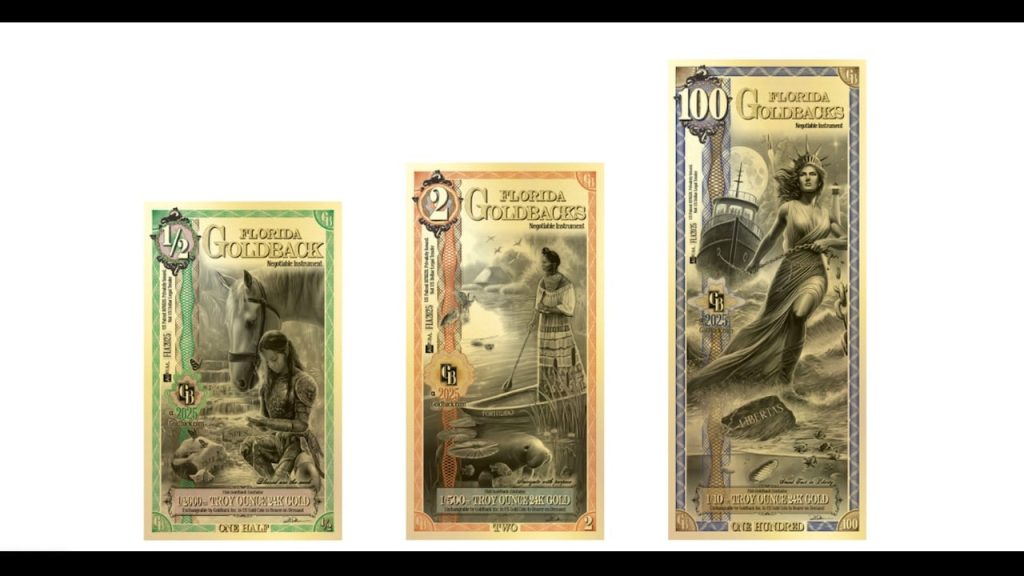

Goldback is set to release the Florida Goldback Series with three new denominations. (i.e., 1/2, 2, and 100).

Goldbacks are a neat form of fractional gold — made with a small amount of physical gold embedded within a polymer sheet. The note-shaped gold products could serve as “an inflation-resistant” currency, just as silver coins, rounds, and bars also allow for small everyday transactions.

A 1 Goldback contains 1/1000th troy ounce of pure 24-karat gold. At the current price, the exchange rate for 1 Goldback is around $5.46.

There’s a cost involved in manufacturing gold into such a small increment, but it’s important to mention that $5.46 is roughly 100 percent over the melt value of the gold that a One Goldback note contains. That’s one reason why it probably doesn’t make sense to buy a ton of them. Buy the more cost-effective bullion coins, bars, and rounds for bigger money.

There are currently about $200 million worth of Goldbacks in existence so far.

The Florida Goldback will make the sixth series of notes, joining Utah, New Hampshire, Nevada, Wyoming, and South Dakota. The Florida series will have the typical denominations (1, 5, 10, 25, 50) along with the new 1/2, 2, and 100 Goldback denominations. Goldback said it is expanding the currency to offer “greater flexibility” and to offer “more versatility for users.”

While each Goldback series references a state, it’s important to make clear that they are not state-issued currencies. Imprinting a state name on the note does not give it any legal standing — it’s just a marketing thing. Using Goldbacks is essentially a voluntary barter transaction.

In a recent interview with Kitco News, Goldback CEO Jeremy Cordon described Goldbacks as a functional sound money alternative.

“We’re trying to skip the step where you sell your gold and go back into dollars. We want people to keep their gold and just circulate the gold itself by making gold small enough to be good at that.”

He said persistent inflation is driving increased interest in the Goldback currency, noting that the dollar has lost nearly 90 percent of its purchasing power over the last 50 years.

“People are really starting to feel inflation now. When inflation was 2 or 3 or 4 percent, it was more of this sneaky long-term thing. And over the past five or six years, inflation has gotten so bad where now people are noticing that they can’t pay their rent, and they’re noticing that there’s not a lot left over, and they’re noticing that things cost twice as much at the grocery store, and the packs of food they are used to buying are smaller and cost the same or more.”

Cordon pointed out that “gold has room to grow if the dollar has room to fall.”

On the subject of Bitcoin, Cordon acknowledged its role in the de-dollarization trend but insisted physical gold is a better alternative for everyday transactions.

The high transaction cost and volatility of Bitcoin make it impractical for everyday use.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.

Read the full article here