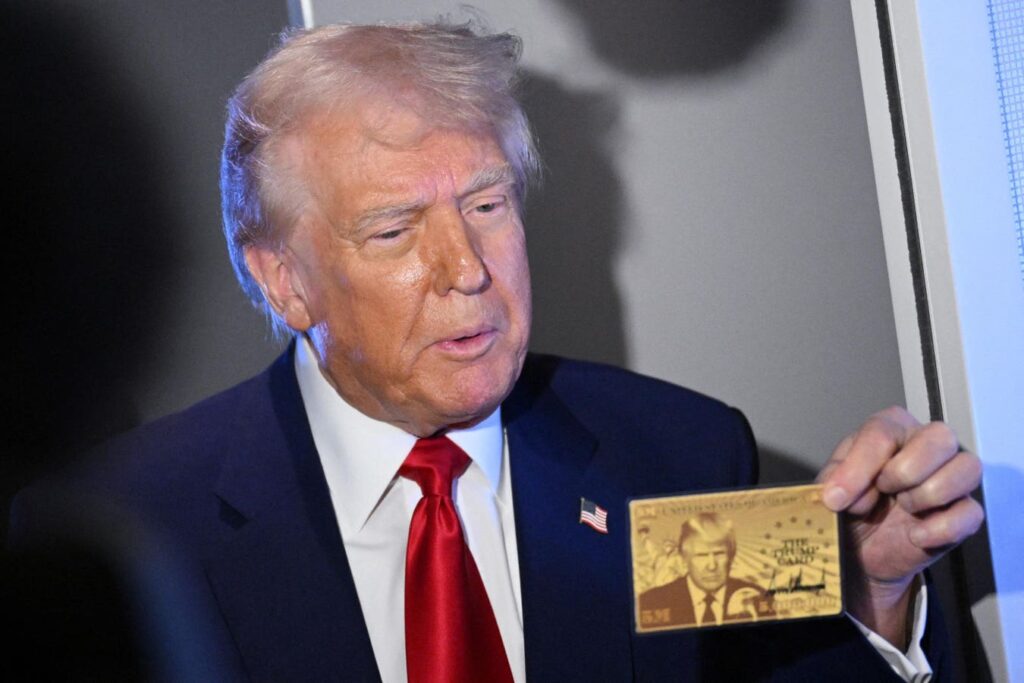

US President Donald Trump holds the $5 million dollar Gold Card as he speaks to reporters while in … More

AFP via Getty ImagesAs Washington wrestles with immigration reform and debt reduction, Trump’s proposed Gold Card has caught the attention of global elites and America’s investor immigration community. The idea is that the Gold Card would offer a direct pathway to U.S. citizenship for vetted high-net-worth “world-class global citizens.” The special inducement is that investors would be relieved of U.S. taxation on their foreign income and no job creation would be required. Instead investors would simply make a one-time non-refundable payment of $5 million to the federal government. That’s it!

The Gold Card seeks to compete with America’s long-established EB-5 visa program, which since 1990 has allowed foreign nationals to invest in job-creating U.S. enterprises in exchange for lawful permanent residence and also, eventually, citizenship. Unlike with the Gold Card, the EB-5 investor gets his money back at the end of the process if all goes well. But the Gold Card’s streamlined appeal—fewer strings, faster status, and significant tax advantages—poses both a challenge to the EB-5 program and a legislative minefield in its own right.

A Tale of Two Visas

While both programs lead to the same destination—U.S. citizenship—the roads diverge sharply.

Trump’s Gold Card would require no job creation, no economic modeling, and no indirect employment calculations. It would offer immediate permanent residence for a flat $5 million contribution to the U.S. government—essentially a pay-to-stay model. If the process is structured like other immigrant visas, Gold Card holders would become eligible to apply for citizenship after five years of continuous residence. Rumors have it that more than 1,000 Gold Cards are already “pre-sold,” signaling strong global demand for a simple route to U.S. citizenship and a passport among the ultra-wealthy.

By contrast, the EB-5 program requires a minimum investment of $800,000 (or $1,050,000 in non-targeted employment areas) in projects that create at least 10 jobs. Long processing times plagued the program with applicants waiting for sometimes even a decade to go through the entire process to permanent resident status. Indeed, many considered the program to be on life support due to these long processing delays until the Reform and Integrity Act (RIA) was passed in 2022. The RIA introduced set aside EB5 rural, infrastructure and high unemployment projects along with concurrent adjustment of status processing for investors who could apply from inside the United States. These reforms opened the doors for investor immigrants who could then employ ‘premium processing’ to speed up approvals and, for those inside the U.S., apply for employment and travel authorizations as part of their adjustment of status applications until their green cards were approved. These reforms resurrected interest in the EB5 program which remains open for investors until October 2025 when processing backlogs are expected to appear again. As for citizenship, once applicants qualify for a green card they can begin counting down the five years needed towards apply for U.S. naturalization and to obtain a U.S. passport.

