The yield on the long bond and the 10-year Treasury surged today on deficit concerns.

Today’s Bond Market Action

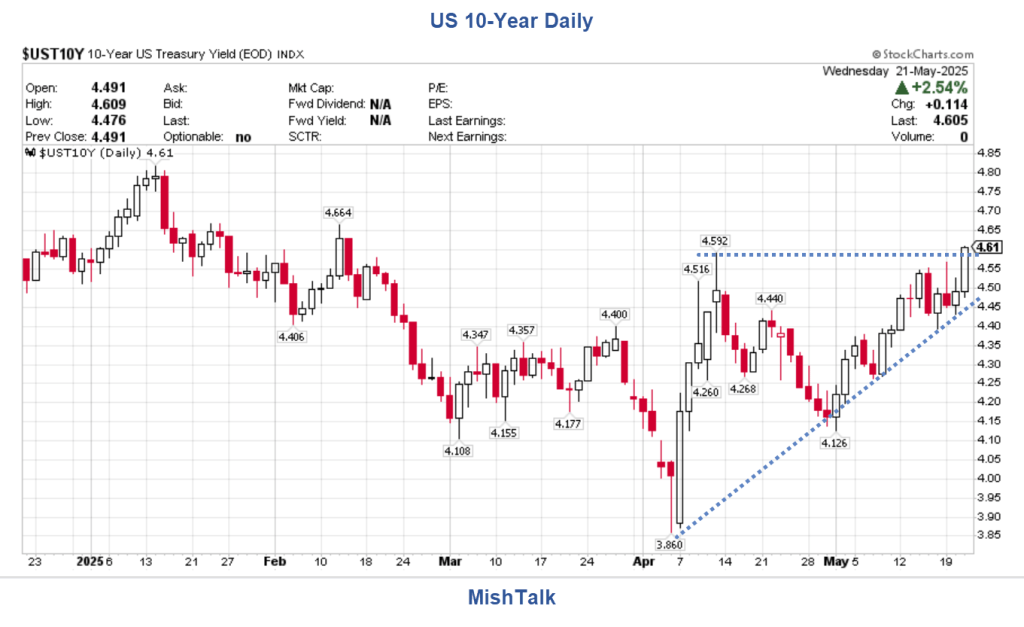

- 10-Year: Up 11 basis points to 4.59 Percent

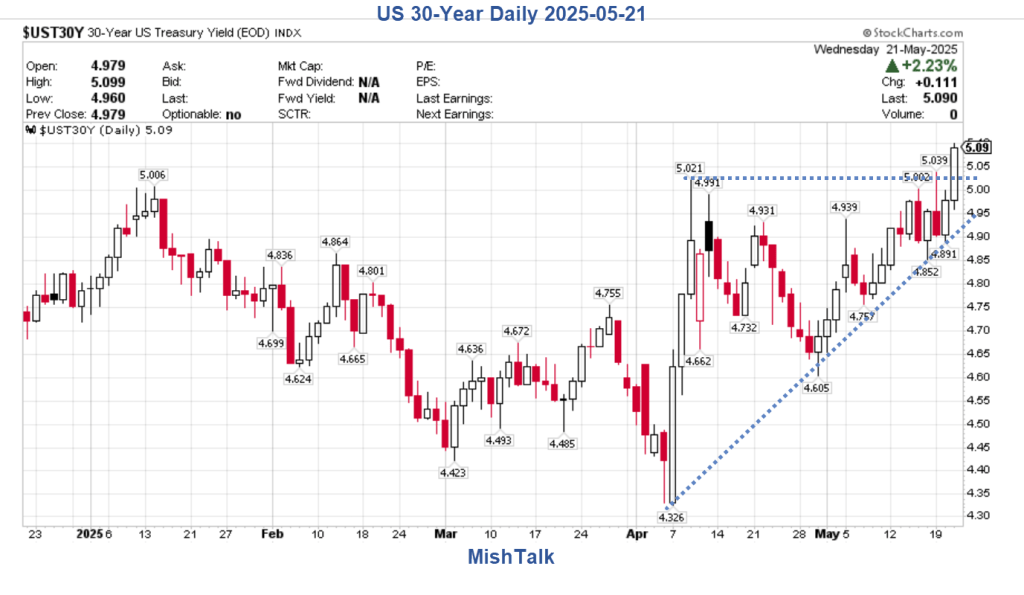

- 30-Year: Up 11 basis points to 5.08 percent

- 5-Year: Up 9 basis points to 4.16 percent

Technical Disaster

The lead chart is a technical disaster. Short-term resistance is only 10 basis points away at 5.18 percent.

Next resistance dates all the way back to 2007 with a peak at 5.44 percent.

