The gross negligence of the Washington GOP with respect to its fundamental duty in the governance process of American democracy—to function as the Watchdog of the US Treasury—seems to know no bounds. Very simply, with current policies fixing to add $22 trillion of baseline deficits over the next decade on top of the $36 trillion of public debt already on the books, the only plausible ”One Big Beautiful Bill” (OBBB) for an honest conservative party would be a plan to slash the baseline deficits by material amounts—say $8 trillion over the next decade, at minimum.

But even that would mean a $50 trillion public debt by the mid 2030s and potentially a rolling disaster from there—as the Baby Boom driven OASDI rolls surge upwards to 100 million recipients by mid-century. And yet, the imposters, double-talkers, right-wing statists, military/industrial complex-footmen and Trumpites (yes, we do repeat ourselves) who now dominate the party on both ends of Pennsylvania Avenue are having a leisurely debate about how much to add to the $22 trillion of new red ink already baked into the cake.

Rather than urgently pursuing the ways and means to make subtractions from these enormous baseline spending columns—a target-rich venue that amounts to upwards of $90 trillion over the decade ahead—they are proverbially fiddling while any hope of saving the nation’s fiscal bacon literally burns.

If nothing else, a Republican White House with even nominal regard for fiscal rectitude would be sounding the alarm about the surging red ink flowing from the FY 2025 budget through April. As it happens, a macro economy which is teetering on the edge of recession still has had enough residual gumption to generate a 4.9% or $146 billion revenue increase YTD. So that last gasp of economic growth-driven revenue gain should have been seen as a godsend bridge to enable time for launching a full-bore attack on spending.

Nothing doing at the Trump White House, of course, the short-lived exertions of the now departing Elon Musk and his DOGE boys to the contrary notwithstanding. In fact, Federal outlays during the first seven months of FY 2025 were up by more than double the revenue gain—that is, by +9% and $340 billion.

And, yes, these billowing gains were spread across the board. Indeed, in most cases the increases YTD are so large that any fiscally responsible White House would have sent a five-alarm package of rescissions and entitlement curtailments to Capitol Hill within weeks of the inauguration.

FY 2025 April YTD Spending Increases By Federal Agency:

- Commerce: +100.0%.

- Homeland: +52.3%.

- Interior: +43.8%.

- Veterans: +16.6%.

- DOT: +12.7%.

- USDA: 11.0%.

- HHS: +10.7%.

- Interest Expense: +9.6%.

- Social Security Administration: +8.8%.

- DOD: +8.3%.

- Energy: 7.3%.

Indeed, in what is surely a case of the dog which didn’t bark, the Trump Administration has not yet sent a single dollar of rescissions to the Hill—even after the DOGE boys mustered up a sweeping roadmap for exactly that. So the pathetic claim that the nation’s festering fiscal catastrophe was all the fault of “Joe Biden” just doesn’t wash. Without even trying hard, the White House could have hoovered up a $100 billion rescission package of defense and nondefense discretionary spending cuts just to get the ball rolling.

Yet that default on out-of-control departmental spending came on top of Trump’s taking off the table Social Security, Medicare, Veterans and defense, along with mandatory payments on the debt that now exceed $1 trillion per year—even as he essentially urged the GOP to give Medicaid a hall pass, too. Rather than offering a modicum of pushback on the latter, however, the alleged conservative Senator from Missouri, Josh Hawley, spoke for much of the GOP caucus when he echoed Trump’s behind closed doors admonition not to “f‑‑‑ with Medicaid:”

“I hope congressional Republicans are listening,” Hawley wrote in a Tuesday post, resharing a report about Trump telling the GOP at the meeting to leave Medicaid alone.

Hawley has long warned his party against Medicaid cuts, writing in a New York Times op-ed earlier this month that slashing health care for the working poor “is both morally wrong and politically suicidal.”