Tax Breaks—and Legal Barriers

The proposed tax treatment under the Gold Card may be its most controversial feature. According to Trump’s team, Gold Card recipients would be exempt from paying U.S. taxes on foreign-sourced income—income earned in Europe, Asia, or elsewhere outside the United States. They would only be taxed on U.S. earnings, which marks a significant departure from America’s current worldwide taxation model for green card holders and citizens.

But such preferential treatment would almost certainly require an act of Congress to amend the Internal Revenue Code. Moreover, it could face constitutional scrutiny under the Fourteenth Amendment’s equal protection principles.

It seems pretty obvious that if you grant tax exemptions to one class of green card holders based purely on wealth or visa type, and not others who are similarly situated, you invite legal challenges. Indeed, the U.S. tax system currently draws no distinction between categories of lawful permanent residents. Creating a carve-out for Gold Card holders would raise administrative, legal, and political hurdles—especially in a time of fiscal tightening and rising populist backlash. The distinction is even harder to justify at the citizenship stage, where all naturalized Americans must be treated equally under federal law.

Visa Numbers and Congressional Realities

Beyond tax policy, the mechanics of implementing a Gold Card program would require detailed legislative action. Current U.S. immigration law sets annual numerical limits on employment-based immigrant visas, including the EB-5. Family members of EB-5 investors are counted against the cap, significantly limiting how many principal applicants can be approved each year.

Unless Congress authorizes a new visa category or adjusts quotas, Gold Card applicants could find themselves competing with EB-5 investors for a shrinking pool of green cards. Processing times, country caps, and adjudication standards would all need to be codified, either through legislation or agency rule-making.

Ali Jahanjiri, CEO and Publisher of EB5 Investor Magazine, welcomes discussion of the Gold Card to … More

Ali JahangiriAli Jahangiri, CEO and publisher of EB5 Investors Magazine, believes that despite these complications, there’s room for both programs. “EB-5 builds America,” he said. “The Gold Card funds America. These programs are different in purpose and can co-exist.” He added that the EB-5 has proven its worth over three decades, generating $55 billion in foreign investment and supporting iconic projects like the Brightline high-speed rail in Miami and the Hudson Yards development in New York.

Public Benefit or Policy Pitfall?

Proponents argue that the Gold Card could deliver significant fiscal benefits. A $5 million fee per applicant could raise tens of billions in revenue—enough to help pay down the national debt, enhance border security, or fund disaster relief efforts through FEMA. With almost 4 million individuals globally holding net assets over $5 million, even a modest adoption rate could bring in major capital.

Critics, however, warn that replacing EB-5 with a revenue-driven model prioritizes government funding over economic development and job creation.

The EB-5 was built to foster employment, rebuild communities, and spark infrastructure in rural or underserved areas. That mission risks being lost if the Gold Card becomes the dominant path. Additionally, the EB-5 program enjoys legal durability. Under the 2022 EB-5 Reform and Integrity Act (RIA), petitions filed under current regulations must continue to be processed—even if the program is not reauthorized in 2027. This provides investors a level of certainty that may not exist with the as-yet unlegislated Gold Card.

Legal Challenges on the Horizon

Meanwhile, the EB-5 program is mired in its own legal turmoil. A pending federal court case challenges the government’s interpretation of the required “sustainment period”—how long EB-5 funds must remain invested. Industry stakeholders argue that the USCIS’s current two-year requirement deviates from both the law and investor expectations, potentially jeopardizing long-term projects.

Such uncertainties add weight to the appeal of a “cleaner” option like the Gold Card. But attorneys warn that the legal landscape for the Gold Card will be anything but clean if key provisions are rushed through executive action without legislative clarity.

Conclusion: Reform or Rivalry?

The future of U.S. investor immigration may rest on how Congress responds to these competing visions. Will lawmakers preserve and refine the EB-5, or pivot toward a higher-stakes, revenue-centric Gold Card model? Or will both programs be allowed to co-exist, each serving a different class of investor?

What is clear is that the Gold Card has injected new energy—and new controversy—into an often-overlooked part of U.S. immigration policy. It reflects a shift in priorities from job creation to fiscal recovery, from complex regulatory schemes to transactional simplicity.

But simplicity, in law and politics, especially when it comes to citizenship is rarely simple.

Read the full article here