Special tax breaks for venture capitalists, Alaskan fisheries, spaceports, private schools, rum makers and others — together costing tens of billions of dollars — quietly caught a ride on Republicans’ sprawling domestic policy megabill.

The legislation is primarily designed to prevent $4 trillion in looming tax increases set to hit at the end of this year. But, shortly before approving the plan, Senate Republicans added a new crop of unrelated, bespoke tax breaks. House GOP lawmakers got in their share, too.

Many are the sort of narrowly targeted breaks Republicans have long complained are unfair, reward influential special interests and unnecessarily complicate the tax code.

There’s a new supersized deduction for business meals — though only for employees at certain Alaskan fishing boats and processing plants, with the measure stipulating the facilities must be “located in the United States north of 50 degrees north latitude” though not in a “metropolitan statistical area.”

There’s a $17 billion expansion of a little-known provision that enables venture capitalists to make a fortune tax-free.

Sen. James Lankford (R-Okla.) won a carve-out for the oil and gas industry from a minimum tax on big corporations that was created during the Biden administration.

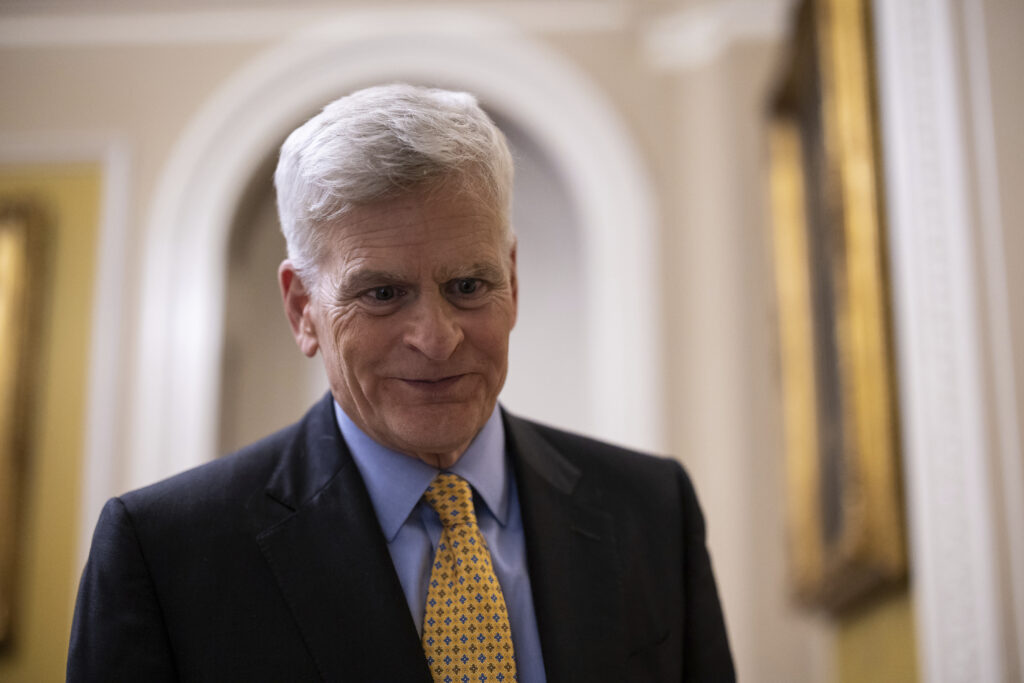

There’s a $2 billion break important to the rum industry and, tangentially, Louisiana, said Sen. Bill Cassidy (R-La.), a tax writer.

“We have the highest per capita intake of alcohol in the nation,” he said.

The targeted tax breaks have been overshadowed by the main purpose of the legislation: preventing a whole slate of tax cuts from expiring at the end of this year, and enacting a handful of breaks for things like tips and overtime pay that President Donald Trump had promised.

But they nevertheless got the same fast-track-into-law treatment, despite some seeming to come out of nowhere with little public vetting.

