New York, the Benchmark

New York State is ground zero for the global affordability crisis. That’s because it is the benchmark for global cost-of-living studies everywhere. The thing is, the benchmark for affordability is starting to break. And when that happens, you don’t rely on cost-of-living anymore. You have a diminishing standard-of-living, everywhere.

New York City is often used as the baseline for global cost-of-living studies because it’s one of the best-known and most data-rich cities in the world. As a major center for finance, culture, and business, it provides a clear picture of what life in a large, developed city costs. And supposedly, it is also an example of a great place to live with lots of reliable information to prove it. Researchers and organizations have plenty of reliable information about prices, housing, transportation, and everyday expenses in New York, which makes it an ideal point of comparison. Since the U.S. dollar is also the world’s most widely used currency, it’s easy to measure other cities against New York’s cost levels. Over time, this has made New York the standard reference city for understanding how expensive other places are to live in. However, cost-of-living doesn’t indicate the standard-of-living. When you contrast cost and standard of living, you get affordability. And New York has many unachievable examples of situations that show standard of living. That is why you see a loud, populist, social democrat get elected like Zohran Mandami.

For many in the United States and New York State, cost of living is getting out of control. Now, the crutch they rely on is running on high octane at full throttle toward the fiscal cliff.

At the start of November, 14 states across the United States declared food emergencies over Supplemental Nutrition Assistance Program(SNAP) funding. New York State is the second largest beneficiaries of SNAP funding. About 12%(2.9 million people) of the entire State depends on SNAP benefits to reduce cost-of-living, which costs the Federal government $650 million every month. (California is #1. The State receives over $1.045 Billion in SNAP funding every month.)

Axios reports:

Which states are declaring emergencies over SNAP funding

“New York Gov. Kathy Hochul (D) declared a state of emergency on Thursday as 2.9 million New Yorkers are set to lose crucial SNAP benefits this week because of the government shutdown…

…”No state, including our own, can backfill the money because I’m going to tell you a number. $650 million every month is what we get from the federal government — our people do — for SNAP programs,” Hochul said on Thursday.”

The Difference between Cost of Living and Standard of Living

When you look at the cost of living state-wide in New York, the numbers are actually quite high. A website called Numbeo shows the cost being around $6,237.40 per month (excluding rent) to take care of a family of four. If you include rent, it looks something like this…

