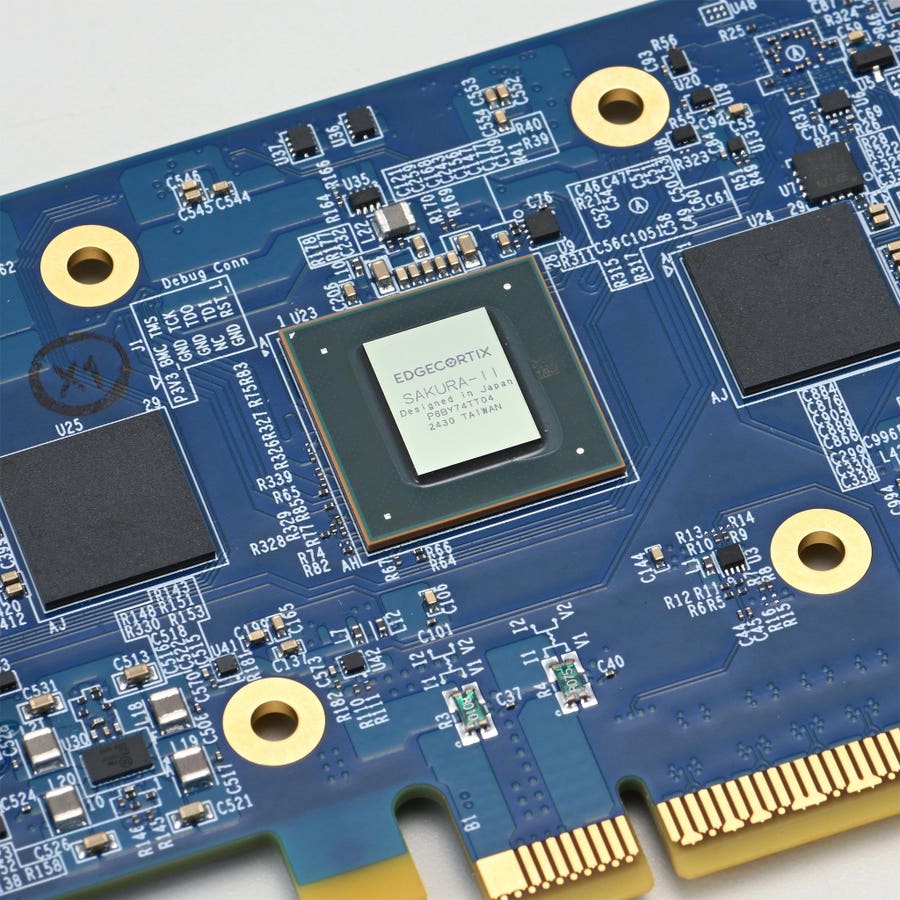

EdgeCortix’s Sakura-II module.

Courtesy of EdgeCortix

As Japan races to develop its domestic semiconductor ecosystem, Tokyo-headquartered chip design startup EdgeCortix announced it received 3 billion yen ($21 million) from a government-backed agency to develop specialized chips that can power “edge AI,” a rapidly growing field of AI that involves running applications on devices themselves instead of on the cloud.

The fresh funds, in the form of a project award from Japan’s New Energy and Industrial Technology Development Organization (NEDO), bring the five-year-old company’s total funding to $86 million, including $49 million in non-dilutive government grants and $37 million in equity financing. It received a 4 billion yen ($27.7 million) subsidy from a separate NEDO program last November.

Across three previous equity funding rounds, with the most recent being a $20 million raise in October 2023, the startup’s investors include SBI Investment, a CVC unit of Japanese financial services conglomerate SBI Group; Monozukuri Ventures; Seoul-based VC firm Futureplay; and automotive chips maker Renesas Electronics, formerly under Japanese electronics giant NEC. Renesas is also a customer of EdgeCortix.

“Building systems that are significantly more performance-per-watt efficient for AI processing than the current status quo, whether that’s GPUs or other types of systems, especially in constrained environments…that is a critical factor for almost all edge applications,” says Sakyasingha Dasgupta, founder and CEO at EdgeCortix, in a video interview. “That essentially differentiates us from the broader edge AI market.”

