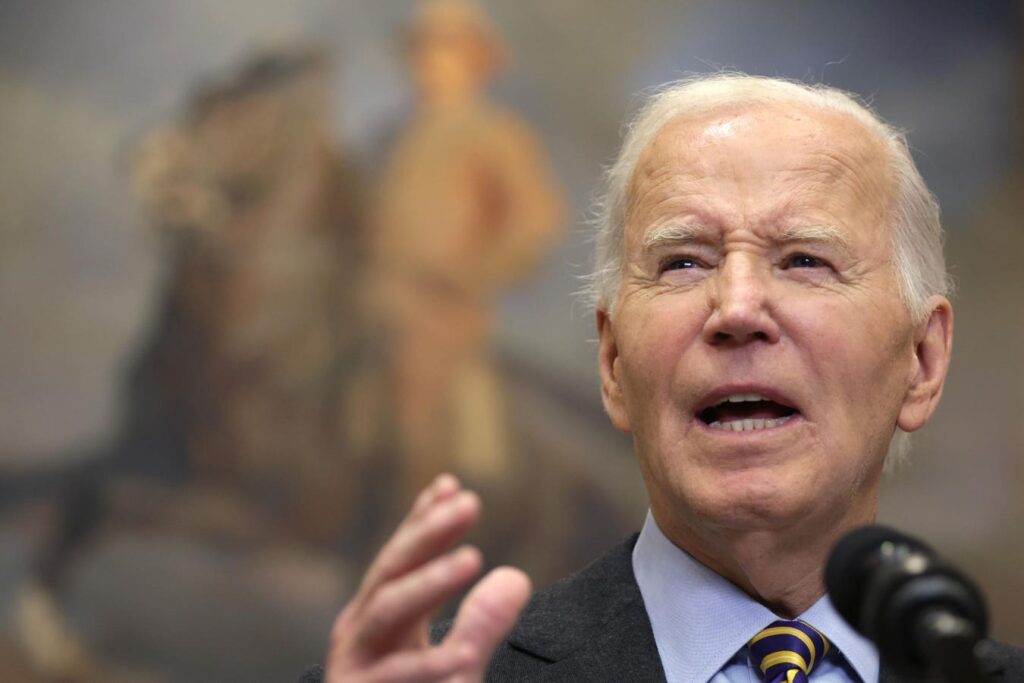

WASHINGTON, DC – JANUARY 10: U.S. President Joe Biden speaks at the Roosevelt Room of the White … [+]

After a lengthy delay, the Education Department announced last week that application processing has officially resumed for several income-driven repayment plans, giving borrowers opportunities to pursue long-term student loan forgiveness. Processing had been paused for months due to a court order associated with a legal challenge to the SAVE plan, leaving millions of borrowers stuck.

Income-driven repayment, or IDR, plans provide affordable payments for federal student loan borrowers. Under IDR plans, payments are calculated using a formula applied to the borrower’s income and family size. Payments are typically reevaluated every year, and they change periodically in accordance with a borrower’s income. Under current law, borrowers enrolled in IDR plans are entitled to complete federal student loan forgiveness of any remaining balance after 20 or 25 years in repayment, depending on the program. Enrolling in an IDR plan is also typically required for borrowers who are pursuing Public Service Loan Forgiveness, or PSLF.

But the entire IDR system has been upended for months. A group of Republican-led states filed a legal challenge against the Biden administration last spring over the SAVE plan. SAVE is the newest IDR option that lowers payments compared to other IDR plans, waives excess interest, and can even accelerate student loan forgiveness in certain cases. But a federal court order in August blocked the Education Department from implementing the SAVE plan, and this has had cascading impacts throughout the federal student loan system. The Education Department’s recent announcement that IDR processing has resumed may be a big deal for many borrowers.

Student Loan Forgiveness Progress Had Been Halted For Many IDR And PSLF Borrowers

The injunction issued by the 8th Circuit Court of Appeals in August had catastrophic ramifications for borrowers. Technically, the order was limited to just the SAVE plan — but that alone impacted eight million borrowers. Those borrowers were then forced into a forbearance. While no payments have been due during the forbearance and no interest is accruing on impacted loan balances, the period does not count toward student loan forgiveness under IDR plans or PSLF. This has left these borrowers stuck.

