Topline

Artificial intelligence titan Nvidia took center stage Wednesday afternoon when the company shared financial results from its quarter ending last month, and though it was another stretch of record-setting sales amid the AI boom, Nvidia reported unusually weak bottom line growth as Washington regulations on the company’s China dealings took hold.

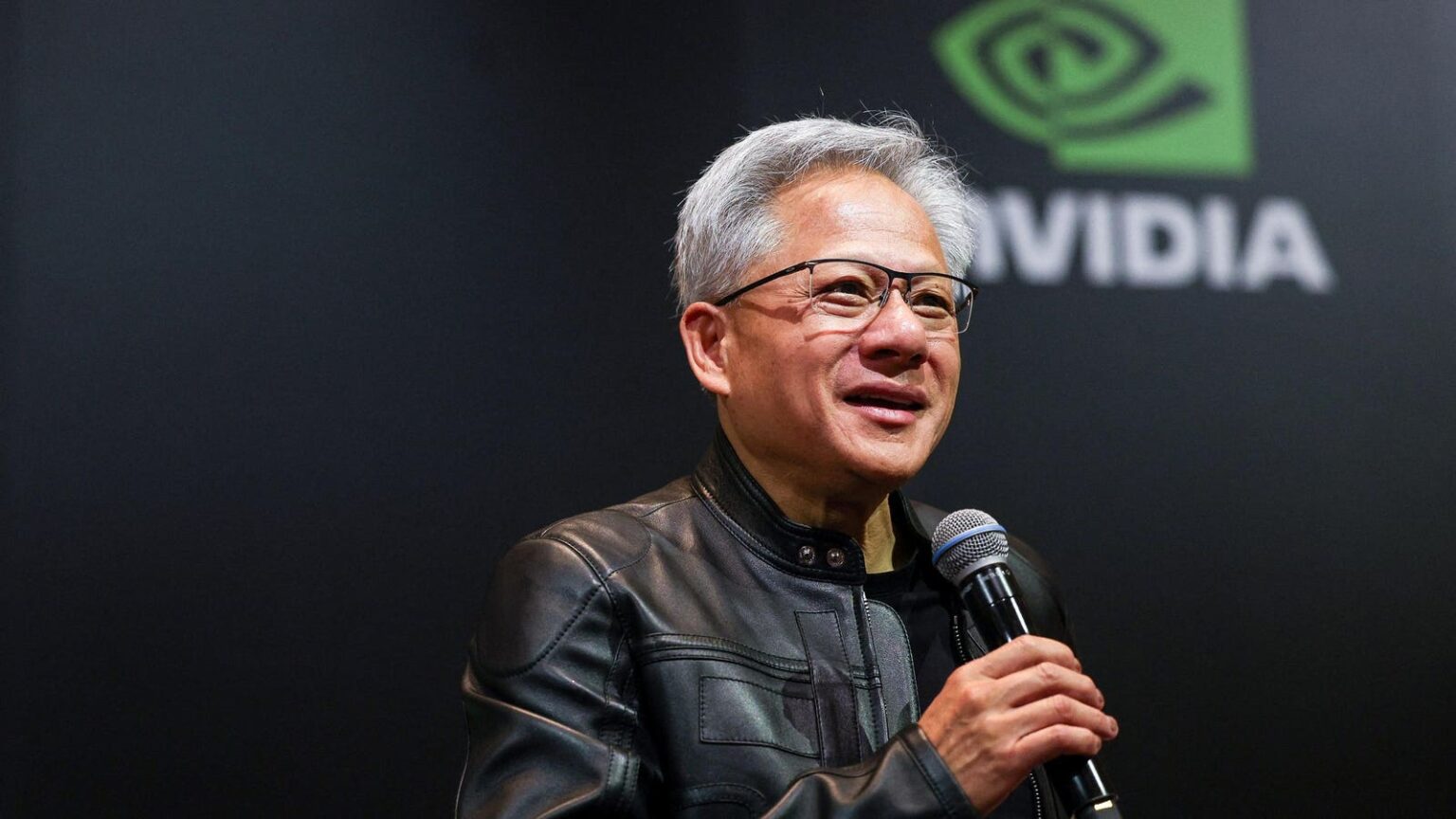

Nvidia CEO Jensen Huang, the world’s 11th-richest person, has come a long way from bussing tables.

AFP via Getty ImagesKey Facts

Shares of Nvidia jumped 3% to $138 following the better-than-anticipated quarterly results.

Nvidia reported $44.1 billion in revenue for the three-month period ending April 27, besting Wall Street forecasts of $43.3 billion in revenue, according to consensus analyst estimates compiled by FactSet.

That equates to year-over-year top line growth of a robust 69%, smashing the $39.3 billion sales record set the prior quarter.

Nvidia beat bottom line growth expectations as well, though by a more modest margin, as it brought in $0.83 adjusted diluted earnings per share and $19.9 billion net income, compared to respective projections of $0.73 diluted earnings and $18.3 billion net income, equating to an annual EPS increase of 33%.

That’s a far cry from the more than 70% year-over-year earnings expansion Nvidia reported in each of the prior seven quarters.

So why the ebbing growth as the global generative AI push remains in full force? It largely traces to the $4.5 billion charge the company took this quarter after the Trump administration curbed the company’s ability to export its H20 AI chips to China, which has a $50 billion market for Nvidia’s chips, according to Rosenblatt analysts.

Big Number

$8 billion. That’s how much revenue Nvidia expects to lose during the summer quarter due to new H20 export controls, the company said Wednesday.

Surprising Fact

The 61% gross margin Nvidia raked in last quarter was its weakest gross margin since 2022. Bank of America expects margins to recover to nearly 75% by year’s end.

Key Background

Nvidia is the unquestioned market leader in designing the semiconductor technology needed to train and power generative AI applications ranging from OpenAI’s ChatGPT to Tesla full self-driving. The pervasiveness of Nvidia’s graphics processing units, or GPUs, in the AI gold rush – as Nvidia enjoys a whopping 75% share in this burgeoning AI accelerator market – led Nvidia to become one of the world’s most valuable companies, Nvidia’s $3.3 trillion market capitalization trails only Microsoft’s $3.4 trillion market cap. Since the November 2022 release of ChatGPT sparked a spike in interest in AI’s ability to drive corporate growth, Nvidia stock has blossomed. Shares of the Silicon Valley firm are up 700% during that timeframe, outperforming the S&P benchmark by a magnitude of 14.

Tangent

Now worth more than Berkshire Hathaway, Walmart, JPMorgan Chase and Coca-Cola, combined, Nvidia has quite the humble origins, tracing its founding to a 1993 meeting between Huang and his two cofounders at a Denny’s diner.

Forbes Valuation

Huang, the company’s only-ever CEO, has come a long way since his first job as a Denny’s busboy, as he is the 11th-richest person in the world thanks to his $119 billion fortune, according to Forbes’ latest calculations.

Nvidia Stock Dipped Ahead Of Earnings

Shares of Nvidia pulled back 0.5% to $134.81 during Wednesday’s session. Major indexes were down slightly ahead of Nvidia earnings, an event which often catalyzes broader moves. There needs to be a “positive earnings surprise” from Nvidia for the market to “squeeze higher,” according to Fabio Bassi, JPMorgan’s head of global cross asset strategy. Nvidia’s earnings come as the broader equity market stages a massive comeback from its tariff-driven slide this spring, as the S&P 500 is up 6% in May, heading toward its best monthly gain since 2023.

Further Reading

Read the full article here