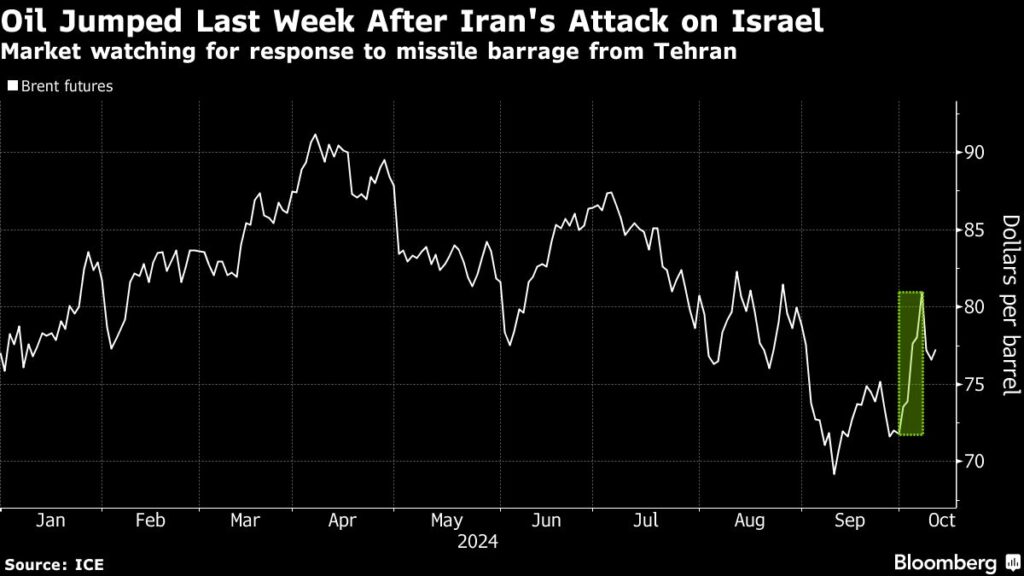

(Bloomberg) — Oil rose after a two-day decline as traders watched for an Israeli response to Iran’s missile attack early last week, while US crude stockpiles expanded the most since April.

Most Read from Bloomberg

Brent rose above $77 a barrel and West Texas Intermediate was close to $74. The market remains on edge after Israeli Defense Minister Yoav Gallant said on Wednesday the response “will be deadly, precise and above all surprising,” while Iran has warned it’s ready to launch thousands of missiles if needed.

Oil has been jolted by the hostilities, with volatility soaring and hedge funds adding more net-long positions. President Joe Biden has discouraged an attack on Iranian oil infrastructure, and spoke with Israeli Prime Minister Benjamin Netanyahu on Wednesday for the first time in over a month. But the call threw into focus the US leader’s limited ability to influence Israel’s prime minister.

“The market remains in a ‘wait and see’ mode, with considerable upside risks if the conflict escalates further and impacts energy infrastructure in the Persian Gulf,” SEB analyst Ole Hvalbye wrote in a note. “The potential for upside risks outweighs the downside in the current volatile environment.”

Still, concerns over China’s economy continue to linger, and the lack of fresh major stimulus from Beijing this week prompted a broad market selloff on Tuesday, including in oil. The central government said it would hold a new briefing on fiscal policy on Saturday.

In the US, meanwhile, crude stockpiles swelled by 5.8 million barrels last week, the biggest increase since late April, according to government data released on Wednesday. Gasoline inventories dropped.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

–With assistance from Yongchang Chin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here