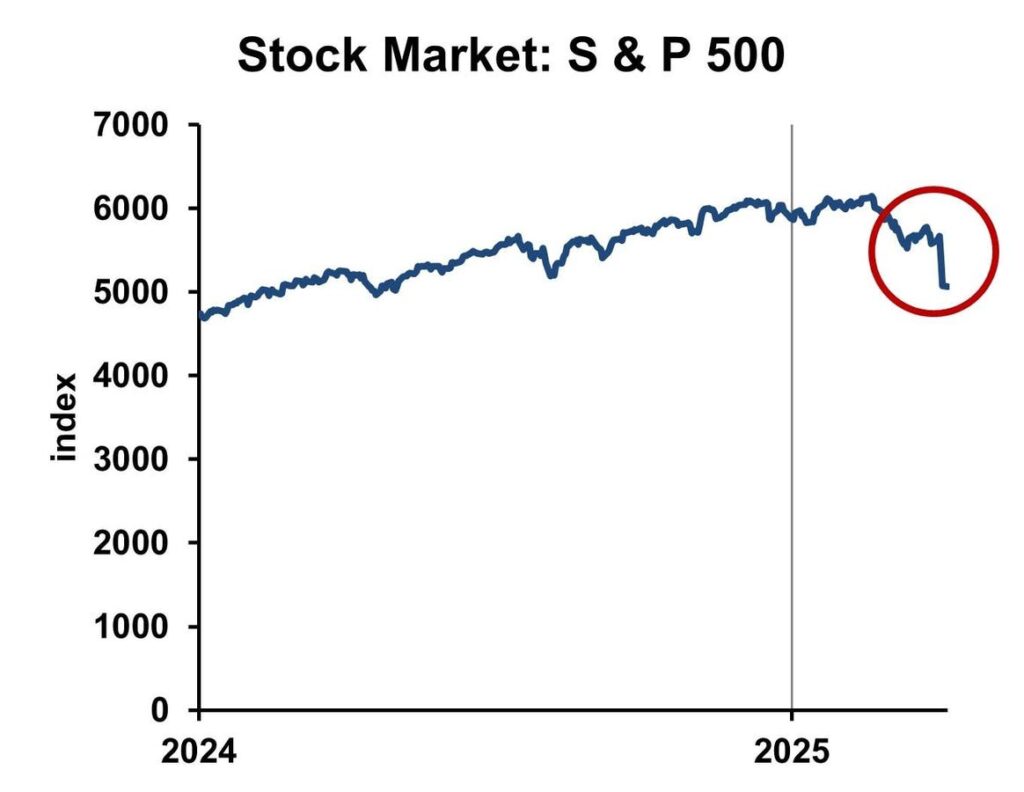

Stock market, January 2, 2024 – April 7, 2025

Dr. Bill Conerly based on data from Standard & Poor’sThe stock market had a rough spell last week after President Trump announced new tariffs. The one-day drop was six percent (on the Standard & Poor’s 500) on its worst day, which followed a nearly five percent drop the day prior. Despite the sense of panic or dread that many people felt, a stock market crash does not predict an economic recession nor further stock market declines. Of course, neither does a crash preclude them.

This time could be different, but this article will review data that includes the Cuban Missile Crisis, the Vietnam War, the inflationary 1970s, the double-dip recessions of the early 1980s, the Dot-Com Bubble and Covid-19. Every event is unique, so no one can be certain how the economy and the stock market will respond to the new tariffs. However, we have enough evidence to recommend chilling out.

A Stock Market Crash And Recession Risk

In 2022 I reviewed whether stock market drops foretold recessions. Using a 20% decline as a threshold for a bear market, here’s what I found. “The stock market did not drop this much from its previous peak around the recessions of 1953, 1957, 1960, 1980, 1981 or 1990. The stock market turned bear at the same time that the 1970 and 2020 recessions began, so it provided no early alert. It provided one month of advance notice for the 2001 recession. The stock market was three months late in its warning of the 1973 recession and eight months late in 2008. False warnings came in 1962, 1977 and 1987.”

Why would stocks drop 20% if not for a recession? A math example explains it. In the standard Dividend Discount Model, a stock is worth the sum of future dividends, discounted for the time value of money. A one dollar dividend, with a ten percent interest rate and a five percent expected growth rate, generates a stock market value of $20.00. If the stock analyst becomes pessimistic about the growth rate and cuts expectations for future growth from 5.00% down to 3.75%, the valuation of the stock goes from $20.00 to $16.00. A 20% drop in stock prices is the usual definition of a bear market. It can occur if long-term growth expectations are less optimistic, even if nobody expects a recession.

The key concept of the stock market is that today’s change reflects the change in expectations. A market decline does not necessarily imply that people are thinking the economy will get worse; they might simply think that past expectations were too optimistic.

Stock Market Crashes And Future Stock Prices

If a stock market decline does not forecast recession, does it at least forecast further stock market drops? Not at all. I looked at all instances since 1950 (when my data begin) of the Standard & Poor’s 500 index dropping at least as much as it did on April 4, six percent. There were 19 days of such a drop before the tariff-induced decline. I calculated the percent change in the index on subsequent days.

In the fifth day following a steep market drop, prices had increased 13 out of 19 times, achieving an average gain of three percent. Over the 30 days following the steep drop, again the market was up 13 out of 19 times, with an average rebound of four percent—not fully recovering, but moving up.

A full year after the day of steep decline, the market rose 16 out of 19 times, averaging a 24% rebound, which more than made up for the sharp drop. And ten years later, we had market gains in 15 out of 16 cases. (Three of the steep declines occurred during the 2020 pandemic, so we do not yet have 10-year results. As of this week, the market is 50% higher than its pre-pandemic peak.)

Will this year’s stock market drop be different? It certainly could be. Mr. Market offers no guarantees. But history suggests an implication for business leaders, and one for investors.

Business leaders should not assume that simply because of the stock market decline a recession is coming. But they should recognize that expectations for the future have changed. Perhaps people had been too exuberant in past months, or perhaps now they are unduly pessimistic. A person who had been highly optimistic when the market was booming in 2024 should now think of the market as a trusted friend who is saying, “Buddy, you’re ignoring important information.” But the person who watched last year’s stock market boom and thought, “Those kids on Wall Street are crazy,” can now feel more comfortable about that belief.

Investors who are panicked about their stocks should use this event to evaluate their investment strategy. They should not bail out of stocks simply because the market fell recently. Instead, they should consider their overall investment strategy. That includes investment goals, time horizon and tolerance for risk. Some people may determine that their strategy is fine and no changes are necessary. Others may want to adjust their asset allocation so that they sleep better at night. But it would be a mistake to sell stocks thinking, “I’ll get back into the market when it looks better.” It will, indeed, look better after it has gone up a good bit. At that time, the cautious investor has already missed the rebound.

Any asset allocation adjustment to reduce risk should be made with long-term goals in mind. A conservative investment strategy may not generate enough return over the long run for a comfortable retirement. If that’s the case, then trimming current expenses to increase savings should accompany the move to a more conservative portfolio. But if conservative investing will hit the goals and also provide psychological comfort, that’s a good approach.

We humans are emotional creatures. Whether that’s good or bad, it is who we are. But business and investment decisions are best made without emotions overwhelming us. A stock market crash can make us panicked in a way the hurts our decision-making. Stay calm and look at hard data.

Read the full article here