Some House Republicans grumbled about the provisions — “loaded with pork to buy key Senate votes,” the chamber’s hard-right Freedom Caucus said in a memo to colleagues. But House lawmakers backed down from threats to sink the plan over fiscal concerns and other complaints, and approved it Thursday on a 218-214 vote that sends it to Trump for his signature into law.

Even as Senate Republicans added their own provisions to the legislation, they deleted some earmarks that had been approved by the House.

Though some of the add-ons are small — like an increase in a special deduction for certain Alaskan whaling captains to buy weapons and maintain their boats — others have price tags that run in the billions.

The bill includes an expansion of a little-known break that Silicon Valley investors have used to nix tax bills on tens and even hundreds of millions of dollars in earnings from Internet startups. Another spends $26 billion to create a new $1,700 credit for people who give to groups providing scholarships for children to attend private school.

Sen. Mitch McConnell (R-Ky.) secured a $7 billion tax cut for farmers that allows them to postpone paying some of the capital gains taxes they owe when selling off farmland.

There’s also a $1 billion provision allowing “spaceports” — which the legislation defines as “any facility located at or in close proximity to a launch site or reentry site” — to sell tax-exempt bonds, like airports. Sen. Ron Wyden, the chamber’s top Democratic tax writer, said in an X post that “Trump’s wedding gift to [Jeff] Bezos and birthday gift to [Elon] Musk were tucked in the new budget bill.”

Finance Chair Mike Crapo (R-Idaho) chafed at suggestions the various tax breaks are earmarks.

“I wouldn’t describe them that way,” he said. “You can go through there and find 100 specific issues, and if you want to call them earmarks, that’s your choice, but I don’t think they are.”

“Would you say that if we build a highway, would you say we’re doing an earmark for roads?” he said. “It’s infrastructure policy.”

His colleagues are likewise defending their provisions.

Lankford says the special break for oil and gas companies is needed because the arcane calculations that go into determining when a company is subject to a 15 percent minimum tax are biased against the industry.

The provision reverses the “tax penalty Democrats placed on America’s energy producers and allows our producers to deduct essential capital costs just like any other manufacturer,” he said.

Cassidy said the rum item is a permanent version of a temporary break lawmakers have approved many times before. The Treasury has long transferred federal excise taxes imposed on rum made in Puerto Rico and the Virgin Islands and sold in the U.S. back to those governments.

“We’re attempting to provide certainty for businesses, and that includes distillers,” said Cassidy, whose sugarcane-producing state is part of their supply chain.

Democrats tried, unsuccessfully, to kill some of the proposals.

During Senate deliberations, Sen. Mazie Hirono (D-Hawaii) watched her amendment targeting the private-school tax break win bipartisan support but nevertheless go down on a 50-50 vote.

“Nearly 90 percent of K through 12 students attend public schools, yet Republicans are pushing a plan in this bill to undermine support for public schools,” she said. Sen. Ted Cruz (R-Texas) retorted that Democrats “are more beholden to teacher union bosses than they are dedicated to fighting for kids.”

Even as they added their own pet projects, Senate Republicans jettisoned earmarks that had been approved by their colleagues in the House. Out is an $800 million tax cut for corporations that have income in the Virgin Islands.

They also dumped plans to spend $10 billion on a provision pushed by the fitness industry, including the YMCA, that would have allowed people to count gym-membership fees as a medical expense in Health Savings Accounts. A provision boosting the Earned Income Tax Credit for some Purple Heart winners was similarly axed.

It wasn’t all bad news for House members, though.

Rep. Mike Kelly (R-Pa.) was pleased to see Senate Republicans reinserted his plan sending a $3 billion tax break to real estate investment trusts, after lawmakers had initially deleted it from their draft.

“It was a little questionable about what was going to go and what wasn’t,” he said.

And Senate Republicans not only kept a House-approved provision exempting gun silencers from a long-standing $200 tax on firearms — they dumped the tax on all guns it applied to, except machine guns and what the legislation terms “a destructive device.” That cost: $1.7 billion.

Rep. David Kustoff (R-Tenn.) hailed the plan, calling the charge “an illegal poll tax used as a piggy bank for the federal government.”

Read the full article here