By Joel Gilbert

How did Letitia James’s claim that she married her father in order to qualify for her first loan evolve into a lifetime of mortgage and bank fraud?

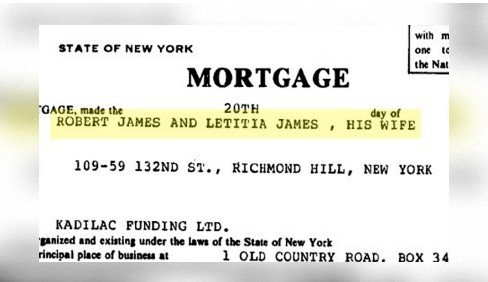

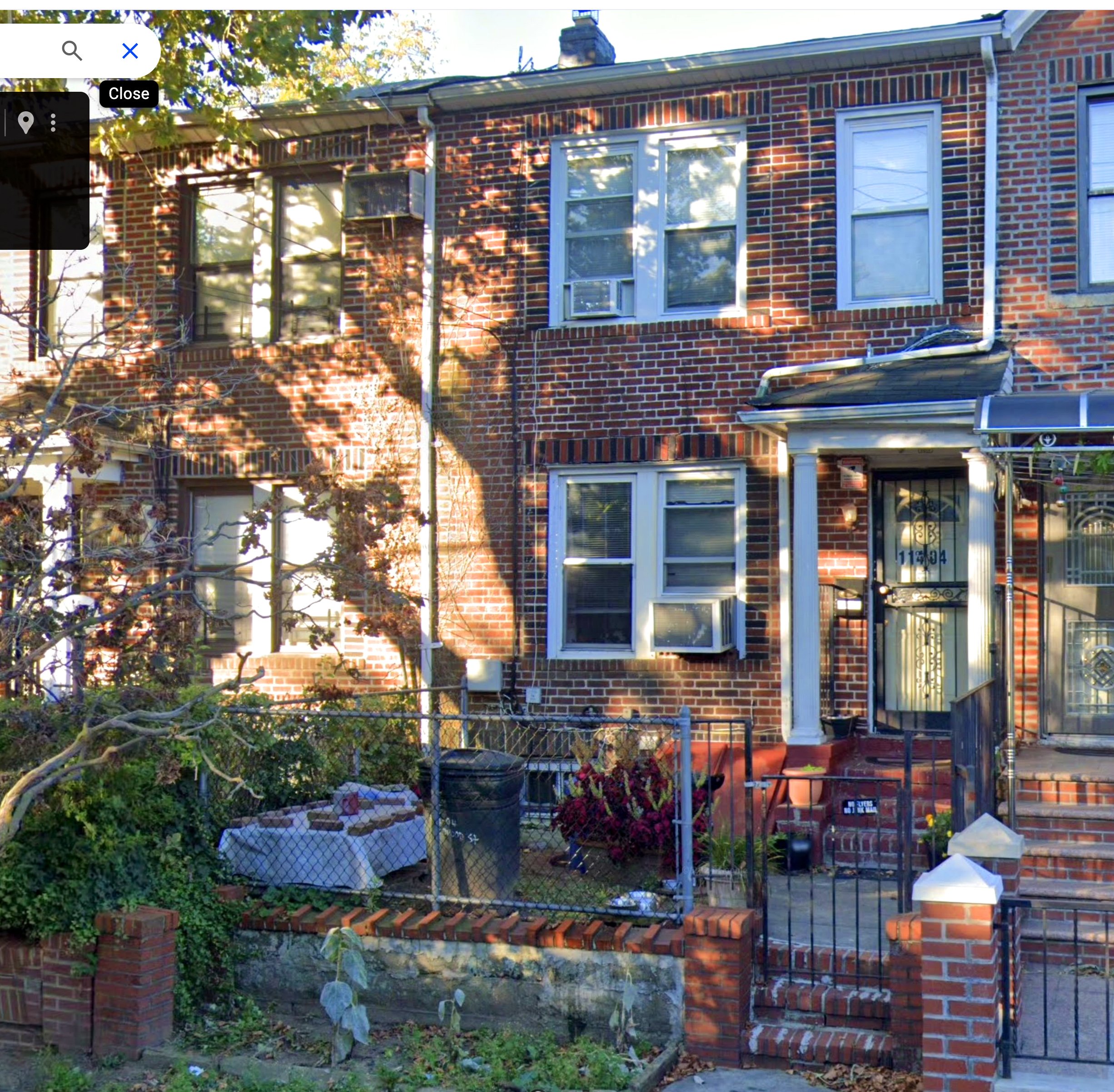

It all began in the spring of 1983, when a 24-year-old Letitia James and her father, Robert James, posing as “husband and wife,” took out a real-estate loan for $30,300 from Kadilac Funding Ltd. for the purchase of a two-story townhome in Queens. The loan document, signed by both, listed “ROBERT JAMES AND LETITIA JAMES, HIS WIFE” in three separate places. This was no clerical error.

