Panic selling

This article explores the mechanics of panic selling, how it damages your portfolio, and what you can do to stay on track. If you’ve ever been tempted to sell during a market crash, this guide will help you make better-informed decisions and build lasting wealth.

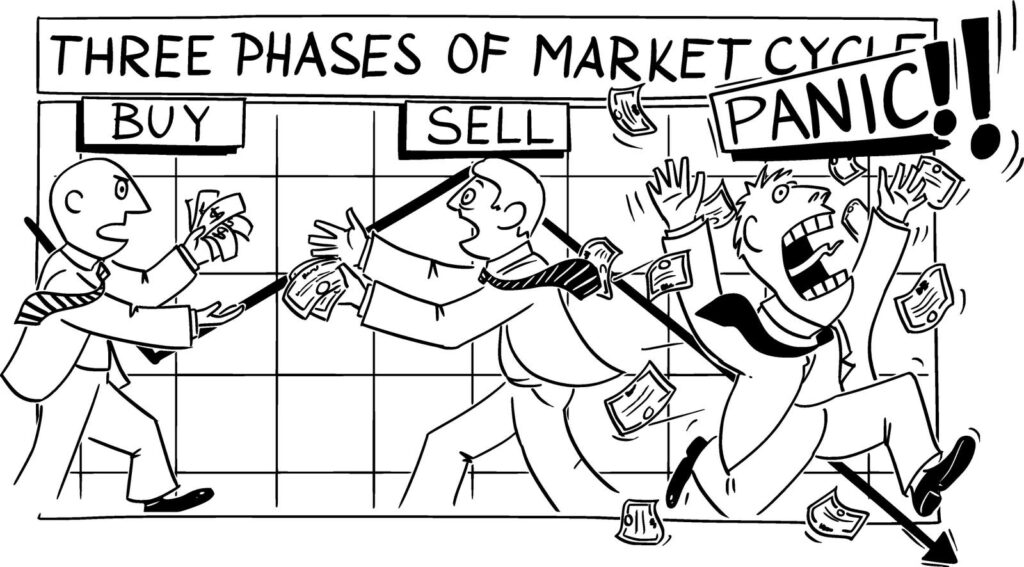

What Is Panic Selling?

Panic selling is when you hastily liquidate your assets in response to a sharp market downturn. This reaction is driven by fear rather than a rational assessment of a stock’s value or a company’s long-term prospects. It often results in significant financial losses because you sell at a low point and miss the subsequent recovery.

Fear, loss aversion, and herd mentality all contribute to panic selling. Studies in psychology and behavioral finance show that people feel the pain of losses more intensely than the pleasure of gains. This leads investors to overreact to market downturns, selling at precisely the wrong moment.

Look at the 2008 financial crisis. Many investors dumped their stocks at record lows, only to watch the market recover in the years that followed. Those who held onto their investments or bought more during the downturn saw substantial gains. Similarly, during the COVID-19 market crash in March 2020, the S&P 500 plummeted over 30% in a matter of weeks. Investors who panicked and sold missed out on one of the fastest market recoveries in history, as the S&P 500 rebounded to new all-time highs within months.

How Panic Selling Damages Your Portfolio

1. Locks In Losses

Markets operate in cycles, and downturns—while painful—are almost always followed by eventual recoveries. By selling in a downturn, you crystallize the loss, removing any possibility of recovery once the market rebounds. Historical data demonstrates that downturns are a normal part of market behavior and are usually followed by periods of growth. Thus, selling at a low locks in a loss that may have only been transient.

Consider an investor who buys shares of a stock at $100. If the stock drops to $70 and they panic sell, they have realized a 30% loss. If they had held onto the stock and the market recovered to $120, they would have seen a 20% gain instead.

2. Misses The Market’s Best Days

While the idea of selling before a crash and buying back in at the bottom is theoretically appealing, it is practically unachievable for the vast majority of investors. Even professionals with access to sophisticated models and data struggle to predict market movements with any consistent accuracy.

