President Donald Trump’s Consumer Financial Protection Bureau (CFPB) terminated a Biden-era case against Citi that forced the bank to pay 100 consumers that were not affected by its purported harm to consumers.

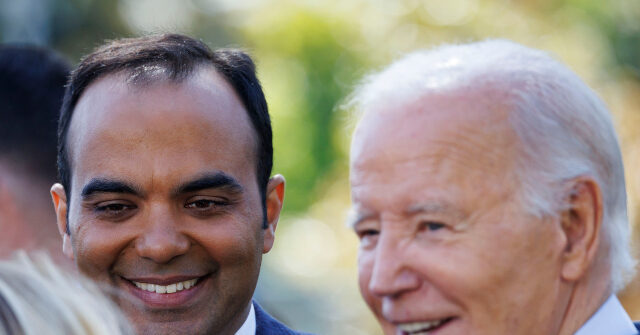

On July 8, Brent McIntosh, the chief legal officer for Citigroup, one of the nation’s largest banks, wrote in a letter to the CFPB, which was obtained by Breitbart News, about a Biden-era case that alleged the bank had discriminated against certain credit card applicants of Armenian nationality. The Biden-era case, championed by progressive CFPB Director Rohit Chopra, required Citi to pay $25.9 million, consisting of $1.4 million in redress payments to those who had been affected by the denied credit applications, and $24.5 million to the CFPB’s victims relief fund.

Citi said that it sought to crack down on “large-scale fraud perpetrated by a much-publicized organized crime ring operated in Southern California by Armenian nationals and Armenian-Americans.”

Citi admitted that, while trying to crack down on said fraud, the bank had taken Armenian national origin into account while considering credit card applications, in particular those Armenian surnames with “ian” and “yan” around Glendale, California, an area of the Golden State that has a large Armenian community.

The bank said in July 2020 that it had immediately taken action to investigate and address the conduct, which led to the termination of several employees over the conduct against said credit card applicants and retraining of the underwriting staff to avoid future incidents. Citi added that the number of applicants was “so small the impact was never detectable in any statistical analysis we performed.”

Despite the small number of applicants affected by the now-terminated employees’ decisions, Citi said that the Biden-era CFPB went well beyond addressing the “isolated incidents.”

This included:

- The Bureau forced Citi to pay redress to more than 100 consumers whose surnames ended in “ian” or “yan” who were not of Armenian origin. Many with last names such as “Christian” or “Bryan” had been paid redress even though they were not impacted by the purported isolated incidents. [Emphasis added]

- The Chopra consent order compelled Citi to monitor for these last names of Armenian origin locally and nationally, where the only area it would make sense would be in Glendale, California.

- The Biden-era CFPB consent order required Citi to do statistical analysis to investigate Citi’s credit card decisions nationwide, even though most of the analysis did not revolve around those of Armenian descent applying for credit cards or credit limit increases.

“The Biden-Chopra CFPB didn’t know an Armenian from an Irishman,” a senior CFPB official told Breitbart News.

Citi alleged that the CFPB’s odd use of statistical analysis led the Bureau to “artificially inflate the number of supposedly affected persons to approximately 579 people (again, with more than 100 of these lacking Armenian last names, a fact revealed only after entry into the Consent Order).”

The bank said that after applying its own analysis it found even fewer consumers harmed, or 80 applicants out of roughly 137 million applications between January 1, 2015, through December 31, 2021.

Given that Citi has worked to redress its errors and already paid the civil penalty to the Bureau after entering into the Consent Order, it asked that the CFPB terminate the remainder of the five-year term against Citi.

The CFPB, under Acting Director Russ Vought, terminated the case against Citi.

Read the full article here