The U.S. $800 de minimis exemption for goods imported from China has been reduced but not cancelled. … More

China’s ultra cheap fashion and general goods giants may be out of the tariff frying pan for now, but tougher rules over the de minimis tariff mean they are still in the line of fire.

While the Trump administration announced a temporary trade deal Monday that slashed tariffs on Chinese goods to 30% from 145% for a 90-day period while talks continue, tariff rules that hit direct to consumer imports have also been cut in half, but a $100 flat-fee option wasn’t changed, the White House has explained.

The de minimis tariff was initially seen as being left out of the wider deal, meaning a 120% tariff rate on shipments from China valued at less than $800, or a flat $100 fee per postal item, remained. However, the White House then released an explanatory text of the executive order, clarifying that the tariff rate wasn’t reduced to 54%, but still maintaining the $100 fee option.

That means many imports of low cost orders from the likes of Temu and Shein have still been priced out by the modified rules.

A Latin term known only within the world of customs, de minimis has become the buzz phrase of the current trade war — broadly translating as ‘too small to matter’ — and relates specifically to small packages shipped directly to consumers from abroad, usually bypassing the warehouses and distribution hubs used to ship to store.

De Minimis Limits Set High

Such packages were shipped in huge quantities to the U.S. by China’s online discount powerhouses, especially as the $800 ceiling in the U.S. is high compared with many other countries, having been raised in the U.S. by President Barack Obama from $200 in 2016. In neighboring Canada, it is about $40 and in Europe around $150.

The exemption was originally designed to avoid unnecessary red tape expense when it could cost more to collect a duty than customs would receive from tax revenues.

But with the threshold high in the U.S., around four million small packages claiming de minimis exemptions crossed into the U.S. daily last year, which was exploited by low-cost exporters such as Temu and Shein.

The packages are also thought to be one of the ways in which opioid drugs such as fentanyl being smuggled into the U.S. – a huge area of focus for President Trump – and former President Joe Biden had also been looking at changing the de minimis rules during his administration.

De Minimis Hits $46 Billion Market

According to a White House fact sheet released in 2024, individual shipments to the U.S. claiming de minimis exemptions annually now exceed more than a billion, up from around 140 million a decade before. Nomura Holdings estimated that around $46 billion of U.S.-bound packages came from China last year, double China’s own reckonings, although that remains just a small fraction of the value of total annual imports, which in 2024 were valued at over $5.3 trillion.

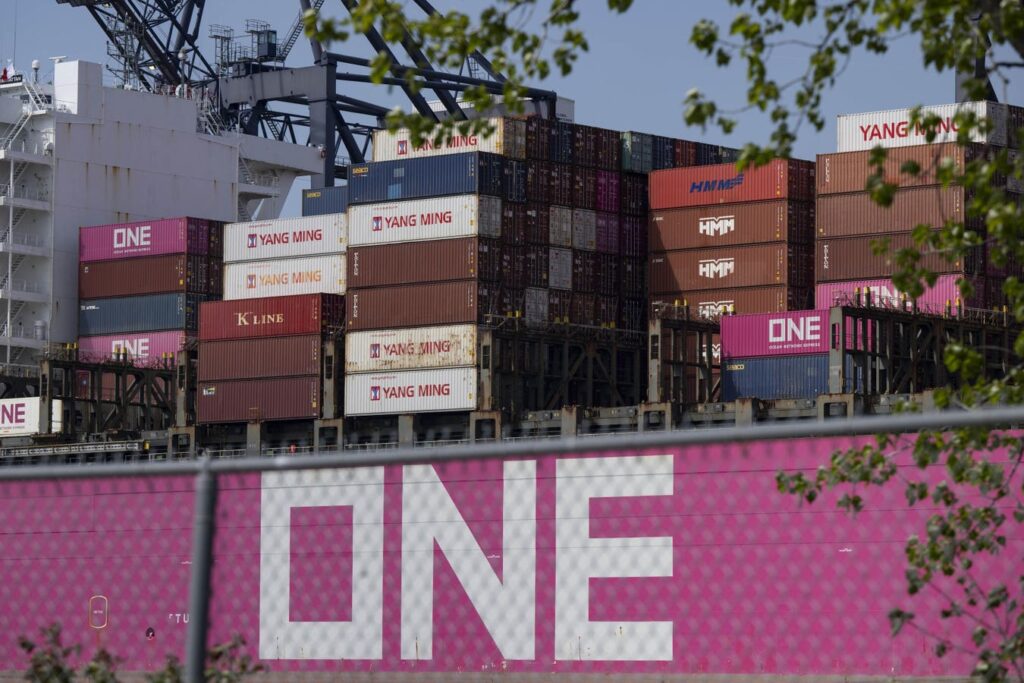

Shein and Temu used the de minimis exemption to deliver direct to consumers. (Photo by RODRIGO … More

The clampdown on the de minimis exemption for imports from mainland China and Hong Kong means products normally using the loophole are now being channeled through customs and are incurring levies, meaning ecommerce deliveries from China are also likely to become slower and elongate delivery times as exporters switch to shipping over air cargo.

With so many changes to the tariff rates, implementation dates, and ongoing negotiations between the U.S. administration and a host of countries around the world, the picture remains unclear and subject to change – possibly huge change.

That for now is leaving the likes of China’s Shein and Temu in limbo, and India could be the big winner in the post-tariff fall out at the expense of some Southeast Asian production countries, according to Ken Pilot, founder of Ken Pilot Ventures, speaking at the World Retail Congress in London this week.

“My big concern is southeast Asia, I think they will feel a bit of a bump, when you look at our big ally the U.K. having tariffs of 10%, perhaps we’ll see Vietnam finish up at 25-30%,” he said.

“I can see India being the big winner and a lot more production moving to India. However, the challenge now is with this tariff decrease, everyone is going to want to get a boat and prices for shipping might go to pandemic levels. Speed to market and not over-producing your products are critical.”

For Shein and Temu, the de minimis debate goes on and for now at least shopping like a billionaire might mean you actually have to be a billionaire.

Read the full article here