| Rent Per Month | ||

|---|---|---|

| 1 Bedroom Apartment in City Centre | 4,142.86 $ | 3,000.00–5,500.00 |

| 1 Bedroom Apartment Outside of City Centre | 2,465.00 $ | 2,000.00–4,000.00 |

| 3 Bedroom Apartment in City Centre | 7,947.73 $ | 5,000.00–12,000.00 |

| 3 Bedroom Apartment Outside of City Centre | 5,104.35 $ | 3,500.00–7,000.00 |

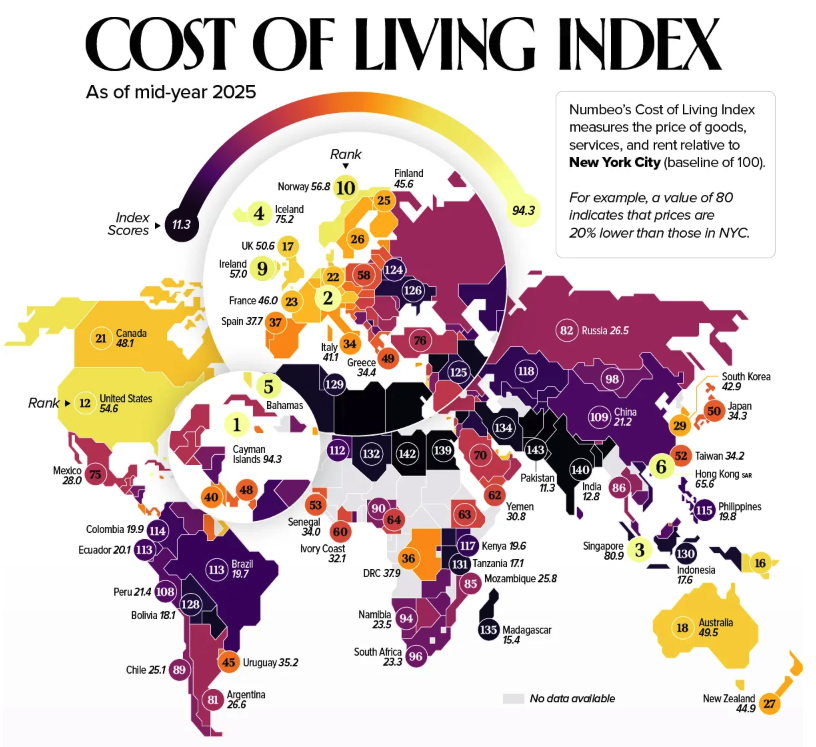

So, for a family of four living in the city centre it would cost somewhere between $10,000-14,000 / month to live comfortably. Is this really achievable? According to a recent statistics from the Visual Capitalist, the average American is doing pretty good. Most American’s are living at almost half the cost as those living in New York State.

New York is the baseline at 100. The USA is at 54.6. Yet, over 10% of Americans rely on SNAP benefits. When you contrast cost of living to standard of living, you get more clarity on the actually financial situation of everyday Americans living in New York State.

If a family of four needs between $10,000 – $14,000 USD to living comfortably that makes New York quite a high-standard to live comfortably. In fact, the reality is it’s even higher. According to a recent study by SmartAssets, a family of four in New York needs $276,973 per year to live comfortably. In other words, a family of four needs an income over $275,000 to achieve what financial advisors are saying is a reasonable standard of living.

New York Post reports:

Here’s how much money a family of four now needs to earn each year to live comfortably in New York

“A family of four living in New York state now needs a staggering $276,973 per year to live comfortably, a new study has found.

SmartAsset conducted the study amid ongoing inflation, looking at each state’s costs for housing and groceries and defining “comfort” as being able to live by the “50/30/20 budget rule.”

“This rule suggests allocating 50% of your income to necessities, 30% to discretionary spending, and 20% to long-term goals like retirement savings or paying off debt,” the study’s authors explained.

The average household income in the Empire State currently stands at about $126,000, meaning most families subsist on about half of what is needed to meet the SmartAsset’s definition of comfort.”

In neighboring New Jersey, a family of four now needs $282,713 to live comfortably.

SmartAsset says the Garden State is one of the areas where costs are rising most rapidly. Just a year ago, a family of four needed $251,181 to live comfortably there, meaning overall costs have surged a whopping 12.55% in the past year alone.

Meanwhile, Connecticut was the costliest in the tri-state area, with a family of four now needing an annual income of $290,368 to be comfortable.”

Obviously, this financial planning company isn’t living on the Dave Ramsey plan. Otherwise, the budget plan would look a lot different. But even with Dave Ramsey walking into the Tri-State area to clean house, I’m willing to bet budgets would be pretty tight for many years. Instead, New Yorkers have elected a Governor, and Mayor intent on achieving a higher standard of living while believing that if they could just control the cost-of-living everything will work out in the end.

Socialism Ruins the Benchmark, If it Wasn’t Already

We’ve already seen Governor Kathy Hochul’s plan for more SNAP funding. Now, let’s look at New York Mayor Mandami’s plan.

Mandami plans on introducing government run grocery stores to provide accessibility and lower the cost of groceries for all.

He also plans to implement city-run supportive housing.

All of this has a cost. Just like every purchase a person makes. It has a cost, and Mandami needs funding. So, his main plan to increase taxes on the rich. These are the same people who provide jobs so others can pay their own cost of living and increase their standard of living. When business owners leave town, each person’s opportunity to increase standard of living also decreases. Mandami doesn’t believe that…

But in any event, as New York State increases government interventions and more people rely on SNAP benefits just how reliable will it be to use New York as a benchmark for affordability?

In the last ten to twenty-five years was New York ever a good benchmark for affordability?

