Advice for owners on filing and paying taxes, borrowing, managing workers and benefits and much more.

New and threatened tariffs. Expiring tax breaks. Tighter lending rules at the Small Business Administration (SBA). Small business owners face lots of challenges and uncertainty these days.

But then, starting and running a small business has always been tough. And yet, small businesses remain the mainstay of the U.S. economy, creating jobs, millionaires, and in some cases, big companies and billionaires. Diane Hendricks, #1 on Forbes’ new list of America’s Richest Self-Made Women, with a net worth of $22.5 billion, started a roofing supply business with her late husband, Ken, in Wisconsin in 1982. Under her watch, ABC Supply, which she owns and has chaired since Ken’s death in 2007, has grown to more than 900 branch locations and $20 billion in sales. Peter Cancro started making sandwiches at a Jersey Shore sandwich shop in 1971 at the age of 14, bought out the owner before his high school graduation, and built Jersey Mike’s into a chain with more than 3,000 locations, before finally selling a majority stake this year to private equity firm Blackstone. He’s now worth $4.9 billion.

Today, the U.S. has more than 33 million small businesses, employing nearly 62 million Americans, some 46% of private sector employees. According to the SBA, from 1995 to 2021, small businesses created 17.3 million net new jobs, accounting for 63% of the net jobs created during this period. Underlying that impressive net job growth number, however, are millions of small business births and closures. About one in five of all small businesses fail in their first year and one in two succumb in the first five years.

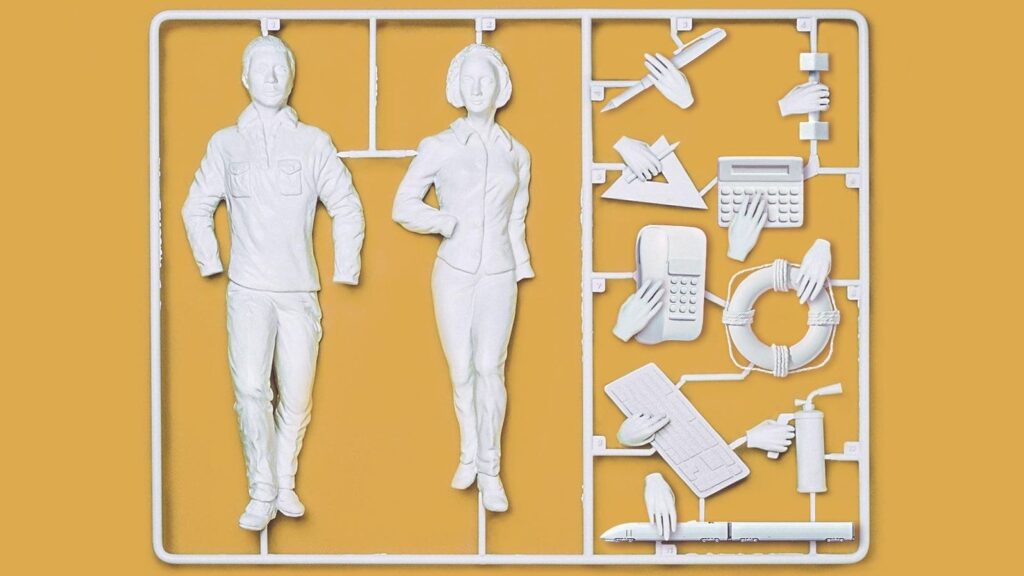

This new Forbes Small Business Toolkit aims to help you beat the odds, with information on choosing the right entity, assembling your professional team, filing and paying taxes on time, managing small business loans, and more. Despite the drama in Washington, some of these business basics won’t change. But some will change–so we intend to keep the Toolkit updated, with developments business owners are likely too busy to track on their own.

Small businesses have faced greater-than-normal challenges in recent months as they struggle to navigate President Trump’s tariffs and tax proposals. The threat of tariffs (and tariffs already imposed) have already resulted in higher expenses and supply chain disruptions for some small businesses. And more are likely coming. Since tariffs are paid for by U.S. companies that import goods and materials, many small businesses will have to pay more for what they buy, yet may not be able to pass along the full cost increases to customers. The most recent National Federation of Independent Business Small Business Optimism Index shows retailers, in particular, have had their enthusiasm curbed by tariffs.

The Republican tax bill, as passed last month by the House, included some wins for small businesses. It restored expensing and made the existing Section 199A deduction for small businesses that pass through their profits to the owner’s tax return (S corps, partnerships and the self-employed) permanent and more generous. But those hoping that a business-friendly Senate might push even further by lowering corporate tax rates, too, likely won’t get their wish. The cost of the bill (and how it increases the federal deficit and debt) may mean we’ll see less, not more, tax relief for businesses, as it makes its way through the Senate and the reconciliation process.

Adding to the uncertainty, interest rates and other costs remain high, making borrowing tricky at a time when assistance from federal agencies like the SBA has been reduced (the agency has announced plans to reduce its workforce by 43%) and loan guarantee rules tightened. Reduced staffing at the IRS (the agency expects to lose at least 20,000 employees) means there are fewer representatives available to answer the phones and help resolve tax disputes—some of those tax issues, like liens, can paralyze a small business if not resolved in a timely manner.

There are some bright spots. Earlier this year, the Treasury Department walked back most of the Corporate Transparency Act (CTA), limiting its scope to foreign companies. Before the revision, an estimated 32.6 million companies were potentially subject to reporting requirements, with significant penalties for noncompliance. The administration has also signaled that more regulatory rollback is coming, though businesses aren’t yet sure what that might look like.

With so much uncertainty—and more changes on the way—we suggest bookmarking this Toolkit and checking back for our updates.

Getting Started

You have a business idea and a plan—what comes next?

Getting Paid And Paying Taxes

Once your doors are open, you’ll need to track revenues and costs and taxes. It’s tricky.

Getting Ahead

Successful companies keep an eye on what’s on the horizon, from industry trends to new regulations and even other businesses worth buying.

Getting Funding

If you’re ready to grow your business, there are lots of funding options, including investors, SBA-backed loans, conventional loans and grants.

Read the full article here