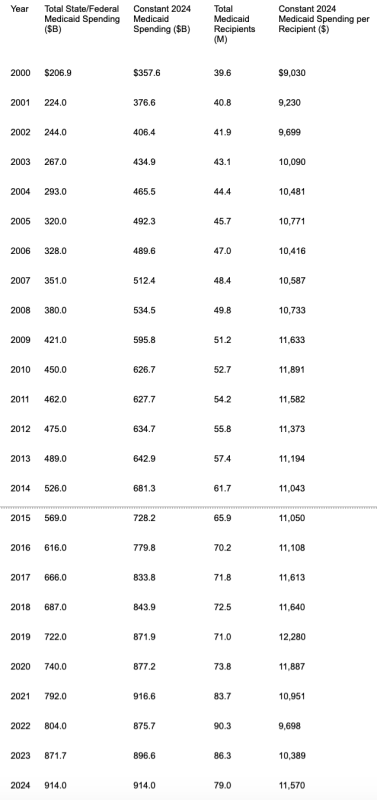

Of course, the Dem rhetoric is that deep cuts in Medicaid will be used to fund tax cuts for the rich. Never mind that sweeping Medicaid reforms are badly needed and fully justified given that the rolls have grown from 40 million to 80 million since the year 2000 alone—even as total Medicaid spending has more than quadrupled and real benefits per recipient have grown by nearly 30%.

Still, that’s exactly the political pickle that the GOP put itself in when it passed the unpaid for multi-trillion so-called TCJA of 2017. That is, rather than stand behind these corporate and individual tax cuts on a permanent basis with offsetting spending cuts, the cowardly GOP tax writers in December 2017 caused most of the TCJA to expire in December 2025. That enabled the bill to comply with Congressional reconciliation process rules—no long-run deficit increase—but it also left on the doorstep of a future Congress a tremendous due bill amounting to $4 trillion of built-in tax increases over the next 10-year budget window.

Needless to say, the GOP is now so obsessed with avoiding the massive 2026 tax increase that it planted squarely in the tax code that any spending cut that it can get a consensus for—such as the relatively superficial cuts in Medicaid and food stamps in the OBBB—will be going not to desperately needed reduction of the baseline deficit, but to paying the due bill on its eight years-ago tax cut. And as it does, it will be giving the Dems yet another opportunity to demagogue about heartless Republicans taking food stamps and medical insurance from poor people to pay for tax cuts for the rich.

And, yes, that’s actually the math of the One Big Beautiful Bill approved by the House last week. Fully 55% or $2.1 trillion of the $3.8 trillion cost of extending the TCJA will go to the top 5% of households with incomes of $250,000 or more.

But here’s the thing. The top 5% are already being taxed to the gills and actually face a marginal Federal rate of nearly 45% when you add the extra Medicare and investment income taxes to the 39.5% top rate in the regular schedule. Accordingly, in 2022 the top 5% accounted for 61% of all of Uncle Sam’s income tax collections.

Moreover, in the case of the blue states, where much of the $6.1 trillion of AGI attributable to the top 5% is earned, combined Federal/state/city marginal tax rates are well above 50%. So there is every reason for fairness and economic incentives to roll back the top marginal tax rate to 37% because the producer classes should never have even that much confiscated from their earnings in the first place.

And yet and yet. The “stupid party” insists on setting itself up for the kind of demagogic attacks that are being waged in the Senate right now because it insists on playing budgetary shell games with the tax code—all of which sooner or later come back to bite it in the political arse time and again.

So once again all the new provisions for eliminating tax cuts on tips and overtime, offsetting deductions on Social Security income and deductions for interest on car loans are set to expire in 2028, creating yet another tax increase cliff just a few years down the road. The fact is, if the intended permanent tax reductions in the OBBB were scored honestly, the true cost—including added debt service—would be well more than $5 trillion over the next 10-year budget window.

So there you have it. A $22 trillion baseline deficit which should be subjected to all-out subtraction and shrinkage is getting another $5 trillion dose of red ink because the so-called conservative party has lost its mind on the fiscal front.

