Two more tariff announcements, one on port fees, the other on China isolation were added and removed.

Trump Worried About Trade With China Stalling

On April 17, Bloomberg reported Trump Says He Is Reluctant to Keep Raising Tariffs on China

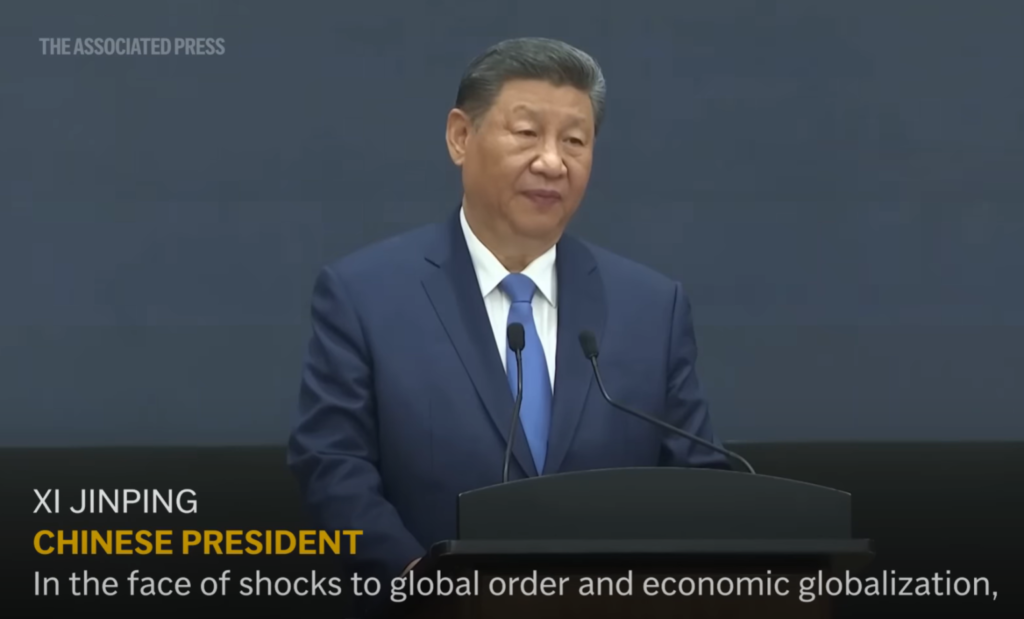

President Donald Trump said he was reluctant to continue ratcheting up tariffs on China because it could stall trade between the two countries, and insisted Beijing had repeatedly reached out in a bid to broker a deal.

“I have a very good relationship with President Xi, and I think it’s going to continue. And I would say they have reached out a number of times,” Trump said.

When pressed on whether Xi himself directly had contacted him or whether it was Chinese officials, Trump responded, “Well, the same. I view it very similar. It would be top levels of China.”

“At a certain point I don’t want them to go higher because at a certain point you make it where people don’t buy. So I may not want to go higher, or I may not want to even go up to that level,” Trump said. “I may want to go to less because, you know, you want people to buy.”

Three Things

- All of a sudden Trump is worried about China retaliations and trade not just stalling, but ending.

- Xi did not call trump.

- I expect these low level officials reaching out are telling Trump that Xi would take his call, The message would be much different if Xi wanted to talk to Trump.

U.S. Plans to Use Tariff Negotiations to Isolate China

On April 15, the Wall Street Journal reported U.S. Plans to Use Tariff Negotiations to Isolate China

The idea is to extract commitments from U.S. trading partners to isolate China’s economy in exchange for reductions in trade and tariff barriers imposed by the White House. U.S. officials plan to use negotiations with more than 70 nations to ask them to disallow China to ship goods through their countries, prevent Chinese firms from locating in their territories to avoid U.S. tariffs, and not absorb China’s cheap industrial goods into their economies.

Those measures are meant to put a dent in China’s already rickety economy and force Beijing to the negotiating table with less leverage ahead of potential talks between Trump and Chinese President Xi Jinping. The exact demands could vary widely by nation, given their degree of involvement with the Chinese economy.

The White House and Treasury didn’t respond to requests for comment.

The tactic is part of a strategy being pushed by Bessent to isolate the Chinese economy that has gained traction among Trump officials recently. Debates over the scope and severity of U.S. tariffs are ongoing, but officials largely appear to agree with Bessent’s China plan.

It involves cutting China off from the U.S. economy with tariffs and potentially even cutting Chinese stocks out of U.S. exchanges. Bessent didn’t rule out the administration trying to delist Chinese stocks in a recent interview with Fox Business.

Still, the ultimate goal of the administration’s China policy isn’t yet clear.

“The ball is in China’s court,” Leavitt said when reading Trump’s statement. “China needs to make a deal with us. We don’t have to make a deal with them. China wants what we have…the American consumer.”

It also isn’t clear that the anti-China line has entered into negotiations with all nations. Some countries haven’t heard demands from U.S. negotiators related to China, say people familiar with the talks, though they acknowledge that negotiations remain in early stages. Many expect the Trump administration to raise China-related demands sooner or later.

Goal Isn’t Clear, Ball in Trump’s Court

The goal isn’t clear because Trump has conflicting goals that can change frequently, even hourly.

The ball in in Trump’s court. He can reach out to Xi. And no nation can trust any deal Trump makes, so why bother reaching out.

As long as Trump keeps up with inflammatory statements, there will not be a meeting with Xi.

