Topline

Dick’s Sporting Goods, the retail market share leader in sporting goods, will acquire Foot Locker, the world’s largest specialty footwear retailer, for $2.4 billion, nearly tripling total store count, expanding its global presence and further solidifying leadership in both the performance athletic sector and the broader sneaker and sportswear markets.

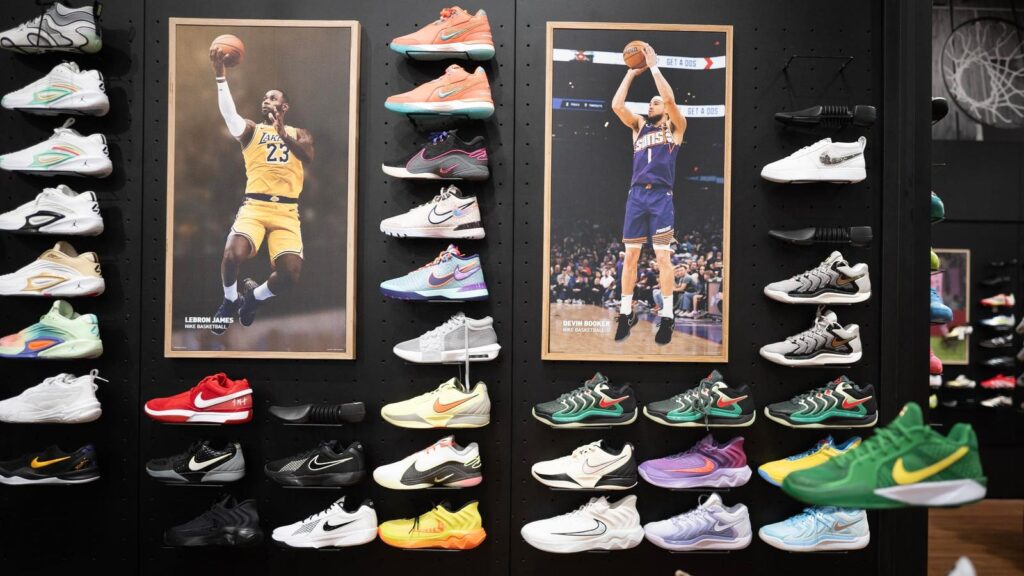

CHICAGO, ILLINOIS – MARCH 11: Merchandise is offered for sale at a Dick’s Sporting Goods store on … More

Key Facts

Dick’s will pay $24 per share for Foot Locker, approximately a 90% premium over its share price before the announcement, or shareholders can choose to receive 0.1168 share of Dick’s common stock for each Foot Locker owned.

In 2024, Dick’s reported $13 billion in revenues, having grown sales by 3.5% year-over-year, while Foot Locker’s revenue totaled $8 billion and declined by 1.9% at constant currency rates.

Dick’s exclusively operates in the U.S. market with 856 stores in a total addressable footwear, apparel and hardline market of $140 billion, while Foot Locker generates about 30% of revenues internationally and targets a $300 billion total addressable global market with a 2,400 retail footprint spanning North America, Europe, the Middle East and Asia-Pacific markets.

The two retailers will continue to operate separately and Dick’s has no immediate plans to open Dick’s stores internationally.

The deal will be financed through a combination of cash and new debt, predicted to deliver between $100 million and $125 million in cost synergies and to close in the second half of 2025, pending regulatory and other approvals.

Key Background

Dick’s said it has been considering acquiring Foot Locker for some time. Dick’s has a strong track record of success with an emphasis on sporting goods and serving performance athletes. It operates 700 Dick’s big-box stores, as well as two highly experiential spinoffs, including 11 Dick’s Field House and 12 Dick’s House of Sports. It also operates about 100 Golf Galaxy stores and a handful of Going Going Gone! stores. Foot Locker, which specializes in “sneaker culture” and more broadly lifestyle-focused customers, has been struggling, most especially after Nike, Foot Locker’s number one brand, shifted its distribution model away from wholesale partnerships to DTC in 2017, a mistake that is currently being corrected under new Nike CEO Elliott Hill. Nike is also the top footwear brand at Dicks. Combined, Nike could represent as much as 30% to 35% of Dick’s and Foot Locker’s combined sales, reported Investopedia.

Crucial Quote

“Dick’s has been phenomenally successful over the past six years. It has consolidated its grip on the sporting goods market, adding an impressive 1.6 percentage points of market share to reach 11.1%. Foot Locker would add an immediate 4.3 percentage points of market share. And there is no doubt Dick’s could help accelerate the transformation of the business that current management has been pursuing – though there is still a lot to do on that front. Plus, there’s the increased buying power against the big sneaker brands, and some back-end synergies. Lot’s to like, some issues to iron out,” shared Neil Saunders, Managing Director, GlobalData Retail.

Nike To Benefit

Nike is expected to be a key beneficiary of the acquisition. “We view this as a positive for NKE, given DKS’ strong management and efficiency. NKE maintains strong ties with both retailers and leads footwear sales across both banners,” wrote Jefferies in a research note. It reported that footwear currently represents 38% of Dick’s business and over half of Foot Locker’s. Nike is the top-selling footwear brand for both. “A better-run FL under DKS leadership would be a net benefit for NKE, reinforcing its distribution strategy and solidifying its position in athletic retail,” it continued.

Chief Critics

In the acquisition conference call, UBS analyst Michael Lasser questioned the poor track record of retail mergers when a strong retailer acquires an underperforming one, like Foot Locker. Apparently, the company’s answer didn’t satisfy, as USB issued a note stating, “There’s a far longer list of retail mergers that were not successful than those that were. Simply put, its difficult to bring together disparate systems, cultures, models, infrastructure and teams. At least some of the benefits are often offset by dis-synergies from integration.” Jefferies analyst Jonathan Matuszewski is similarly cautious, “We see the potential for value creation from a DKS/FL tie-up. We don’t agree with all aspects of the playbook (running the businesses independently, not closing stores), but there are opportunities (improved merchandising, apparel, owned brands). What’s hard to see is the journey ahead as a ‘slam dunk.’”

Tangent

The Dick’s-Foot Locker announcement follows the agreement two weeks ago for 3G Capital to acquire the Skechers sneaker brand for $9.4 billion and take it private. In 2024, Skechers generated $9 billion in revenues, divided about 60%/40% between wholesale and direct-to-consumer. Sketchers operates over 5,000 branded stores, including just over 1,000 internationally. Both Dick’s and Foot Locker sell Skechers footwear.

Further Reading

Dick’s Sporting Goods to Buy Foot Locker for $2.4 Billion (Wall Street Journal, 5/15/2025)

Dick’s Sporting Goods To Buy Struggling Shoe Chain Foot Locker For $2.4B (ABC News, 5/15/2025)

Dick’s Sporting Goods Shares Tumble As Analysts Question Foot Locker Deal, Note Past Failed Retail Mergers (Marketwatch, 5/15/2025)

Read the full article here