Yet when pressed, Republican politicians resort to the delusion that tax cuts will largely pay for themselves by stimulating additional economic growth and a resulting reflow of higher revenues and lower unemployment-related spending.

”Growing” your way out of fiscal policy deficits has been a bogus theory ever since the Lafferites invented it in the early 1980s and even bamboozled the Gipper with its endless repetition. In truth, this hoary claim is both wrong in theory and has never been even remotely proven in practice.

There is one powerful core reason for this inconvenient truth: To wit, Federal revenues are driven by nominal GDP, not so-called real GDP. To be sure, the tax brackets are indexed to prevent bracket creep, but when wages go up by 4% owing to 2% inflation and 2% real gains, taxable income is 4% higher. And if the mix is 4% real growth and 0% inflation, taxable income is still just 4% higher.

Indeed, the whole theory of tax cuts is that lower rates will increase the supply of labor hours offered in the market, as well as the supply of other factors of production such as productivity fostering capital investment. These additional supply-side resources, in turn, would tend to reduce costs and inflationary pressures.

That is to say, all things equal supply side tax cuts will help improve the mix as between the inflation component and the real component of nominal GDP. But as far as the US Treasury is concerned, it is nominal income that is reported on 1040s and nominal revenues that are collected in withholding tax payments.

So the question recurs. Is there any reason to assume that the tax provisions of the GOP’s OBBB will cause nominal GDP, as opposed to real GDP, to be higher over the next decade than is assumed in the CBO baseline?

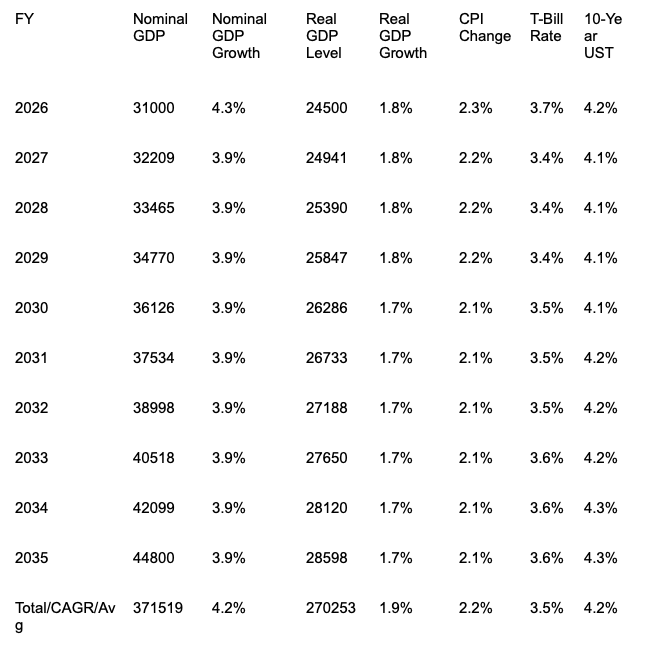

As shown below, the CBO baseline which projects $22 trillion of deficits over FY 2026-2035 assumes that nominal GDP will grow at a 4.20% compound rate, generating a total of $371.5 trillion of nominal GDP over the period. In turn, baseline revenue under current law of $67.167 trillion amounts to 18.1% of nominal GDP.

As it happens, the growth rate of nominal GDP between Q4 2007 and Q1 2025 was, well, exactly 4.21% per annum. And that was during a period in which there was massive monetary expansion and stimulus.

To wit, between Q4 2007 and Q1 2025, Federal Reserve credit outstanding—or what is otherwise described as high-powered money—rose at the staggering rate of 12.5% per annum. And, folks, we do not believe there is a snowball’s chance in the hot place that the Eccles Building will be in a position to run the Fed’s printing presses at anything close to that red-hot rate during the decade ahead.