At that time, young Letitia likely lacked sufficient income or credit to qualify for a mortgage as a single woman. The fraudulent claim of marriage to her father allowed her to obtain financing she otherwise couldn’t have, an act that meets the legal definition of mortgage fraud under state and federal statutes.

This deception set a precedent for her. Once Letitia discovered that falsifying personal information could deliver tangible financial rewards without consequence, the act of misrepresentation for loans became a lifelong habit.

Decades of mortgage misrepresentations followed. Even after she became the high-profile Attorney General of New York state on January 1, 2019, James continued the same behavior pattern.

In 2020, James purchased a property at 3121 Perone Avenue in Norfolk, Virginia, signing a document claiming it would be her primary or secondary residence, rather than a rental property, to secure a lower interest rate. That misrepresentation recently became part of the criminal indictment against her for mortgage and bank fraud, carrying a potential 30-year prison sentence.

In 2021, James applied for a $200,000 line of credit mortgage from Citizen’s Bank on her 5-unit apartment building in Brooklyn, but in mortgage documents James claimed it only had one apartment unit. Accordingly, James received a lower residential mortgage interest rate she was not entitled to, and avoided a higher commercial loan rate and much higher closing costs.

In 2023, James bought a home at 604 Sterling Avenue in Norfolk, Virginia. Per Sam Antar, Letitia qualified for the loan only after certifying in an updated application that it would be her “primary residence”, even though she lived in Brooklyn.

Letitia’s father’s participation in 1983 not only legitimized mortgage fraud in Letitia’s mind, but also created a powerful model of “family teamwork” in bending the rules. Letitia’s “primary residence” at 604 Sterling Avenue in Norfolk was a joint loan with yet another family member, Shamice Thompson-Hairston. Letitia later told a crowd that she made the purchase in order to provide a home for Shamice’s “kids”. However, the “kids” were both adult felons with long rap sheets, including Nakia Monique Thompson who is a wanted fugitive with an active arrest warrant in North Carolina. To this day Letitia James is harboring her fugitive niece, a new category of crime for Letitia James’s own rap sheet.

“I went to Howard University!” Letitia James boasted at a rally at the United Place Theatre on Oct 13, 2025. Yet even an elite education cannot always undo deeply ingrained behavioral patterns.

When someone commits mortgage fraud at a young age, it can establish a deeply rooted psychological pattern based on their experience that fraudulent claims when applying for loans can deliver tangible rewards without consequences. The initial act of deception, especially involving family, reinforces a sense of invincibility and normalizes unethical behavior as a tool for financial advancement.

In a September 14, 2025 interview on The Point with Marcia Kramer (CBS New York), when told by Kramer, “Trump has two grand jury investigations against you”, James responded, “He’s announced this investigation into my alleged mortgage fraud. As you know, in order to engage in mortgage fraud, you need intent”.

James is correct that intent is an essential element of mortgage fraud. Prosecutors must prove beyond a reasonable doubt that the defendant acted with intent to defraud. Defense attorneys often argue that mistakes, misunderstandings, or lack of awareness negate criminal liability.

However, it will depend on whether the evidence suggests James “should have known” or consciously disregarded the truth. Given James’s 43-year pattern of mortgage fraud, combined with her extensive legal experience and her public record as a defender of property laws in New York state, prosecutors are quite likely to convince a jury that James knew exactly what she was doing.

Letitia James’s story illustrates the powerful psychology of rationalized fraud – how one minor deception with her father, rewarded and unpunished, can evolve into a lifelong modus operandi of criminal behavior. Over time, the boundary between being “clever” and criminal became blurred for James, warping her moral compass and creating a sense of entitlement.

The irony is staggering. Letitia James, a woman educated at Howard University and charged with enforcing justice, including mortgage laws, appears to have internalized the very behavior she has prosecuted, including the very charges she filed against her most high-profile target, Donald Trump.

Joel Gilbert is a Los Angeles-based film producer and president of Highway 61 Entertainment. He is the producer of the new film Roseanne Barr Is America. He is also the producer of: Dreams from My Real Father, The Trayvon Hoax, Trump: The Art of the Insult, and many other films on American politics and music icons. Gilbert is on Twitter: @JoelSGilbert.

Read the full article here