Q2 2023.

The truth is, the Fed’s elephantine balance sheet and interest rate-pegging regime are also still fueling dangerous financial bubbles and rampant speculation.

The Fed’s interest rate repression has so distorted the debt markets, in fact, that it has enabled the Wall Street nincompoop running the US Treasury to buy back tens of billions of long-term US Treasury bonds, of all things, and finance these purchases by issuing T-bills into the phony FOMC-controlled short-term money market.

What unfathomable insanity. There is no other way to put it.

So, yes, the good folks at the BLS have disappeared another 911,000 jobs for the year ending in March 2025. But so what?

After all, there is nothing new about the agency’s gross incompetence, given that this latest rug pull comes on top of the 818,000 jobs the BLS disappeared for the year ending March 2024 and the 306,000 jobs for the year ending March 2023 that also got a “just kidding” markdown. That’s 2.035 million jobs gone up in revisionary smoke during the last 36 months in the context of 12 material downward benchmark revisions in the last 20 years (versus only four material upward revisions).

Obviously, a lot more people should be fired than the hapless BLS commissioner who got canned by Trump a while back.

To wit, what’s not fit for purpose here isn’t merely the numbers crunchers at the BLS, but the 12-person monetary politburo at the FOMC, which has been foolish enough to make the monthly nonfarm payroll survey the be-all-and-end-all of the “incoming data” by which they supposedly macro-manage the entire $30 trillion US economy.

Editor’s Note: When the official scorekeepers keep misreading the economy—and the monetary politburo keeps doubling down on the same failed medicine—the risks to savers and investors only grow.

You don’t have to be trapped by their errors or lulled by Wall Street’s cheerleading. Legendary investor Doug Casey has just released a special free dispatch revealing what the mainstream media won’t tell you about gold—and why it could be the single most important asset to safeguard and grow your wealth as the debt crisis deepens. You can see it here.

Read the full article here