Relative to each other, they can’t. But relative to something else, they easily can.

A reader asked me to comment on a video by Brent Johnson, CEO of Santiago Capital.

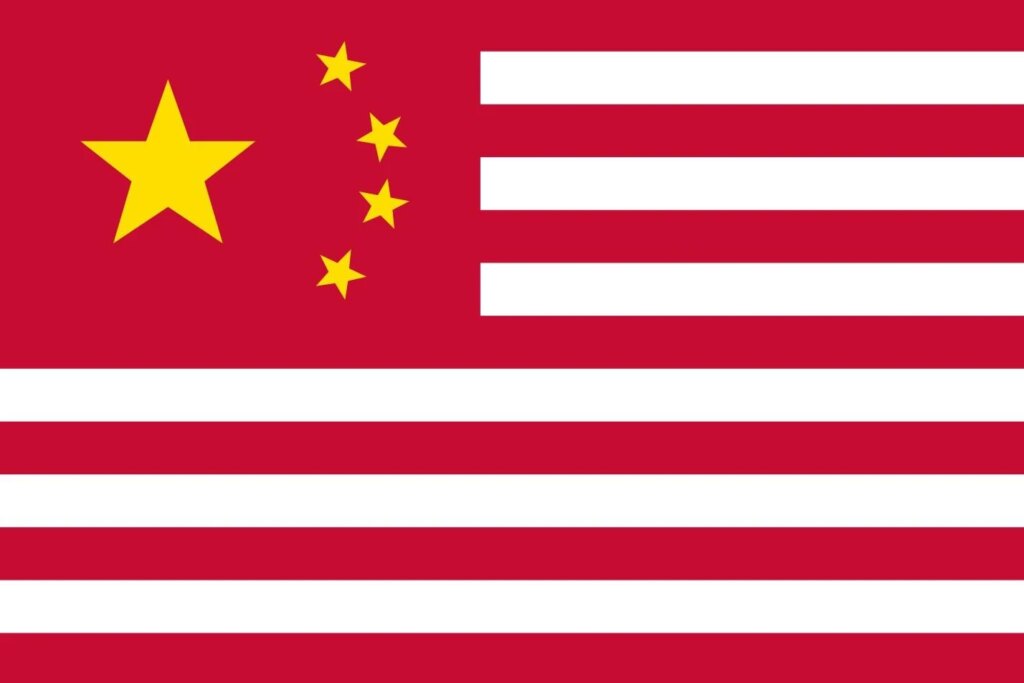

Chinese Yuan Devaluation – What you Need to Know

My reader thought Brent and I were in disagreement. But I agree with nearly all of it.

Brent did say that he thought most people thought Trump would lose the trade war.

My position is Trump has midterm election concerns that China doesn’t have, but no one will win the trade war because no one ever does.

But the focus of his video is more on the yuan than the trade war and my previous posts for years have been in agreement with what he is saying.

At 41 minutes, the video is too long (something I am often guilty of myself), and that the key ideas could have been covered in 10-15 minutes easily.

Nonetheless, please take the time to play the video, Brent covers many key ideas on which most get wrong.

Five Key Agreements

- China is worse off than most think

- China may find it hard to defend a peg to the yuan

- Talk of China selling Treasuries to hurt the US is nonsense

- China needs reserves to stop capital flight

- China has significant US dollar liabilities for which it needs reserves

Agreement Discussion

Point 4 and 5 are significant.

We have heard massive amounts of nonsense over the years about “China dumping US treasuries.”

I have pointed out numerous times that bouts of China selling US treasuries were to strengthen the yuan or to stop capital flight, the exact opposite of what most pundits think.

Santiago spent a lot of time on that topic as well.

Points 1 and 2 are related and it is starting to matter big time. China has a massive property bubble that has bust.

Demographics make that bubble impossible to revive.

Santiago places more faith in China’s official holding of US treasuries and dollar denominated liabilities than I do. China masks its US treasury and US agency securities via State Owned Enterprises (SOE) through exchanges in Europe.

I suspect China has a lot more reserves than Santiago thinks, but hey, I could be wrong. The reverse could be true if China’s US dollar liabilities are bigger than China admits or Santiago thinks.

Neither of us really knows, and that is a comment he made as well.

Recent alleged “dumping of US treasuries” is more likely to be of European nature than Chinese in nature, IMO.