Obviously, that certainty is owing to the fact that with the inflation genie out of the bottle, the Fed is now engaged in a rearguard struggle to bring it down to even close to its supposedly sacrosanct 2.00% target. So we believe the Fed’s printing presses will stay close to idle for many years to come, yet without inflationary stimulus from the Fed there is absolutely no reason to believe that the nominal GDP growth rate will accelerate. Indeed, if the US economy generates even the 4.2% nominal growth CAGR embodied in the CBO baseline, it will be something of an economic miracle.

So under no circumstances is it reasonable to assume more than the CBO’s $371.2 trillion of nominal GDP will materialize over the next decade. Art Laffer’s napkin to the contrary notwithstanding, therefore, there is no way that Federal revenue even under current law would come in higher than the $67 trillion already in the CBO baseline for FY 2026-2035. Under the circumstances, in fact, the CBO baseline already amounts to Rosy Scenario Redux.

To be sure, it is possible that the implicit mix of inflation and growth will vary from the CBO assumptions, which peg real GDP growth at 1.9% per annum and the implicit GDP deflator at 2.3% in alignment with the CPI assumption shown in the table above. But even a shift to real growth of, say 2.9%, and a corresponding reduction of inflation to 1.3% per annum, would make hardly a dime’s worth of difference in the budget numbers owing to what might be termed the second Inconvenient Truth about economic growth and budget impact.

The idea that higher economic growth is significantly favorable to the budget is essentially an obsolete Keynesian axiom reflective of a time when the US economy was driven by Workfare, as opposed to today’s overwhelming dominance by Welfare.

Under the older Keynesian formulation, an economy operating at well less than full employment would generate a surge in unemployment insurance (UI) payments, which, in turn, would balloon the deficit. And that was supposedly a good thing because unemployment payments would cushion the fall of wage-based consumption spending, thereby braking the recessionary contraction; and then such counter-cycle UI outlays would automatically shrink as the economy recovered.

Whatever the once-upon-a-time merits of this countercyclical budget model, it is surely vestigial today. The CBO baseline spending for FY 2026, for instance, includes $4.2 trillion of outlays for Welfare State programs including Social Security, Medicare, Medicaid, Veterans Benefits and food stamps versus just $38 billion for unemployment insurance. UI spending is thus a mere 0.9% of the Welfare State budget, and the latter is almost entirely insensitive to the state of the macro economy.

Accordingly, even a tripling of unemployment insurance spending owing to weaker than forecast real growth and employment would hardly make a ripple in Federal spending and deficits. On the other hand, of course, higher real growth than the 1.9% per annum rate assumed in the CBO baseline would not make a damn bit of difference to Federal spending, either.

In the first place, higher growth as we have indicated is largely irrelevant to the giant Welfare State budget: Virtually none of the 145 million people who receive these benefits work or have jobs to lose or gain anyway.

At the same time, the CBO forecast essentially assumes full employment for the entire period, meaning that the de minimis $38 billion projected for Unemployment Insurance outlays in FY 2026 and the years beyond is driven overwhelmingly by ongoing “frictional” unemployment (workers moving between jobs) that is present even in a so-called full-employment economy. An even stronger economy than the CBO optimistically assumes, therefore, wouldn’t reduce the cyclical component of UI spending because there isn’t much cyclical spending embedded in the baseline numbers.

In short, higher real growth owing to supply side tax cuts under today’s factual circumstances is likely to neither boost revenue collections materially nor reduce spending levels by measurable amounts relative to the CBO baseline. Accordingly, there is precious little revenue reflow or so-called dynamic effect of modestly higher economic growth rates on the deficit outcomes.

The current catastrophic path of the Federal budget, therefore, can only be addressed by politically painful decisions to slash spending, including entitlements and defense or force the people to pay higher taxes for the bloated level of government spending that no one wants to meaningfully challenge.

Nor are we talking pure theory and economic logic. The proof is actually in the pudding from the 2017 Trump tax cut itself. Owing to the immense cumulative distortions in the US economy owing to decades of money-printing and cheap debt, the Trump tax cut—even on the business side—got mostly captured by Wall Street speculators rather than fueling Main Street growth.

