Is the U.S. about to experience another banking crisis?

Shares in banks, and particularly regional banks, imploded yesterday. At one point the regional bank index (KRE) was down 7%.

The issues pertain to two recent bankruptcies in the subprime auto-lending and auto parts manufacturing industries: TriColor Holdings and FirstBrands.

About a month ago, a large subprime auto lender, TriColor Holdings, filed for bankruptcy. At the time of bankruptcy, the firm had assets and liabilities somewhere between $1 billion and $10 billion. Obviously, this was not a massive company, but the details of the situation are concerning.

Subprime auto lending is some of the riskiest lending in the world. In its simplest rendering, subprime auto lending consists of lending high-interest loans to low-income and undocumented borrowers. The lender then usually packages up the loans into securities, and sells them in a secondary market to hedge funds/ banks/ etc.

By packaging these loans, firms are able to claim they are less risky, allowing them to sell them to banks and other institutional investors who wouldn’t be able to own them otherwise.

If this sounds familiar to you, it’s essentially the same scheme that created and then imploded the housing bubble in 2003-2007. And once again, it appears that multiple major financial institutions were in on the scheme.

As I’m writing this, JP Morgan, Fifth Third Bank and Barclays have declared they have exposure in the hundreds of millions of dollars to TriColor. Obviously, these are small losses given the size of these institutions (Fifth Third is the smallest bank and has assets and liabilities in the hundreds of billions of dollars).

However, the issue of fraud is triggering some concerns.

Some 29,000 of the loans TriColor made involved vehicles that already had loans outstanding. And some 40% of the loans outstanding shared similar characteristics suggesting there might have been multiple loans made using the same vehicle as collateral.

Put simply, it appears TriColor was cooking the books to generate as many loans as possible, e.g. lending out two or even three loans for the same car, which means the car can’t possibly serve as correct collateral on the debt.

This is rattling the credit markets. True, the subprime auto lending market is only $20 billion in size (subprime mortgages are over $800 BILLION in size), but the situation is raising concerns that loose lending standards and derivatives might once again be an issue for the credit markets.

This situation is being made worse by the bankruptcy of First Brands, an auto parts manufacturer that also collapsed in late September. Here again, there are allegations of cooking the books, though the losses are larger (initial estimates put the fallout closer to $10 billion), and the fallout is worse.

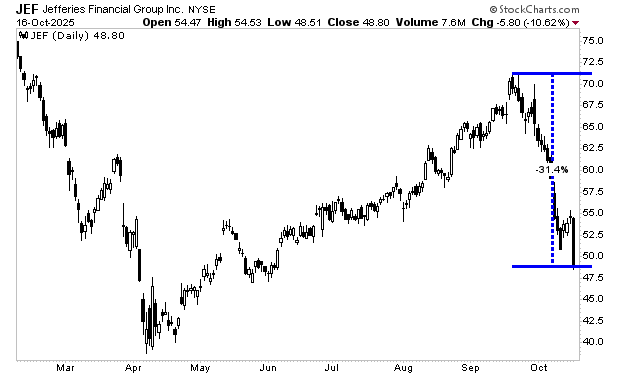

Jeffries Financial Group (JEF) has claimed that its exposure to FirstBrands is in the ballpark of $750 million via one of its investment funds. However, JEF shares are down 30% in roughly one month, suggesting things are in fact worse behind the scenes.

Indeed, yesterday was a bloodbath in the banking sector with individual regional banks (Zion Bancorp, Western Bank Alliance, etc.) down 12%. Heck even the big banks (Wells Fargo, JP Morgan) plunged over 2% on the day.

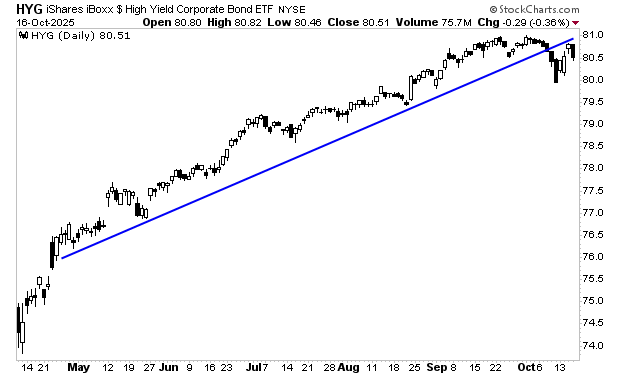

The issue is spreading throughout the credit markets. The high yield credit ETF (HYG) has taken out its bull market trendline. Even worse, it’s been rejected after a bounce, indicating that what used to be support is now resistance.

Put simply, something VERY bad is brewing in the banking system. And the big question for investors is whether these issues will trigger a stock market crash.

To answer this, I rely on a proprietary indicator that has triggered before every major meltdown in the last 50 years. This signal caught the 1987 crash, the Tech Crash, the Great Financial Crisis and more.

We detail this trigger, how it works, and what it’s saying about the markets today in How to Predict a Crash.

Normally we’d sell this report for $499, but in light of its recent warning, we’re making 99 copies available to the investing public.

To pick up one of the last copies…

CLICK HERE NOW!

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Read the full article here