There was an interesting article overnight in the otherwise conservative and establishmentarian Financial Times, perhaps best known over the past decade for religiously keeping its readers out of the best performing asset class of all time (bitcoin in particular, and crypto in general which have been relentlessly and constantly bashed with fanatical obsession by all of its now former FT Alphaville writers whose track record of picking trades leaves Jim Cramer in the dust).

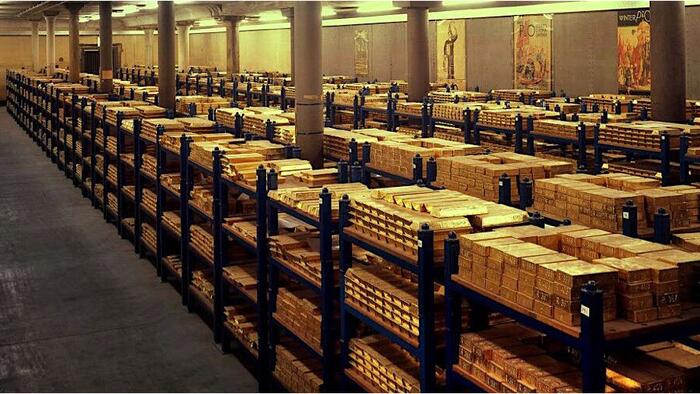

While normally the FT does not bother with reports about gold, and certainly not global flows of gold, this time it made an exception, observing that in recent months there has been a unprecedented “shortage of bullion in London” (which as a reminder for new readers is ground central of the LBMA which stands for London Bullion Market Association) as a result of which “the wait to withdraw bullion stored in the Bank of England’s vaults has risen from a few days to between four and eight weeks, according to people familiar with the process, as the central bank struggles to keep up with demand.”

“People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive. “Liquidity in the London market has been diminished.”

Loading…

Read the full article here