(Bloomberg) — An ally of Donald Trump in the US Senate has a plan for filling up the president-elect’s proposed strategic Bitcoin stockpile without adding to the government deficit: Sell off some of the Federal Reserve’s gold.

Most Read from Bloomberg

Republican Senator Cynthia Lummis of Wyoming plans to push forward with a bill to do exactly that when the new Congress is seated next year. The bill calls for the US to acquire 1 million Bitcoin, representing nearly 5% of the outstanding tokens. The purchases would cost about $90 billion at current market prices, though the sum would likely increase if the bill passes and investors front-run the government’s buying.

“We already have the financial assets in the form of gold certificates to convert to Bitcoin,” Lummis said in an interview with Bloomberg. “So the effect on the US balance sheet is pretty neutral.”

Lummis’ bill would greatly expand the scope of what Trump so far has indicated is his plan for a strategic Bitcoin reserve, which is for the government to maintain ownership of the roughly 200,000 tokens that the US already possesses following asset seizures. According to Lummis’ bill, the cryptocurrency would be held for a minimum of 20 years, and the presumed appreciation in value would help to reduce the national debt.

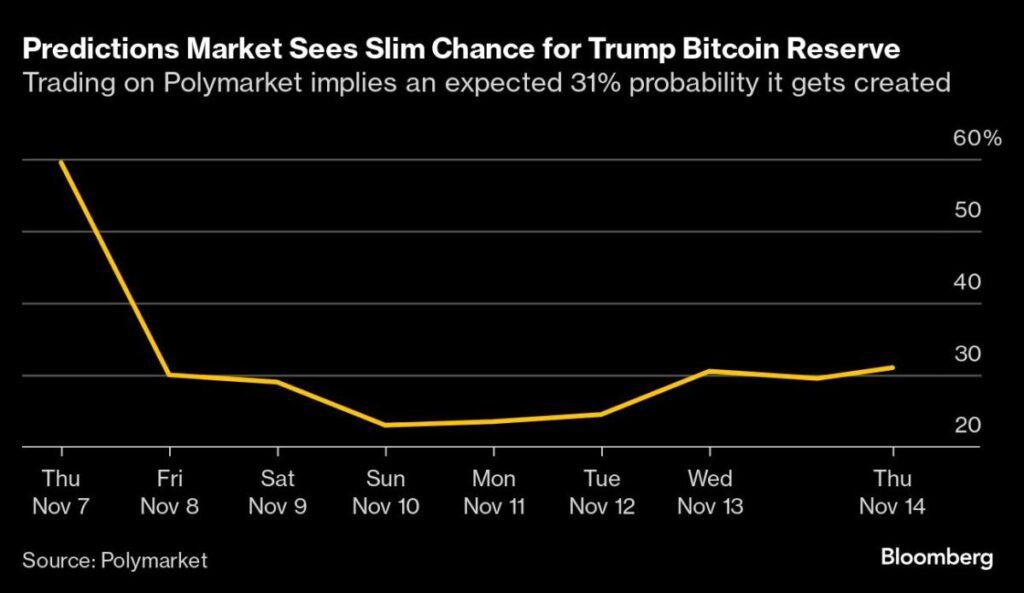

Yet despite the arrival of a Bitcoin believer in the White House and what the industry hopes will be the most crypto-friendly Congress ever, some market watchers believe Lummis’ bill, which currently has no co-sponsors, faces an uphill battle. Pricing on the cryptocurrency-based predictions platform Polymarket currently implies a 31% probability that Trump will create a Bitcoin reserve.

“It’s still putting government money on the line, and Bitcoin has not shown itself to be a particularly stable asset,” said Jennifer J. Schulp, director of financial regulation studies at the Cato Institute’s Center for Monetary and Financial Alternatives. “The bill asks senators and members of Congress, who may not understand crypto that well, to make a much bigger leap of faith in terms of its long-term viability.”

Michael Novogratz, the billionaire head of crypto investment firm Galaxy Digital, told Bloomberg Television that he believes there is a low likelihood that the US will set up a Bitcoin strategic reserve. If the US does create such a stockpile, Novogratz predicted that it would push the price of the largest digital token to $500,000 since other nations would feel compelled to create similar stockpiles.

Read the full article here