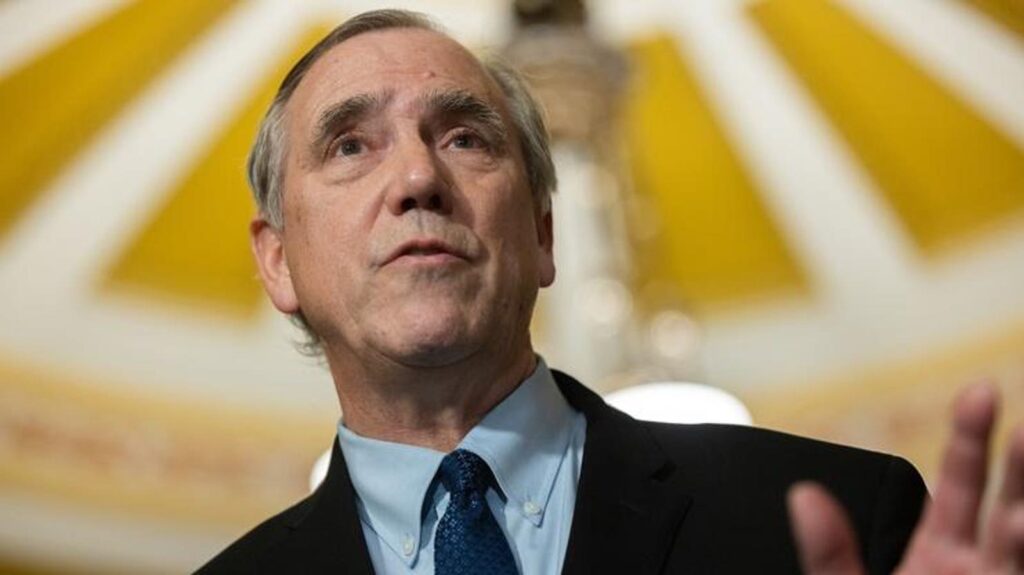

WASHINGTON, DC – MAY 6: Senator Jeff Merkley (D-OR) speaks at a press conference with members of … More

Republican-led plans to make massive changes to federal student loan forgiveness and repayment programs by repealing several existing options suddenly hit a major roadblock on Thursday after a key senate official determined that the proposal would violate a senate rule. As a result, GOP lawmakers may not be able to enact all of their proposed changes, at least not in their current form.

The proposed student loan reforms are part of a much broader legislative effort by congressional Republicans to enact President Donald Trump’s policy priorities through the budget reconciliation process. GOP lawmakers hope to extend and expand massive tax cuts, paid for in part by slashing government spending (including costs associated with affordable federal student loan repayment programs and loan forgiveness). By passing the legislation through the reconciliation process, Republican lawmakers would be able to enact the changes through simple majorities in the House and the Senate. While the GOP holds a slim majority in the House, most legislation would need 60 votes in the Senate to overcome a filibuster. Republicans hold 53 seats in the Senate – enough to pass a bill through reconciliation, but not through the traditional legislative process if enough Democrats oppose it.

But not all legislation can be passed through the budget reconciliation process. Policy changes must comply with the “Byrd Rule.” This rule requires that reconciliation bills must center primarily on budgetary matters related to spending and revenue, and cannot be used to enact unrelated policy changes. The rule also prohibits increasing the deficit beyond the budgetary window of the reconciliation bill.

On Thursday, the Senate Parliamentarian – an official, nonpartisan advisor to the Senate who interprets Senate rules – made a determination that key elements of the Senate GOP’s proposed reconciliation bill would violate the Byrd Rule and, therefore, would require 60 votes in the Senate to pass. With most or all Democrats expected to oppose the bill, the Parliamentarian’s ruling now severely complicates Republican efforts to enact major changes to the federal student loan system. Here’s a breakdown.