It Isn’t Just Cost-of-Living, It’s the Money

Politicians and pundits point fingers at supply chains, greedy corporations, and even the weather. The real story runs deeper: it’s not that things are getting more expensive, it’s that the USD is losing its value.

The Fiat Money Problem

Fiat money is at the core of today’s cost-of-living crisis. It is currency that isn’t backed by anything tangible like gold or silver, but created by government decree. Since the United States fully abandoned the gold standard in 1971, the dollar has been subject to continuous expansion. Every new dollar that’s created dilutes the purchasing power of the dollars already in circulation. The result? Prices rise, but not because goods become scarcer. It’s because money itself becomes less valuable.

When the Federal Reserve expands the money supply, it creates the illusion of prosperity. Credit becomes cheap, debt expands, and asset prices soar. But this isn’t real growth. It’s a distortion. When new money flows unevenly through the economy, benefiting those closest to its creation (banks, government contractors, asset holders) before the average citizen even sees it. By the time it reaches working families, prices have already risen.

Why Housing Costs So Much

Housing is the perfect example of monetary inflation in action. Cheap credit and artificially low interest rates have driven up real-estate prices for decades. In cities like New York, where demand is already high, these easy-money policies inflate property values far beyond what ordinary incomes can sustain. It’s not a shortage of bricks or land that makes apartments unaffordable, it’s the torrent of new money chasing a limited supply of assets.

When the Fed pumps liquidity into the system, it doesn’t create new housing. The new, easy money bids up the price of existing homes. That’s why a one-bedroom apartment in Manhattan now costs what a family home used to, and why young people feel perpetually priced out of ownership.

Inflation: A Monetary Phenomenon, Not a Mystery

Mainstream economists talk about inflation as if it’s some natural force. They talk about it like a mix of supply bottlenecks, labor shortages, or “greedflation.” But inflation, properly defined, is an expansion of the money supply, not merely the symptom of rising prices. Prices go up because the US dollar goes down. This erosion of purchasing power punishes savers, distorts investments, and transfers wealth from those on fixed incomes to those who hold real assets or debt.

Wages Can’t Keep Up With Monetary Debasement

Even when wages rise, they rarely keep pace with the rate of monetary inflation. Workers may earn more nominally, but their real purchasing power declines. The average American feels squeezed not because their productivity has collapsed, but because their money buys less every year. In effect, inflation is a hidden tax — a way for governments to extract wealth without ever passing a law or holding a vote.

Why New York City Feels It First

New York City sits at the intersection of global finance and monetary expansion. Trillions of dollars flow through its markets, and those closest to the money spigot — banks, funds, and corporate headquarters — are the first to benefit. That concentration of new money drives up local prices faster than in the rest of the country. By the time that inflation trickles down, it’s baked into everything — rent, coffee, childcare, healthcare. New Yorkers live on the front line of monetary distortion.

Now they’re about to live on the front line of socialism.

What happens next is capital flight. The wealthy leave, taking their jobs, investments, and access to easy money with them. Then all of sudden there is no more money available to the city so they can invest in the programs Mandami promised. But more importantly…

When the Benchmark Breaks

When the money leaves, so does the illusion. What remains is the reality that New York was never truly affordable — it was artificially sustained by an over-leveraged monetary system and political promises that could never be kept. The city that once symbolized wealth and opportunity now stands as proof that endless money printing and government intervention can’t manufacture prosperity.

Fiat money allowed New York to live beyond its means for decades, inflating asset prices, distorting wages, and masking decay with liquidity. But now, as the cost of everything rises and real purchasing power collapses, the façade is cracking. When the people who built the city can no longer afford to live in it, the benchmark for global living standards becomes a benchmark for global decline.

As capital flees, businesses close, and dependency deepens, the endgame becomes clear: you cannot tax or legislate your way out of a broken money system. The crisis in New York is not merely local — it’s the leading indicator of what happens when fiat economics runs its course. When the benchmark falls, the rest of the world will follow. And when the dollar finally breaks, it won’t just be New York that feels the collapse — it will be everyone who built their lives on the illusion that paper could replace value.

Read the full article here