Under normal circumstances, borrowers can simply change their repayment plan. But for months, that has not been possible. The Education Department initially took down all IDR applications following the August injunction, with officials indicating that the court order had scrambled the department’s systems, and they needed to be updated to ensure compliance with the order. While IDR applications went back up several weeks later, IDR processing remained on hold. The department indicated in public guidance that borrowers stuck in the SAVE plan forbearance could apply for a different IDR plan to resume their progress toward eventual student loan forgiveness, but no applications were actually being processed.

The IDR application processing pause went far beyond just the SAVE plan. Recent graduates have not been able to enroll in any IDR plans, putting them at risk of default or forcing them into a forbearance if they can’t afford their payments, which in turn has prevented them from getting on track for student loan forgiveness under the IDR or PSLF programs. And borrowers already enrolled in other IDR plans who needed to have their payments recalculated — which they have a legal right to do if their financial circumstances have changed — have been unable to apply, even if they aren’t even in the SAVE plan.

IDR Processing Officially Resumes, Allowing Borrowers To Get Back On Track For Student Loan Forgiveness

On Friday, the Education Department announced that IDR processing has officially resumed for three plans: Income-Contingent Repayment, Pay As You Earn, and Income-Based Repayment. The Biden administration recently reopened the ICR and PAYE plans to give borrowers more options to get back on track for student loan forgiveness (the plans had been previously closed following the rollout of the SAVE plan).

“Servicers have begun processing certain IDR applications that were paused following court orders affecting the terms and availability of IDR plans,” said the department in updated guidance on Friday. “Specifically, processing has resumed for borrowers’ applications to enroll in the IBR, ICR, and PAYE Plans. Servicers will also process applications for recalculations for IBR, ICR, and PAYE.”

While technically borrowers can also apply for the SAVE plan, that program remains blocked due to the 8th Circuit’s injunction. As a result, the department cannot process applications for the SAVE plan. The department also cannot process applications where the borrower selects the option for their loan servicer to choose the plan with the “lowest monthly payment,” since technically that could be the SAVE Plan — and the SAVE plan remains blocked.

“Processing for all other applications, including applications for SAVE (formerly known as REPAYE) and applications where borrowers selected ‘lowest monthly payment,’ will remain paused,” said the department.

Delays And Potential Complications Remain For IDR And PSLF Borrowers Pursuing Student Loan Forgiveness

While the resumption of IDR application processing will be welcome news for many borrowers, hurdles and complications remain, which could jeopardize student loan forgiveness.

All borrowers should prepare for lengthy processing delays, as loan servicers now have a backlog of IDR applications that have been submitted during the last five months. “Servicers will have applications in the queue that will take some time to work through,” warned the department. No estimates were provided for processing times.

Some borrowers may be placed in a special processing forbearance once their servicer begins working on their IDR application. A processing forbearance can last up to 60 days, and the period can count toward student loan forgiveness for IDR and PSLF. But if it takes the loan servicer longer than 60 days to process, the borrower will go back into a type of forbearance that won’t count toward loan forgiveness.

“If servicers need time to process a borrower’s IDR application, servicers will move the borrower into a processing forbearance for up to 60 days,” explained the department. “Interest accrues during this short-term processing forbearance, and time in the processing forbearance is eligible for PSLF and IDR forgiveness. If the borrower’s application is not processed by their servicer within 60 days, the borrower will be moved into a general forbearance that does not count toward PSLF or IDR until their application is processed.” Interest won’t accrue if the borrower is moved back into a forbearance that doesn’t qualify for loan forgiveness.

In the meantime, millions of borrowers are awaiting a ruling from the 8th Circuit. While technically the legal challenge is only about the SAVE plan, the court is also considering whether to strike down student loan forgiveness at the end of the 20- or 25-year term under the ICR and PAYE plans, as well, as these programs were established using the same legal authority as the SAVE plan. IBR is not being challenged, but Republican lawmakers are also considering repealing certain loan forgiveness pathways for all IDR plans.

Read the full article here