The biggest challenge is correctly timing the market. Some of the most substantial gains occur in the early days of a rebound—often while economic news is still negative. Investors who wait for confirmation that the worst is over frequently miss these sharp upswings. Missing just a few of the market’s best days can have an outsized impact on long-term performance.

For example, analysis by J.P. Morgan found that missing just the 10 best days in the market over a 20-year period could reduce an investor’s total returns by more than 50%. Thus, while panic selling might provide temporary emotional relief, it often results in missing the very gains necessary to recover losses and grow wealth.

3. Derails Your Discipline

Emotional investing is one of the greatest threats to financial success. Panic selling is seldom based on rational analysis; rather, it is typically triggered by fear, uncertainty, and a herd mentality. The proliferation of financial news, sensationalist headlines, and social media can amplify anxiety, leading to impulsive decisions that deviate from long-term plans.

Investing success relies on discipline—the ability to adhere to a well-considered strategy even when markets are turbulent. Emotional decision-making disrupts this discipline and can initiate a cycle of reactionary behavior: selling during downturns, reentering during rallies, and repeating the process whenever volatility arises. This behavior not only diminishes returns but also adds unnecessary stress and confusion.

4. Disrupts Compounding

Compounding refers to the process by which investment returns generate earnings on both the principal and accumulated interest over time. This process works most effectively when investments are left undisturbed, allowing returns to build upon themselves.

Panic selling interrupts this process. When you withdraw from the market during a decline, not only do you stop the compounding process, but you also reduce the base from which future growth can occur. This can delay or even derail long-term financial goals. Rebuilding lost capital is not as simple as breaking even: a 50% loss requires a 100% gain to recover, underscoring how damaging a premature exit can be.

5. Neglects Asset Fundamentals

In times of market distress, investors often overlook the fundamentals of the assets they own. The decision to sell is typically based on price movement rather than intrinsic value. This behavior equates a drop in price with a drop in quality, which is often not the case.

For example, a high-quality stock may decline in value due to sector-wide selloffs, interest rate shifts, or macroeconomic concerns that have little to do with the actual performance or outlook of the company. Selling under such conditions is akin to discarding valuable assets at a discount simply because market sentiment has temporarily turned negative.

6. May Trigger Taxable Events

When you liquidate assets during market downturns, you may unintentionally trigger taxable events, particularly if the assets were held for less than one year. Gains realized on investments sold within a one-year holding period are classified as short-term capital gains, which are taxed at your ordinary income tax rate. For individuals in higher tax brackets, this could mean losing up to 37% of those gains to federal taxes—substantially more than the long-term capital gains rate, which ranges from 0% to 20%.

Moreover, many investors attempt to offset losses through tax-loss harvesting but inadvertently fall afoul of the IRS’s wash-sale rule. This rule disallows a capital loss deduction if the investor repurchases the same or a “substantially identical” security within 30 days before or after the sale. In practice, this means that investors who panic sell and then quickly attempt to reenter the market—whether to recapture missed gains or correct an emotional decision—may find that their losses are not deductible in the current tax year. The disallowed loss is instead added to the cost basis of the new purchase, deferring any tax benefit and complicating future accounting.

7. Compromises Your Financial Goals

Panic selling undermines the very goals your investment strategy was designed to achieve. Whether you’re saving for retirement, a child’s education, or a down payment on a home, these objectives depend on time, consistency, and disciplined growth.

Each time you panic sell, you potentially set back your financial progress by years. Rebuilding a portfolio takes time, and if you become increasingly risk-averse after a major loss, you may succumb to overly conservative strategies that are inadequate for achieving your original goals.

What To Do Instead Of Panic Selling

1. Stick To A Long-Term Investment Strategy

The best safeguard against panic selling is having a long-term investment plan that takes into account your risk tolerance, time horizon, and objectives. When you anchor your decisions to long-term objectives, you are better positioned to weather short-term volatility. A well-constructed investment strategy often includes periodic contributions, which helps reinforce discipline and consistency—regardless of market conditions.