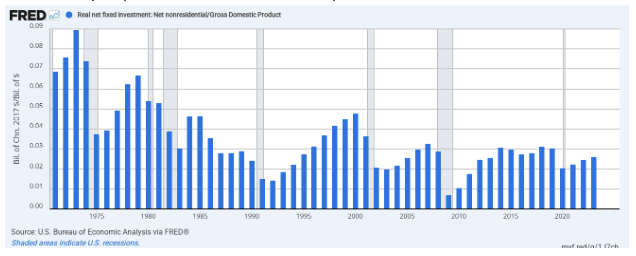

At the time of enactment in December 2017, net business investment in the US economy was already at an all-time low of just under 3.0% of GDP.

As is evident from the graph, investment levels relative to the size of the economy have actually continued to shrink, notwithstanding cutting the corporate tax rate from 35% to 21% and supplying an additional $75 billion per year of incentives for CapEx by unincorporated businesses via the 20% investment deduction.

The question arises, of course, as to where all the increased corporate cash flow from the sharp reduction in businesses taxes actually ended up. But, alas, the latter is no mystery. The money-printing policies of the Fed over the nearly four decades since Alan Greenspan took the helm at the Fed have turned Wall Street into a veritable casino, where gamblers reward the C-suites of America for financial engineering maneuvers like stock buybacks, leveraged recaps, and outright LBOs rather than productive investment in plant, equipment, and technology on Main Street.

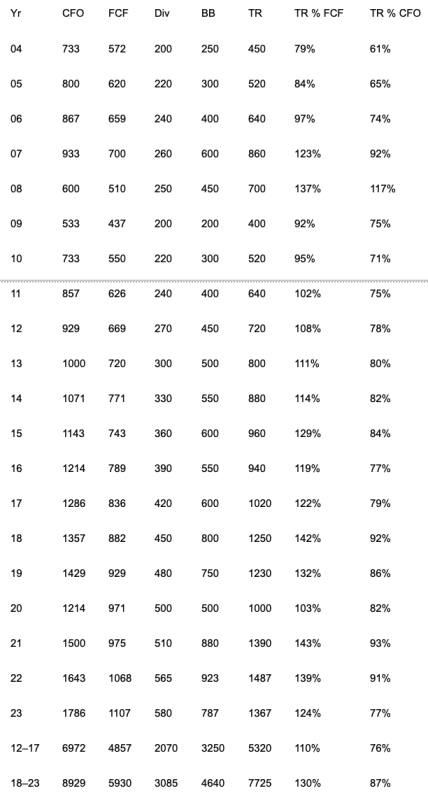

Consequently, operating cash flows of the S&P 500, for instance, rose from $6.972 trillion during the six-year period before the 2017 tax cut (2012-2017) to $8.929 trillion during the six-year afterwards (2018-2023) or by +28%. At the same time, dividends rose by +49% and stock buybacks by +42% as between the two periods.

In total dollars, the gain of $1.957 trillion of operating cash flow during 2018 through 2023 compared to the prior six-year period was offset by an increase of $2.407 trillion in returns to shareholders. Stated differently, 123% of the corporate tax cut-assisted gain in operating cash flows of the S&P 500 companies ended up being flushed back through Wall Street in the form of dividends and stock buybacks!

Indeed, with 87% of operating cash flows being devoted to dividends and stock buybacks during 2018-2023, there was only $1.161 trillion left for net investment on Main Street. That compared to the 76% shareholder return ratio during the six years before the Trump tax cut, which had left $1.673 trillion for net investment on Main Street.

That’s right. The availability of cash flows for net investment on Main Street declined by $512 billion or 31% during the six years after the 2017 tax cut. What this indicates, of course, is that all things are not equal. The rampant money-printing of the Fed has so corrupted Wall Street that even purported supply-side tax cuts have been diverted into increased levels of rent-seeking speculation and financial engineering.

For want of doubt, here are two additional measures of economic performance for the years before and after the 2017 tax cuts. In the case of real economic growth, as measured by real final sales, the annualized gain deteriorated sharply during the post-tax cut period, falling from 2.56% per annum during the five years ending in Q4 2017 to 2.27% per annum in the period since then.

