After major interest rate turnarounds (bottoms), silver is usually the big winner. The reason is clearly explained here. What it comes down to is simply that interest rates reflect the value that the market places on money.

When interest rates are high, the market places a high value on money. When interest rates are low, the market places a low value on money. Silver is the best form of money historically, so expect it to outperform during periods of high interest rates.

Seeing that silver is the most undervalued due to the effects of the debt-based monetary system, it will outperform even gold by multiples as the two metals find fair value during this interest rate reset (higher interest rates for years to come).

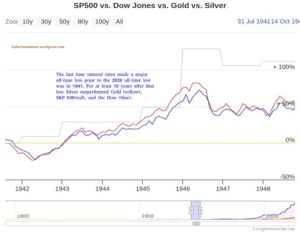

There have been a number of interest turnarounds, or interest rate bottoms, that prove that which is stated above. After the 1941 low in interest rates, silver outperformed gold and the stock market for at least a decade after:

The same happened after 1971; however, the 1971 bottom was not as important as the 1941 bottom.

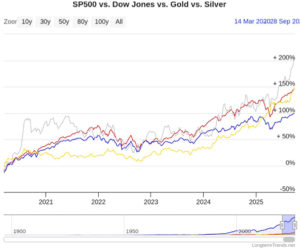

However, in 2020 interest rates made their most important bottom to date, since it was the all-time low and what could possibly be described as the end of a mega cycle. This will also translate in a similar manner for silver. Silver’s outperformance is likely to be even more pronounced this time.

In other words, this could flip to the extent where silver is way overvalued when this cycle has run its course.

We are about halfway in this decade after the mega interest rate bottom, and silver is now really starting to pull away:

Given that this cycle is likely to end closer to a Gold/Silver ratio bottom, and we are now still closer to a top, silver still has much higher to go. This is reflected in one of the many charts that I track on my premium gold and silver blog:

Silver will get back in the channel and reach the top border of the channel as a minimum (more info here).

—

JWR Adds: For more of this kind of analysis, Hub Moolman offers a Premium Service as well as a Silver Fractal Analysis Report that provides more insight regarding the gold and silver markets.

Previous Post

SurvivalBlog’s News From The American Redoubt

Next Post

Preparedness Notes for Tuesday — September 30, 2025

Read the full article here