The Fed’s outlook has soured vs its March forecast. “We expect a meaningful rise in inflation in the coming months,” said Powell

Unemployment projection from Fed press conference.

Trump will not be pleased with the Fed’s outlook. In the press conference, the Fed highlighted more concerns of tariffs on inflation and growth.

Regarding jobs, Powell said the labor force, participation rate, wages are all at “healthy levels”.

“You can see perhaps a very slow cooling but nothing that troubling at this time.”

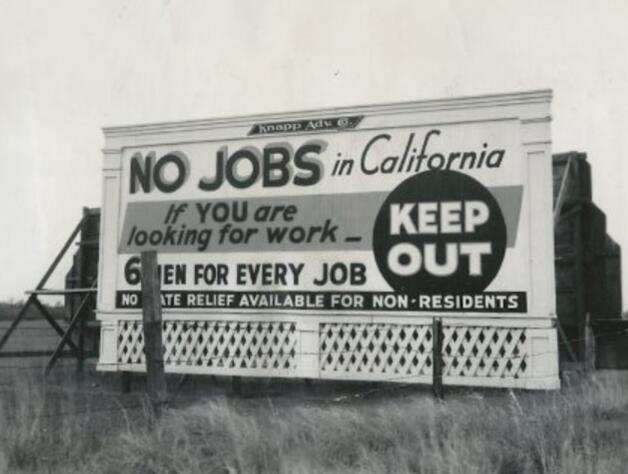

Apparently Powell believes BLS statistics. I don’t. He does not see the train coming down the tracks.

Press Release

As is typical, there is more information in the press conference than the Fed’s Press Release.

Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook has diminished but remains elevated. The Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Press Conference

Skip forward by about 59 minutes.

PCE Inflation

“We expect a meaningful rise in inflation in the coming months,” said Powell.

“Consumers, businesses, and professional forecasters point to tariffs as a driving factor.”

“Increases in tariffs this year are likely to push up prices and weigh on economic activity.”

Powel noted the possibility of “tensions” in economic policy. That’s the stagflation outcome of rising prices and falling employment. “For the time being, the Fed is well positioned to wait.”

“Our job is to make sure that a one time increase in inflation does not turn into an inflation problem.”

The Fed said “We have not been in a situation like this before,” and that everyone will pay the cost of tariffs (consumers and importers).

Trump believes we collect tariffs from countries.

There’s a very good chance unemployment arrests the Fed’s expected inflation. But that assumes I am correct on weakening jobs.

Projection on Appropriate Monetary Policy Rates

“There is no high conviction on the rate path.”

GDP Projection

Powell said “unusual swings in imports have complicated GDP estimates.”

Summary of Economic Projections (SEP)

Chart from Fed’s Summary of Economic Projections.

SEP Change from March

- GDP: 1.4 percent from a year ago, 4th quarter, down 0.3 percentage points

- Unemployment Rate: 4.5 percent, up 0.1 percentage points

- PCE Inflation: 3.0 percent, up 0.3 percentage points

- Core PCE Inflation: 3.1 percent, up 0.3 percentage points

- Fed Funds Rate: 3.9 percent, unchanged

The market expects 2 rate cuts by December, the Fed only 1.

Powell said “unusual swings in imports have complicated GDP estimates.”

Indeed.

Related Posts

June 16, 2025: QCEW Report Shows Overstatement of Jobs by the BLS is Increasing

The discrepancy between QCEW and the BLS jobs report is rising.

June 15, 2025: Is the Fed Behind the Curve in Cutting Interest Rates?

That’s the claim in a Wall Street Journal op-ed.

June 17, 2025: Retail Sales Down Much More than Expected, Drop 0.9 Percent

Retail sales declined 0.9 percent led by autos down 3.5 percent.

June 18, 2025: Housing Starts Plunge 9.8 Percent to the Lowest Level in 5 Years

The homebuilders have spoken. And they don’t like what they see.

June 18, 2025: Intel Will Lay Off Another 15% to 20% of its Work Force

Big job cuts are coming in July.

Q: Is there any doubt the economy is slowing?

A: None

And Trump’s tariff policies greatly exacerbate the setup.

Addendum

I used the word “blame” in the title. Changed to “citing” tariffs.

This post originated on MishTalk.Com

Thanks for Tuning In!

Mish

Read the full article here