Chinese dictator Xi Jinping held a meeting with tech CEOs on Monday to discuss rebuilding China’s damaged economy and push back against America’s efforts to maintain high-tech supremacy.

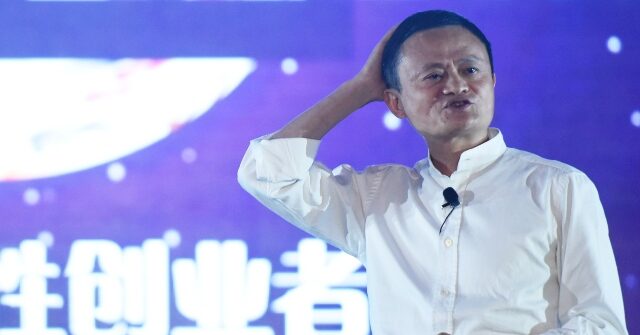

A notable guest at the meeting was Jack Ma, founder of tech giant Alibaba and formerly poster boy for the Chinese Communist Party’s harsh crackdown on tech moguls.

Ma’s presence gave the Monday tech summit the sense of being – if not quite an apology for the regulatory clampdown that transformed Ma from China’s richest man into an exiled art collector in Japan, then at least a tacit promise that nothing similar is planned for the near future.

Ma’s fortune took a turn for the worse after he dared to criticize the Chinese Communist Party’s heavy-handed economic regulations in October 2020. The ebullient Ma, an icon of Chinese popular culture as well as a business mogul, was scrubbed from television shows and business websites then driven into exile. Much of his personal fortune was ruined, and Alibaba was broken into six different companies by Chinese regulators.

Xi and his authoritarian party clearly wanted to teach high-flying entrepreneurs who was holding the real power in China. The lesson was received, but it also snuffed out some of the entrepreneurial energy that drove China’s technology boom, and now the national economy is floundering after a poor recovery from Xi’s destructive coronavirus lockdowns.

In March 2023, Xi ordered Chinese Premier Li Qiang to restore the confidence of businessmen and investors in China’s heavily-regulated technology sector. One of Li’s first moves was bringing Ma back from exile in Japan, setting him up with a few public-relations appearances at events such as the 25th anniversary of Alibaba’s founding.

Ma’s invitation to Xi’s business symposium in Beijing on Monday completed the process of bringing Ma “back in from the cold,” as CNN put it.

The Hang Seng stock index shot to its highest level in almost three years at the sight of Ma regaining a leadership role in Chinese industry, even if it might be largely symbolic. Alibaba picked up almost $18 billion in market value at the peak of this stock boomlet.

“With the domestic economy slowing and geopolitical pressures escalating, the government is making it clear that it values and relies on the private sector to drive innovation and stimulate growth,” University of Southern California law professor Angela Huyue Zhang told CNN.

The Economist welcomed Ma back from “the wilderness” on Monday, taking his return as a signal that “private-sector tech is back in favor” with Xi and his cronies.

Another featured guest at the Beijing meeting was Liang Wenfeng, founder of A.I. upstart DeepSeek, whose debut was the biggest Chinese tech story in years. DeepSeek seemed to rally other companies by proving that China was no longer wholly dependent on American-made computer hardware. Putting Ma at the table with Liang was intended to send a signal that entrepreneurs can once again take big gambles without fearing Xi’s hand at their throats.

Few details of Xi’s remarks to his comprehensive collection of tech CEOs were made public, but the dictator reportedly stressed the importance of the private sector to China’s geopolitical ambitions and sought to encourage more growth and investment.

China’s state-run Xinhua news service said Xi saluted the “competitive spirit” of China’s industrial leaders, promised to help them overcome “temporary” challenges posed by pressure from the United States under President Donald Trump, and made a promise to remove “unreasonable” fees and regulations.

Xi told the CEOs his regime would “promote the fair opening of the competitive field of infrastructure to all kinds of business entities, and continue to make great efforts to solve the problem of difficult and expensive financing for private enterprises.”

The sight of Xi gathering moguls at the Great Hall of the People in Beijing for a respectful and affectionate meeting was probably meant to inspire foreign investors to put more money in China after a few rough years of divestment and “de-risking.”

While foreign observers might conclude Ma and his fellow entrepreneurs came out on top after years of a perilous confrontation with the Chinese Communist Party, The Economist said Monday’s meeting might also be understood as a “victory lap for Mr. Xi,” because the lines between the Party and the private sector have been blurred since Ma was driven into exile:

Rather like many tech firms, the financial system has also become a public-private hybrid. China’s venture-capital and private equity-industries have been permeated by the state. For many startups state capital, with irreconcilably different goals from the professional investors, has become the main form of funding. Businessmen once laughed off the influence of Communist Party cells in private firms, which have been around for ages. Yet over the past five years these cells have amassed much more power. There are few signs that this trend will reverse.

The UK Guardian reported investors spent Monday afternoon “scouring pictures and footage of the meeting to spot top bosses and trading accordingly.”

Among the faces they did not see at the Beijing symposium were executives from two of China’s biggest companies, ByteDance of TikTok fame and search-engine heavyweight Baidu. Baidu’s stocks accordingly fell by eight percent, even as other tech stocks were soaring.

Read the full article here