The day before the latest US Treasury Auction results were released Trump concludes that “foreign nations are paying hundreds of billions of dollars straight into our treasury.”

That could not be further from the truth. US Treasuries have crossed an important rubicon.

It is now costing the US more to issue debt than it has in the past 45 years.

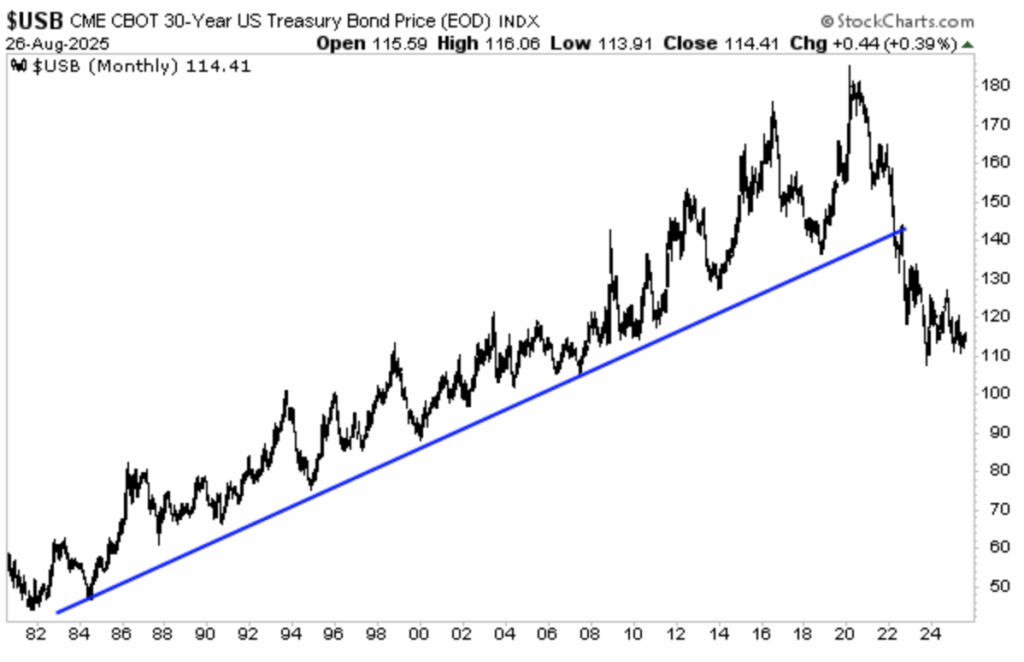

This chart from Graham Summers shows the 30-year US Treasuries turning point.

He writes:

“As you can see, the bull market in bonds is OVER. When inflation arrived in the financial system in 2022, it triggered a tectonic change.”

The 30-year U.S. Treasury bond hasn’t bounced back yet. Instead, it’s kind of just sitting still, figuring out where to go next. What happens over the next year or two could prove whether Brent Johnson’s “Milkshake Theory” is right or wrong.

Here’s the idea:

- When the U.S. government makes the dollar weaker by printing more money, other countries still need dollars.

- Why? Because the U.S. dollar is the main currency that the whole world uses for trade.

- So even if their own money is losing value, foreign countries have to buy U.S. dollars and U.S. government bonds to stay in the game.

It’s like the dollar has a giant straw that “sucks up” money from other countries. The funny part is—even when the U.S. prints more dollars, other nations often end up wanting even more of them to protect themselves.

But history has a way of turning.

The dollar’s pull is strong, yet the world is quietly shifting its loyalty elsewhere.

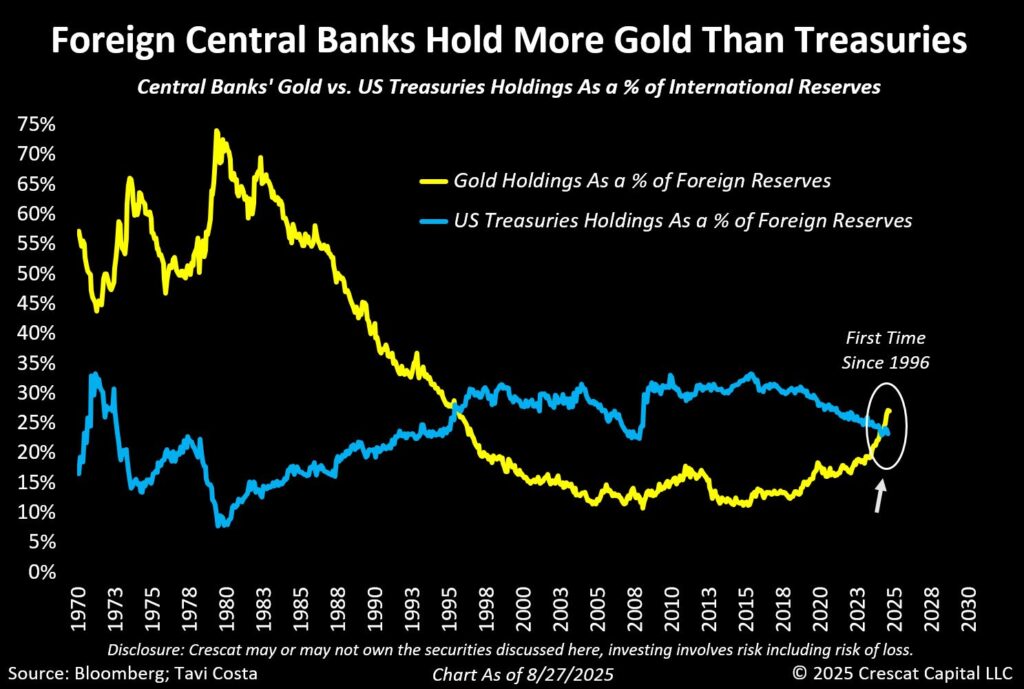

The fact that foreign central banks now hold more gold than U.S. Treasuries marks a Rubicon moment. Once Treasuries were the ultimate safe haven, the asset no reserve manager could ignore. But that trust has cracked.

By choosing gold over Washington’s IOUs, central banks are signaling that the old order is fading. Whether the dollar’s “milkshake” still has a last surge left or not, the world has already stepped into new territory—and there’s no going back.

Read the full article here