For example, a particularly effective method is dollar-cost averaging, where you invest a fixed amount at regular intervals, regardless of the asset’s price. This strategy reduces the risk of investing a large amount at the wrong time and helps to smooth out the cost basis over time. As markets fluctuate, you naturally buy more shares when prices are low and fewer when prices are high. This not only removes the pressure of timing the market but also creates a more stable investment approach that discourages reactive selling.

2. Maintain A Diversified Portfolio

Diversification is a fundamental principle that aims to reduce risk by spreading investments across different asset classes, industries, and geographic regions. A well-diversified portfolio is less susceptible to the poor performance of any single investment, which can provide psychological comfort and stability during market downturns.

For instance, while equities may decline during an economic slowdown, bonds or alternative assets such as real estate or commodities may hold their value or even rise. This risk-reducing effect helps to cushion losses and contributes to a smoother investment experience over time. When you see that not all of your holdings are declining simultaneously, you are less likely to react emotionally and sell out of fear. Furthermore, regular rebalancing—adjusting the portfolio to maintain its target asset allocation—ensures that you systematically buy low and sell high, reinforcing rational investing behavior.

3. Use Risk Management Tools

While no tool can fully eliminate investment risk, certain mechanisms can help mitigate losses and provide peace of mind. One such tool is a stop-loss order, which automatically sells a security if it falls to a predetermined price. For example, if you set a stop-loss order at 10% below the purchase price of a stock, it helps you limit downside exposure in the event of a steep decline.

That said, stop-loss orders should be used carefully. Setting them too tightly can result in getting prematurely stopped out during normal market fluctuations. It is essential to calibrate stop-loss levels based on the asset’s volatility and your risk tolerance. You may also pair stop-loss orders with trailing stops—where the sell point adjusts upward as the asset’s price increases— which can allow you to protect gains while remaining invested during upward trends.

Beyond stop-losses, you can also implement broader risk management practices, such as stress-testing your portfolio under different market scenarios, maintaining adequate cash reserves, and ensuring that your investment horizon aligns with your liquidity needs. These measures collectively enhance financial resilience and reduce the impulse to sell under pressure.

4. Focus On Fundamentals, Not Fear

Savvy investors focus on fundamentals—revenue, earnings, cash flow, competitive advantage—not on the emotions of the marketplace. This involves asking questions such as: Is the business model still sound? Are earnings stable or likely to recover? Does the company maintain a competitive edge in its sector? Has the long-term investment thesis changed? By evaluating these factors, you can differentiate between temporary setbacks and permanent impairment.

Additionally, downturns can present rare opportunities to purchase high-quality assets at discounted prices. Legendary investors like Warren Buffett have consistently advocated for buying when others are fearful. Maintaining a fundamentals-based mindset empowers you to act counter-cyclically—accumulating value during times of widespread pessimism and avoiding emotionally charged sell-offs.

5. Seek Professional Guidance

Working with a financial advisor can help you stay disciplined and avoid costly mistakes. These experts provide objective, research-backed advice that helps clients make rational decisions rather than emotional ones.

They can help you align your investment strategies with long-term goals, calibrate risk exposure appropriately, and make disciplined adjustments when necessary. More importantly, they serve as a voice of reason when fear threatens to derail rational planning..

Advisors can also offer advanced strategies such as tax-loss harvesting, portfolio rebalancing, and income planning, ensuring that all components of your financial life work in harmony.

Final Thoughts

Building lasting wealth is a marathon, not a sprint. By understanding the pitfalls of panic selling and implementing sound investment practices, you can protect your portfolio and pave the way for long-term financial success. Remember: the most successful investors understand that market downturns are temporary. A calm, rational approach will always outperform impulsive reactions.

Read the full article here