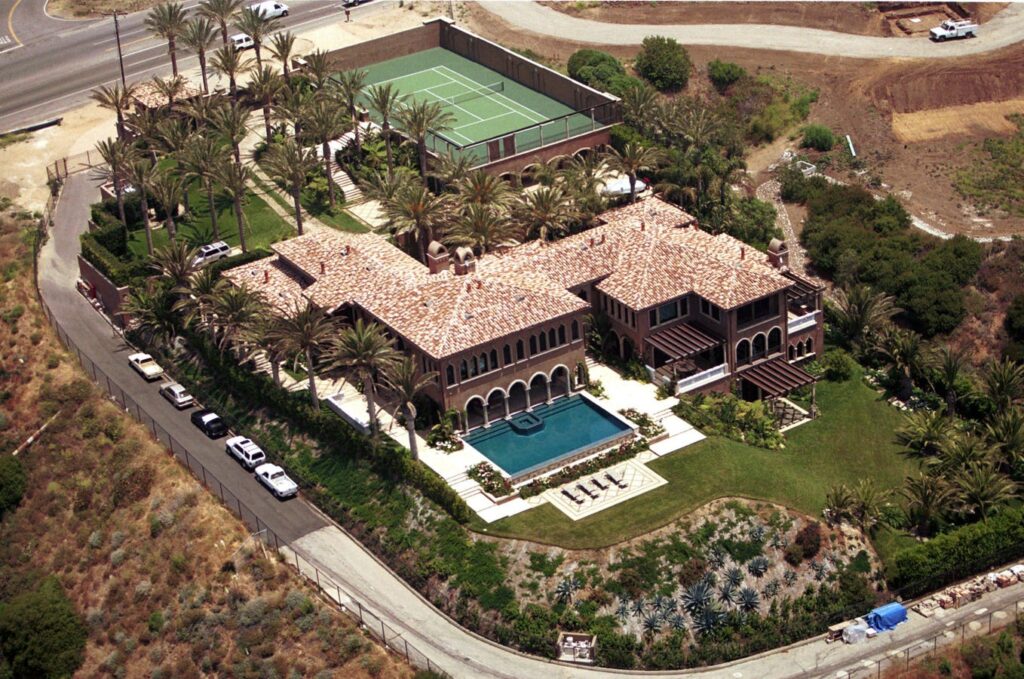

The cost to own an inherited home has increased in California. (FILE PHOTO) The home of Cher is … [+]

Getty ImagesInheriting a home in California can bring a big windfall. However, recent rule changes may make that inherited home more costly to own.

Recently, my eldest client passed away at 106 years old. They left their loverly Los Angeles home, which they had owned for decades, to their heirs. Their property taxes will be jumping from around $5000 per year to over $30,000 per year. This whopping 600% increase in property taxes will definitely change the conversation about what the heirs choose to do with the home. On a happier note, the heir is still inheriting a multi-million dollar home.

What Prop 19 Means For Your Inheritance

In the past, if you inherited a home in California, you were able to maintain the tax bases (and often much lower property taxes) on the real estate you inherited. However, recent tax law changes may make keeping the family home much more expensive. Thanks to Proposition 19.

Before Prop 19 was passed in 2020, you could pass down your home and your very low property tax base to your heir. The rules have changed, and now, the inherited property’s value gets reassessed at the time of transfer, and the property taxes that the inheritors will pay could jump substantially.

These property tax rule changes could make the decision to keep or sell your inherited home much more complicated. What makes the most sense for you will depend on your needs, income and perhaps where you want to live.

Do You Want To Live In The House You Inherited?

There are still additional tax benefits for those looking to make their inherited home their primary residence. If you live in the inherited home, you can apply for up to $1 million of home value to be excluded from the property tax reassessment. To get this benefit, you must move into the property within a year of the transfer and apply for it. Don’t expect the assessor to magically give this substantial tax savings.

The jump in property taxes could make an inherited home unaffordable for your heirs.

If you are inheriting an apartment building, the reassessment benefit would only apply to the unit that you use as your primary residence. The other units would be reassessed at the current market values.

California Inheritance Taxes On Real Estate

It’s not all bad news to inherit a home in California. Real estate is quite expensive in the Golden State. A burned-out shell of a home in the Pacific Palisades is still worth many multiples of the average home in Texas ($299,000, according to Zillow). In fact, burned-out lots in Alta Dena have already sold for multiples of the average cost of a home in Texas.

There is no estate tax in California. It was abolished in 1982. Depending on the estate size, you may owe federal taxes on your inheritance. The federal estate tax exemption for 2025 is just under $14 million.

Taxes When Selling A Home You’ve Inherited

If you choose to sell a home you inherited, you may be able to avoid paying capital gains for the appreciation of the home. You will receive a step-up in cost basis on your inherited home. If you were to sell the home within 6 months of inheriting it, you would likely not owe any capital gains on the sale.

Alternatively, if you move into your inherited home and then sell it later, you could also benefit from the tax exemption on sales of your primary residence. Assuming you lived in the home for at least two of the past five years, you could exclude $250,000 of capital gains from taxation, or $500,000 if you are married and filing jointly.

What To Do With The Money If You Sell Your Inherited Home?

What you should do with the money when selling an inherited home will depend on where you are at in life and your various financial goals. You could invest proceeds and turn the profits into an income stream to support retirement or enhance your lifestyle. Or maybe you can use the money to buy a house that better fits your needs in terms of size, cost, and location. The options are unlimited.

If you are fortunate enough to receive a sizable inheritance, work with a fee-only fiduciary financial planner to help you maximize your windfall. A bonus is they offer tax planning guidance to help you avoid paying unnecessary taxes on your inheritance.

Read the full article here