In addition to the startup’s focus on optimizing energy efficiency, Dasgupta adds, what distinguishes EdgeCortix is its architecture, referring to the design and programming that powers chips. Its patented “Dynamic Neural Accelerator” architecture is an IP core, akin to a “brain” for AI computing that can direct processors within a chip and adjust the way its components interact. This IP core can be integrated with processors such as neural processing units (NPU), which are tailored for machine learning.

The latest grant will finance the development of EdgeCortix’s new chiplet, a type of chip that uses interchangeable components, as opposed to monolithic ones. Dubbed “NovaEdge,” EdgeCortix’s chiplet for edge AI is designed for high-performance generative AI inference and on-device learning, the company says.

Founded in 2019, EdgeCortix operates as a fabless semiconductor company, meaning it does not own its own fabrication facility, or “fab.” The NovaEdge chiplet will utilize a 12-nanometer node produced by billionaire Morris Chang’s Taiwan Semiconductor Manufacturing Co. (TSMC). EdgeCortix plans to commence mass production at TSMC subsidiary Japan Advanced Semiconductor Manufacturing (JASM)’s facility in Kumamoto, Japan, by 2027.

A plant of Japan Advanced Semiconductor Manufacturing Company (JASM).

PHILIP FONG/AFP via Getty Images

With a wide range of applications, ranging from robotics to industrial automation, EdgeCortix’s chips and accompanying software have recently gained traction in the defense industry. Earlier in May, the startup inked an agreement with the U.S. Department of Defense’s venture-oriented Defense Innovation Unit (DIU) to use EdgeCortix’s products for defense technologies, including AI-powered vision and generative AI. In December, the DIU had announced it would launch a new effort to accelerate the adoption of generative AI in both warfighting and enterprise management.

Specifically, on the battlefield, edge AI may help quickly process sensitive information in environments with limited network connectivity or potential cybersecurity threats. Tech giant Palantir–cofounded by billionaires Peter Thiel, Alexander Karp, Stephen Cohen and Joe Lonsdale–has developed a range of edge AI offerings for military purposes, including Skykit, a backpack-sized server that can act as a fully operational intelligence unit for soldiers, analyzing data from sensors on drones and surveillance equipment.

In the nascent field of edge AI, the decentralization of AI represents “a profound shift in the technological landscape,” according to a report published in February by consulting firm Deloitte. Such computing developments may be particularly effective for use cases “requiring rapid responses or operating in disconnected environments,” including smart home devices, autonomous vehicles, wearable health monitors, and industrial Internet of Things (IoT) systems. Global spending on edge infrastructure is projected to grow from $25.3 billion in 2022 to $55.6 billion by 2027, the report added, citing research from the International Data Center (IDC).

A Palantir Technologies Skykit on display.

PATRICK T. FALLON/AFP via Getty Images

Japan’s government-backed investments align with broader efforts to bolster domestic chip design and manufacturing, with the aim of establishing greater independence for advanced AI technologies. Last November, Prime Minister Shigeru Ishiba announced a $65 billion plan to invest in the country’s chip and artificial intelligence industry by 2030, according to local media.

Central to these efforts is the state-backed chipmaker Rapidus. In March, the Japanese government pledged an additional $5.4 billion to Rapidus, bringing its total government subsidies or grants to around $11.5 billion. Headquartered in Tokyo and backed by industry giants, including financial services groups MUFG Bank and SoftBank, electronics makers NEC and Sony, Toyota, and telecoms provider NTT, Rapidus aims to launch commercial production of 2-nanometer chips—some of the world’s thinnest and most advanced—by 2027.

A major link in the global semiconductor supply chain, Japan is also home to industry giants including billionaire Uchiyama family’s Lasertec, which manufactures chip testing equipment; KKR-backed chip production equipment maker Kokusai Electric; Bain-backed Kioxia, Advantest (chip testing equipment); and Sumco, a silicon wafer supplier.

MORE FROM FORBES

Read the full article here