Port Docking Fee

On April, 17, 2025 CNBC reported Trump administration announces fees on Chinese ships docking at U.S. ports

The Trump administration on Thursday announced fees on Chinese-built vessels after a United States Trade Representative investigation by the Biden-Trump administrations found China’s acts, policies and practices were unreasonable and burden or restrict U.S. commerce.

“Ships and shipping are vital to American economic security and the free flow of commerce,” said U.S. Trade Representative Jamieson Greer. “The Trump administration’s actions will begin to reverse Chinese dominance, address threats to the U.S. supply chain, and send a demand signal for U.S.-built ships.”

The USTR said China largely achieved its dominance through its increasingly aggressive and specific targeting of these sectors, severely disadvantaging U.S. companies, workers and the U.S. economy.

The fees will be charged once per voyage and not per port, as originally proposed.

The policy proposal, begun under the Biden administration and culminating in a January report concluded China’s shipbuilding industry had an unfair advantage, would allow the U.S. government to impose steep levies on Chinese-made ships arriving at U.S. ports.

The original proposal called for a service fee of up to $1 million to be charged on each Chinese-owned operators (such as Cosco). The original proposal also said that for non-Chinese-owned ocean carriers with fleets containing

The USTR acknowledged this change was made due to the public comments at the two days of hearings on the fines in March where over 300 trade groups and other interested parties testified. Many warned the government in letters and in testimony that the U.S. was in no position to win an economic war that placed ocean carriers using Chinese-made vessels in the middle. Soon, Chinese-made vessels will represent 98% of the trade ships on the world’s oceans.

The World Shipping Council also issued a statement Friday detailing “serious concerns” over the port fees, calling the move “a step in the wrong direction.”

Port Fees Off

On April 17, Reuters reported United States eases port fees on China-built ships after industry backlash

Ocean shipping transports about 80% of global trade – from food and furniture to cement and coal. Industry executives feared virtually every cargo carrier could face steep, stacking fees that would make U.S. export prices unattractive and foist annual import costs of $30 billion on American consumers.

“Ships and shipping are vital to American economic security and the free flow of commerce,” U.S. Trade Representative Jamieson Greer said in a statement. “The Trump administration’s actions will begin to reverse Chinese dominance, address threats to the U.S. supply chain, and send a demand signal for U.S.-built ships.”

Still, the fees on Chinese-built ships add another irritant to swiftly rising trade tensions between the world’s two largest economies as President Donald Trump seeks to draw China into talks on his new tariffs of 145% on many of its goods.

The revisions tackle major concerns voiced in a tsunami of opposition from the global maritime industry, including domestic port and vessel operators as well as U.S. shippers of everything from coal and corn to bananas and cement.

They grant some requested carve-outs, while phasing in fees that reflect the fact U.S. shipbuilders, which turn out about five vessels annually, will need years to compete with China’s output of more than 1,700 a year.

The USTR exempted ships that ferry goods between domestic ports as well as from those ports to Caribbean islands and U.S. territories. Both American and Canadian vessels that call at Great Lakes ports have also won a reprieve.

As a result, companies such as U.S.-based carriers Matson and Seaboard Marine would dodge the fees. Also exempt are empty ships arriving at U.S. ports to load up with exports such as wheat and soybeans.

Cancellations of Chinese freight ships begin as bookings plummet

Also note Trade war fallout: Cancellations of Chinese freight ships begin as bookings plummet

- The number of canceled sailings of freight vessels out of China is picking up as ocean carriers attempt to manage a pullback in orders due to the trade war and tariffs.

- A steep decline in containers being shipped to the U.S. will have a big impact on the supply chain, from port to trucking, rail and warehouse economics.

- “We won’t go to zero containers, but we will see a decrease in containers and as a result, in the future we will see a massive raft of blank sailings announced,” one freight expert tells CNBC.

- A total of 80 blank, or canceled, sailings out of China have been recorded by freight company HLS Group.

- If each sailing was carrying 8,000 to 10,000 TEUs (twenty-foot equivalent units), that would equal a decline in freight traffic of between 640,000-800,000 containers, and lead to decreased crane operations at the ports, lower fees that could be collected, and declines in container pick-ups and transports by trucks, rails, and to warehouses for storage.

- The World Trade Organization warned on Wednesday thatthe outlook for global trade has “deteriorated sharply” in the wake of Trump’s tariffs plan. JB Hunt shares hit their lowest level since November 2020 after commentary during the trucking company’s earnings call about the uncertainty from tariffs.

Trump Playbook

Announce an absurd policy without consulting any trade experts, then back down when the backlash happens.

“We have no way of knowing how significant this drop in orders will be on vessel schedules,” said Alan Murphy, CEO of Sea-Intelligence. “There are no models to extrapolate this.

Trade Disruption

Neither article discussed the port distortions. Smaller ports cannot handle China’s biggest ships. But small ships are disadvantaged on fees.

As port fee avoidance escalates, traffic at smaller ports would plunge.

Trump does not think any trade policy through.

Related Posts

April 16, 2025: Fed Chair Powell Warns of Higher Inflation and Slower Growth Due to Tariffs

At the Economic Club of Chicago, Jerome Powell makes a cautionary speech.

April 18, 2025: Ford Halts Shipments of F-150s and Other Models to China, Winning?

The shipment halt is a logical conclusion to something no one would buy.

April 15, 2025: A Trade War Debate, Who Has the Cards, the US or China?

Let’s discuss a pair of articles from ZeroHedge and Politico.

Trump claims he has all the cards. His actions show otherwise.

Read the full article here