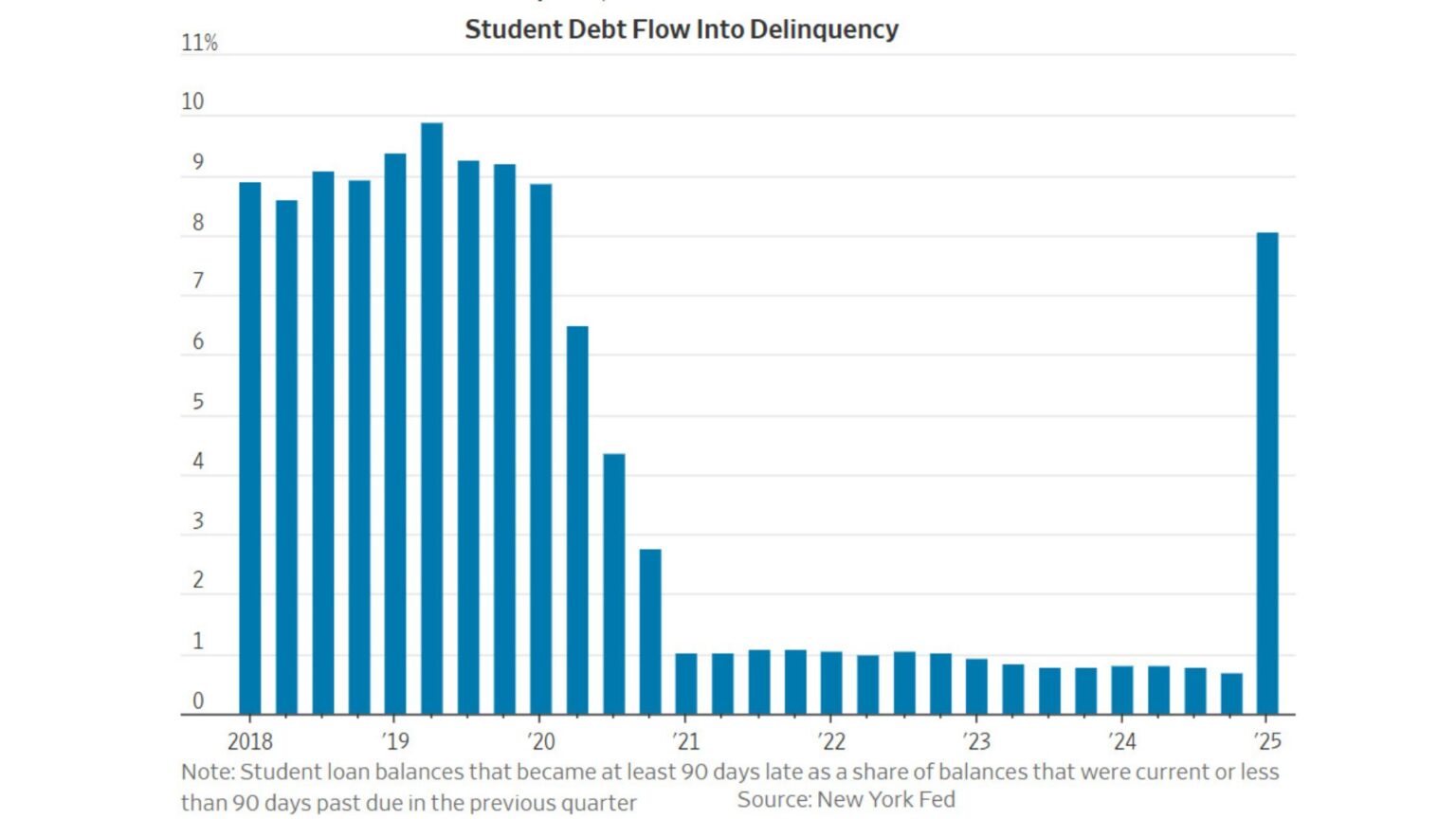

The delinquency rate jumped from 0.7% in the 4th quarter to 8% in the 1st quarter.

Years of Forbearance Have Ended

The Wall Street Journal explains How Student-Loan Crisis Will Show Up in the Economy

Millions of Americans had their student-loan payments put on pause during the pandemic. Now they are back on the hook again.

For borrowers, this means that every month, money that they presumably used to spend elsewhere is going to pay off debt instead. Many who aren’t paying are now considered delinquent or defaulted, a status that sinks credit scores. Around 5.6 million borrowers were marked newly delinquent on their student loans in the first three months of this year.

That will strain personal finances. At the same time, it creates fresh challenges for the broader economy.

Borrowers have been required to repay their student loans for some months now. But just this month, the Trump administration began putting millions of defaulted student-loan borrowers into collections, and threatened to confiscate their wages, tax refunds and federal benefits. The collections process was standard before the pandemic. But it is still likely to be a shock to those who haven’t experienced it before, or who forgot what it was like.

Economists at Morgan Stanley estimated this month that payments this year will rise by a collective $1 billion to $3 billion a month. That could trim 2025 gross domestic product by about 0.1 percentage point, they said.

The Morgan Stanley economists also note that there are about eight million borrowers in the Saving on a Valuable Education plan, or SAVE—a Biden-era plan that allows borrowers to pay based on their income but was challenged in courts. Those borrowers will likely need to begin payments late this year or early next.

Many of the millions of borrowers marked newly delinquent on their student loans already had subprime credit ratings, according to the New York Fed. But two million had credit scores from 620 to 719, or near prime by the New York Fed’s definition. An additional 400,000 were marked as prime, with scores over 720. The average credit score of the near-prime borrowers fell by 140 points, and for the prime borrowers it fell 177 points.

“Just imagine you have these people who haven’t been making payments for half a decade, they’re suddenly getting a letter from a company they’ve never heard of, saying: ‘You owe us student-loan payments,’” said University of Cambridge economist Constantine Yannelis.

Impact on GDP

A 0.1 percentage point decrease in GDP does not sound like a lot. And in many ways it isn’t. But to the millions of people impacted it is an enormous deal.

In addition, you need to increase the impact for 2026 because there are another 8 million borrowers in SAVE plans that have to begin payments next year.

It’s hard to feel sorry for many of these people because going deep in debt to earn generally useless degrees was a self-made choice.

Many others graduated with well-paying jobs and simply chose not to pay anything back based on Biden’s false promises.

Background

It’s important to recall that a major escalation into this setup started with George W. Bush’s Bankruptcy Reform Act of 2005 that made student loan debts not dischargeable in bankruptcy.

That opened the floodgates for the student loan fiasco and irresponsible lending.

People who had no business going to college at all were suckered into loans by colleges promoting “guaranteed jobs” etc. Guaranteed culinary jobs meant McDonalds.

I wrote about this at the time and was disgusted by it.

In general, government and public unions massively increase problems in everything they touch.

Student Debt Cancellation Is Extremely Unfair

On June 3, 2024, I wrote Student Debt Cancellation Is Extremely Unfair. Here Are 10 Reasons Why.

A recent Tweet by Elizabeth Warren and a short rebuttal to her inspired this post. Let’s take a look at the Tweet and my 10 reasons.

The top reason is moral hazard. The problems will never stop and tuitions will keep rising if we bail out everyone who makes poor choices.

This post originated on MishTalk.Com

Thanks for Tuning In!

Mish

Read the full article here