Repeal Of Several Student Loan Repayment Plans Now Uncertain

In both the House and Senate versions of the reconciliation bill, GOP lawmakers would make significant changes to federal student loan repayment plans. The legislation would repeal several popular income-driven repayment options that offer borrowers lower payments tied to their income and family size and a pathway to eventual student loan forgiveness. Under the proposal, the Income-Contingent Repayment plan, Pay As You Earn plan, and Saving on a Valuable Education plan (ICR, PAYE, and SAVE, respectively) would be repealed, including for current borrowers. Borrowers who are currently enrolled in these plans would be moved into the IBR plan instead, which advocacy groups have warned could lead to massive spikes in monthly payments for millions of Americans.

But the Thursday ruling by the Senate Parliamentarian now casts these proposals in doubt. The Parliamentarian ruled that the repeal of existing student loan repayment plans for current borrowers would violate the Byrd Rule and, therefore, would require 60 votes to pass the Senate. It is highly unlikely that seven Democrats would join all Republicans in voting for this measure.

The Parliamentarian did not find, however, that the changes would violate the Byrd rule for new student loan borrowers going forward. So if the repeal of ICR, PAYE, and SAVE cannot pass the Senate via reconciliation for current borrowers in repayment, it still could pass via reconciliation for borrowers who take out new student loans after the bill’s passage.

Changes To Student Loan Forgiveness Eligibility Also Cast Into Doubt

The Senate Parliamentarian also ruled that some proposed changes to student loan forgiveness programs would violate the Byrd Rule, as well. Specifically, Republican-led proposals to cut off student loan forgiveness under the Public Service Loan Forgiveness program for medical and dental residents cannot be passed through the reconciliation process. GOP lawmakers had hoped to restrict PSLF eligibility for doctors and dentists by effectively eliminating their ability to receive PSLF credit during their low-earning residency and internship years. But following the Parliamentarian’s ruling, this provision would require 60 votes in the Senate to pass, which is unlikely to happen.

The Senate Parliamentarian has not yet ruled on other proposed changes to federal student loan forgiveness programs. These include repealing Biden-era rules governing Borrower Defense to Repayment, a loan forgiveness program for borrowers harmed by school misconduct; Biden-era rules governing the Closed School Discharge program, which provides debt relief to borrowers who were unable to complete their degree program due to a campus closure; and a provision that would place restrictions on the Department of Education’s ability to draft new regulations expanding student loan forgiveness access. These provisions of the reconciliation bill are still under review.

What Happens Next For Student Loan Forgiveness And Repayment Reform Efforts

Democrats praised the Senate Parliamentarian’s ruling as a fair interpretation of Senate rules. Democrats have widely criticized the GOP-led reconciliation bill as a vast overreach that would cause real harm for millions of Americans.

“The Byrd Rule must be enforced, and Republicans shouldn’t get away with circumventing the rules of reconciliation,” said Senator Jeff Merkley (D-OR) in a statement on Thursday. “Democrats will continue to make the case against every provision in this Big, Beautiful Betrayal of a bill that violates Senate rules and hurts families, students, and workers. Democrats are fighting hard against Republicans’ plans to increase out-of-pocket health care costs and restrict access to reproductive care. Republicans are scrambling to rewrite parts of this bill to continue advancing their families lose, and billionaires win agenda, but Democrats stand ready to fully scrutinize any changes.”

Meanwhile, Republicans will now need to go back to the drawing board to try to rewrite the legislation in order to comply with the Byrd Rule. It is unclear at this juncture how GOP lawmakers will handle their proposals to repeal popular affordable repayment plan options and student loan forgiveness programs for current borrowers, or whether there would be a way to amend the legislation to comply with the Byrd Rule.

Other Republican lawmakers are calling for the Senate to overrule the Parliamentarian. But Senate Democrats have warned that doing so would have major implications for Senate procedures going forward.

“Should my Senate Republican colleagues overrule the Parliamentarian, it will have major long-term impacts for the Senate and the legislative filibuster,” warned Senator Dick Durbin in May. Republican leaders in the Senate have said they would not move to overrule the Parliamentarian.

Ultimately, borrowers concerned about the future of student loan forgiveness and affordable repayment plans got some good news this week, but they will have to wait and see while the process continues to play out.

Read the full article here