In the case of real wage and salary income, the comparison is even more negative. The growth rate of real wages has deteriorated by nearly one-fifth since 2017.

Per Annum Inflation-Adjusted Growth In Wage and Salary Incomes:

- 2010-2017: +2.43%.

- 2017-2024: +1.92%.

At the end of the day, there are no if, ands, or buts about it. The Trumpified GOP has served up a veritable Debt Bomb, and there is no case whatsoever that the US economy can grow its way out of the $30 trillion of new debt the Donald’s Big Beautiful Bill is about to dump upon the already debt-entombed Main Street economy.

And yet and yet. The GOP has been singing the “Grow your way out” anthem so long that even now it continues to bury its collective head in the sand based on this canard. For instance, GOP Rep. Ron Estes of Kansas told the Daily Caller News Foundation that the problem is not Republican cowardice, but that the CBO green eyeshades have been lying.

“Unfortunately, we’ve seen time and again that the CBO scores Democrats’ spending priorities favorably and Republicans’ tax relief unfavorably. CBO falsely claimed that Republicans’ Tax Cuts and Jobs Act (TCJA) would reduce tax receipts for the Treasury. In reality, TCJA exceeded CBO’s predictions for tax receipts by more than $1 trillion while growing the economy for everyday Americans.”

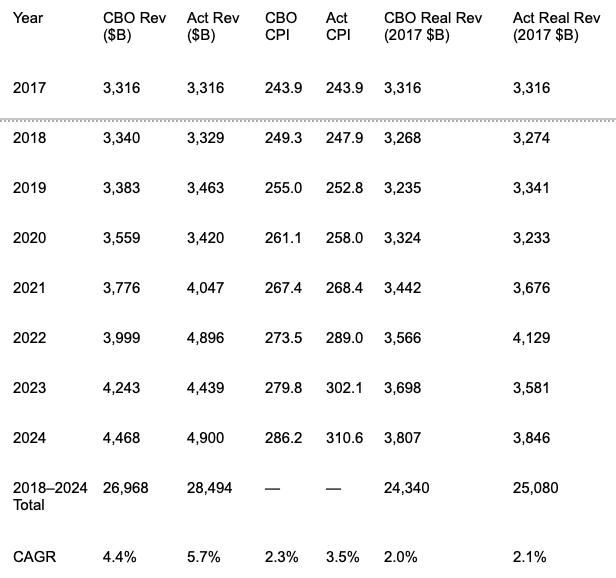

Well, no. Here is the CBO forecast of April 2018 on the Federal revenue outlook after the enactment of TCJA compared to the actual. Yes, it does appear that CBO underestimated nominal revenue by upwards of $1.5 trillion over the 2019-2024 period. But that was almost entirely due to higher than forecast inflation, not more real growth.

To wit, the CBO forecast at the time of the TCJA enactment assumed real growth of 2.0% per annum through 2024. In fact, the actual figure was 2.1% per year—or more than close enough for government work.

What generated the 5.7% overshoot of actual revenues for FY 2018 to FY 2024 was higher inflation, which came in at 3.5% per year versus the 2.3% embedded in the CBO baseline.

And, yes, Americans had higher nominal incomes and made higher nominal tax payments, but real wealth and living standards grew almost entirely in line with the original CBO forecast.

Neither, unfortunately, did those inflated revenues close the deficit gap. That’s because 52% higher than forecast inflation caused offsetting increases in spending and interest payments, too. In fact, just for entitlements with a statutory COLA adjustment, actual spending levels were $320 billion higher than would have been the case under the inflation path in the April 2018 CBO projections.

In short, the main impact of the TCJA was to bury the US electorate even deeper in debt—a condition that the GOP shows no interest in ameliorating. And now in its Trumpified fiscal stupor, not even in the slightest.

Reprinted from David Stockman’s private service

Read the full article here