The Fed’s Beige Book shows a weakening economy

Please consider the Fed’s Beige Book for July 2025.

What is the Beige Book?

The Beige Book is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve Districts. It characterizes regional economic conditions and prospects based on a variety of mostly qualitative information, gathered directly from each District’s sources. Reports are published eight times per year.

What is the purpose of the Beige Book?

The Beige Book is intended to characterize the change in economic conditions since the last report. Outreach for the Beige Book is one of many ways the Federal Reserve System engages with businesses and other organizations about economic developments in their communities. Because this information is collected from a wide range of contacts through a variety of formal and informal methods, the Beige Book can complement other forms of regional information gathering. The Beige Book is not a commentary on the views of Federal Reserve officials.

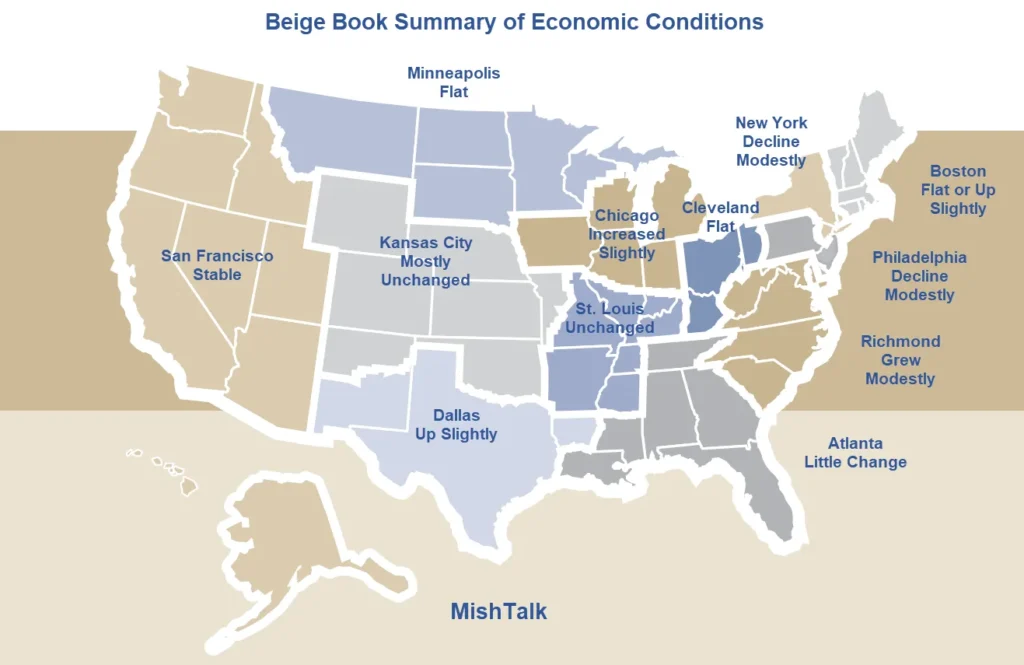

By Fed Region

- Boston: Economic activity was flat or up slightly. Retail revenues decreased modestly, and tourism revenues edged lower, in part because of fewer visitors from Canada. Price increases were modest overall, although tariffs drove above-average price increases in a few cases. Home sales increased modestly. Hiring plans remained conservative amid a guardedly optimistic outlook.

- New York: Economic activity continued to decline modestly as heightened uncertainty hindered decision making. Employment was up slightly and wage growth was modest. Selling price increases remained moderate, while input prices rose steeply with widespread tariff-related cost increases.

- Philadelphia: Business activity continued to decline modestly in the current Beige Book period. Activity fell moderately for nonmanufacturers but edged up slightly for manufacturers. Employment declined slightly, while wages increased slightly. Prices rose modestly after moderate growth last period. Generally, firms expect slight growth over the next six months, although economic uncertainty remains.

- Cleveland: District business activity continued to be flat in recent weeks, but contacts expected activity to increase slightly in the months ahead. Several manufacturers reported softer orders, and transportation contacts reported a steep decline in demand. Contacts said that cost growth remained robust while their selling prices only increased modestly.

- Richmond: The regional economy grew moderately in recent weeks. Consumer spending on retail, leisure, and hospitality increased at a modest to moderate rate. Business conditions were largely unchanged as firms across most sectors reported steady sales and demand. However, manufacturing activity contracted slightly with firms citing higher prices curtailing demand in recent weeks. Employment rose modestly and price growth remained moderate this cycle.

- Atlanta: The economy of the Sixth District was little changed. Labor markets and wages were steady. Prices rose moderately. Consumer spending softened, but travel and tourism increased modestly. Residential and commercial real estate activity declined. Transportation activity grew modestly. Loan growth was flat. Manufacturing was flat, but energy activity rose moderately.

- Chicago: Economic activity increased slightly. Employment increased modestly; consumer spending, business spending, and construction and real estate activity were flat; manufacturing declined slightly; and nonbusiness contacts saw no change in activity. Prices rose moderately, wages rose modestly, and financial conditions loosened slightly. Prospects for 2025 farm income were unchanged.

- St. Louis Economic activity has remained unchanged. Employment levels were generally unchanged. Prices continued to increase moderately, and most contacts continued to expect higher nonlabor costs in the coming months as a result of tariffs. The outlook among contacts remains highly uncertain and slightly pessimistic.

- Minneapolis Economic activity was flat overall. Employment grew slightly and wage growth was moderate. Price growth eased but manufacturers felt more acute pressures. Overall consumer spending was down but tourism activity increased. Construction and energy activity decreased while manufacturing and vehicle sales were flat.

- Kansas City: Economic activity in the Tenth District was mostly unchanged, with some rebound in consumer spending and financial activities. Labor availability was reportedly much higher, which lowered expected wage pressures for the remainder of the year. Prices rose at a moderate pace.

- Dallas: Economic activity in the Eleventh District economy was up slightly over the reporting period. Nonfinancial services activity grew modestly, and manufacturing production held steady. Loan volumes expanded, while oil production was flat, retail sales declined, and the housing market weakened. Employment was unchanged and price pressures held steady. Outlooks remained pessimistic.

- San Francisco Economic activity was largely stable. Employment levels were slightly lower. Wages grew at a slight pace and prices increased modestly. Retail sales expanded modestly, and consumer and business services demand eased. Conditions in manufacturing, and residential real estate markets weakened somewhat. Lending activity and conditions in agriculture were largely unchanged.

Economy at Stall Speed

I count three Fed regions up, and a fourth if you count Boston listed as “flat or up slightly”. Richmond was the standout. The Richmond area grew “moderately.”

New York and Philadelphia declined “modestly”

Add it all up and you have an economy at stall speed.

Related Posts

July 15: Year-Over-Year CPI Jumps 0.3 Percentage Points to 2.7 percent

Month-over-month and year-over-year the CPI rose 0.3 percent.

July 15: Real Hourly Earnings of Private Workers Decline 0.1 Percent in June

Inflation-adjusted wages fell in June. A decline in hours worked makes it worse.

July 19, 2025: Who’s Paying Trump’s Tariffs? Foreign Producers, Walmart, or You?

The answer is you, of course.

This post originated on MishTalk.Com

Thanks for Tuning In!

Mish

Read the full article here