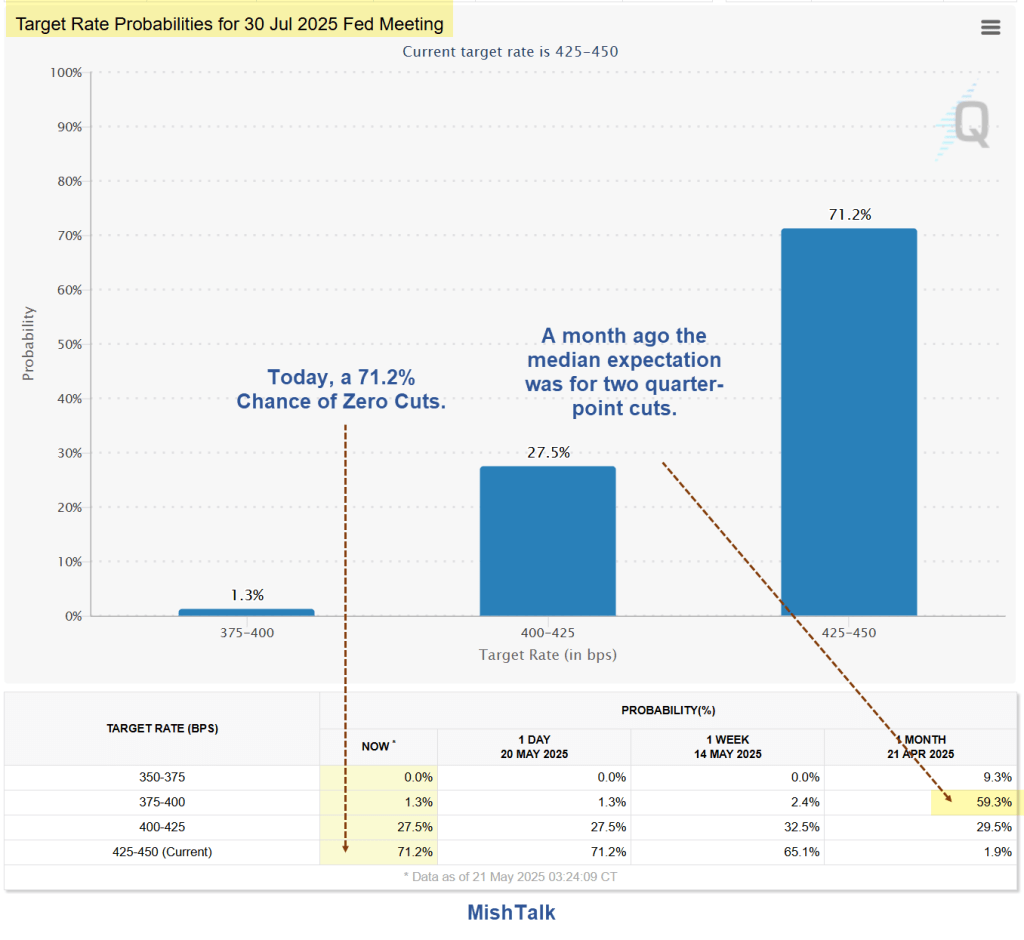

Rate Cuts Priced Out

The bond markets has now priced out rate cuts for June and July.

A month ago, the odds of at lease on quarter-point rate cut for July were over 98 percent. Today, the odds are 28.8 percent.

What Happened?

The short answer is total fiscal irresponsibility by Congress and Trump, plus tariff madness by the President.

May 20: Trump’s “One Big Beautiful Bill” Would Increase the Deficit by $4.8 Trillion

Penn Wharton updated their budget analysis of the House bill as it now stands.

Penn Wharton: “We estimate will increase primary deficits by $5,804 billion ($5.8 trillion) over 10 years. These changes are partly offset by spending cuts of $1,604 billion, for a total conventional cost of $4,806 billion.”

Instead of simplifying the tax code, Trump sloshed around more favors trying to buy votes.

May 20: Trump Threatens to Oust Republicans Who Want to Cut SALT and Medicaid

Trump finally took a fiscal stand. It’s with Democrats.

May 21: How Much Will Trump’s “Golden Dome” Missile Defense Shield Cost?

Trump says $175 Billion. The CBO says $542 billion. Think much higher.

Golden Dome by Executive Order

There is no funding for the Golden Dome program. It cannot be done by executive order.

One thing we have learned over many decades is no government program ever costs as little as preliminary estimates.

Rumsfeld Flashback

In 2003 Secretary of Defense Donald Rumsfeld said the war in Iraq would cost 3.9 Billion. By 2014, the costs soared to $4-6 trillion.

The US did not withdraw its last troops from Afghanistan until August 30, 2021. And most Republicans wanted to stay.

Q&A on the Deficit

Q: Does the Penn Wharton $4.8 trillion deficit increase include anything for the Golden Dome?

A: No

So tack on another $1 trillion over the next 10 years if we start marching down this path.

Ultimately, expect to spend many trillions of dollars on this.

What’s the Tune?

The fundamentals and the technical charts are singing the same tune.

Q: What Tune Is That?

A: Stagflation accompanied by a weakening US dollar

Stagflation is not baked in the cake, but the fundamentals and technicals both point in that direction now.

A return to reciprocal tariffs with increased prices would exacerbate inflation and recession issues.

And my May 20 Hoot of the Day was Trump Threatens a Return to Reciprocal Tariffs

Would anyone be surprised if the next Fed move is a rate hike?

No one should be.

Addendum

30-Year Long Bond – Daily Chart

10-Year Treasury – Daily Chart

This post originated on MishTalk.Com

Thanks for Tuning In!

Mish

Read the full article here