Devaluation by Who, When and How?

Curiously, outside of Santiago, the only devaluation comments I have heard recently pertain to a US dollar devaluation, not a yuan devaluation.

I find the idea of a strict US dollar devaluation laughable although a plunge in the dollar might easily be a given.

US dollar devaluation discussion is silly because the dollar floats and that is not about to change.

There will not be another Plaza Accord agreement to devalue the dollar.

The Plaza Accord was a joint agreement signed on September 22, 1985, at the Plaza Hotel in New York City, between France, West Germany, Japan, the United Kingdom, and the United States, to depreciate the U.S. dollar in relation to the French franc, the German Deutsche Mark, the Japanese yen and the British pound sterling by intervening in currency markets.

For starters, the Plaza Accord didn’t even work. The dollar had already started to weaken by the time the agreement was made. The trend merely continued.

And Now?

Why would Europe, Japan, and Canada agree to cooperate with Trump to weaken the dollar when that would make exporting to the US more difficult?

Yet, the dollar is likely to skink on its own accord given Trump’s downright horrific budget proposals nearly guaranteed to increase the deficit while adding trillions of dollars to the national debt.

US Dollar Index vs Euro and Yuan

The Euro, Yen, British Pound, and Canadian dollar all float. Japan has intervened in the Yen (never successfully), but essentially the Yen mostly floats.

The yuan is currently pegged to whatever level China wants.

Yuan Devaluation How?

- By Peg

- By abandoning the Peg

Santiago discussed a peg devaluation. But what would happen if China just let the yuan float?

There is a lot of irony in my question because Trump accuses China of suppressing the yuan.

That accusation was certainly true from 1994 to 2012. Since then, I have commented many times (contrary to popular opinion) that the Yuan could easily sink if China let it float.

And now the yuan could easily crash (not just sink) if China abandoned the peg with no controls.

Dollar and Yuan Pressure

Santiago had some great charts in his video on China’s US dollar liabilities.

If he is low on US dollar liabilities and I am high on actual reserves, China is in more trouble than either of us has stated.

But even if things are as stated by China, pressure is on the dollar and yuan for both to go lower.

Who Does a Yuan Devaluation Hit the Hardest?

That’s a key question Santiago did not address.

The answer is Europe, especially Germany. A rising Euro and a falling Yuan means Europe will be flooded with exports from China and Germany will struggle exporting to China and the US.

Heck, we are starting to see this already.

Chinese Exports to the US Drop 21 Percent but Total Exports Rise

On May 8, I commented Chinese Exports to the US Drop 21 Percent but Total Exports Rise

For now, China is still doing fine on exports and US shelves are not empty, yet.

China’s export growth rose even as shipments to the US slumped sharply in the first month after President Donald Trump hit its goods with tariffs above 100%.

Total exports expanded 8.1% last month, above the 2% increase forecast by economists. Imports fell 0.2%, leaving a trade surplus of $96 billion, according to data from the customs administration Friday.

Everybody Loses

Because of Trump’s tariffs and a rising Euro, the EU will have a difficult time exporting to the US.

A sinking yuan relative to everything but especially the Euro will make the EU very vulnerable to Chinese imports.

A rising Euro will make German exports difficult, especially to China.

The EU will no doubt react to this, but not as fast as Trump did. But the US acting faster did little but ensure less trade and higher prices for the US.

The US loses in slower growth, retaliations, and higher prices. Small businesses get clobbered.

For discussion, please see Small Businesses Will Get Hit the Hardest by Trump’s Tariffs

Small businesses were already struggling. Tariffs will end the viability of many.

The Lead Question

To answer the lead question: “Under What Circumstances Might the US Dollar and the Yuan Both Crash?” the answer is current conditions, with ramifications noted above.

Relative to each other, the yuan and dollar cannot both sink. But relative to a basket of currencies, or gold, they both can.

There are no winners in these beggar-thy-neighbor strategies. Instead, we are discussing who loses the most and in what ways.

Gold Soars to Another New High, What’s the Message?

On May 6, I asked Gold Soars to Another New High, What’s the Message?

There are three messages. Do you see them?

If you think we are headed for a currency crisis, then you are thinking correctly.

Don’t ask me when, because no one knows. But the message is unmistakable.

Read the full article here