Selling De Beers, the biggest transaction ever attempted in the diamond industry, just got a little harder with news that it is sitting on a $2 billion stockpile of unsold gems.

The De Beers business, which is 85%-owned by London-listed Anglo American, is one of the units being off loaded as part of a defence against an attempted takeover by arch-rival BHP.

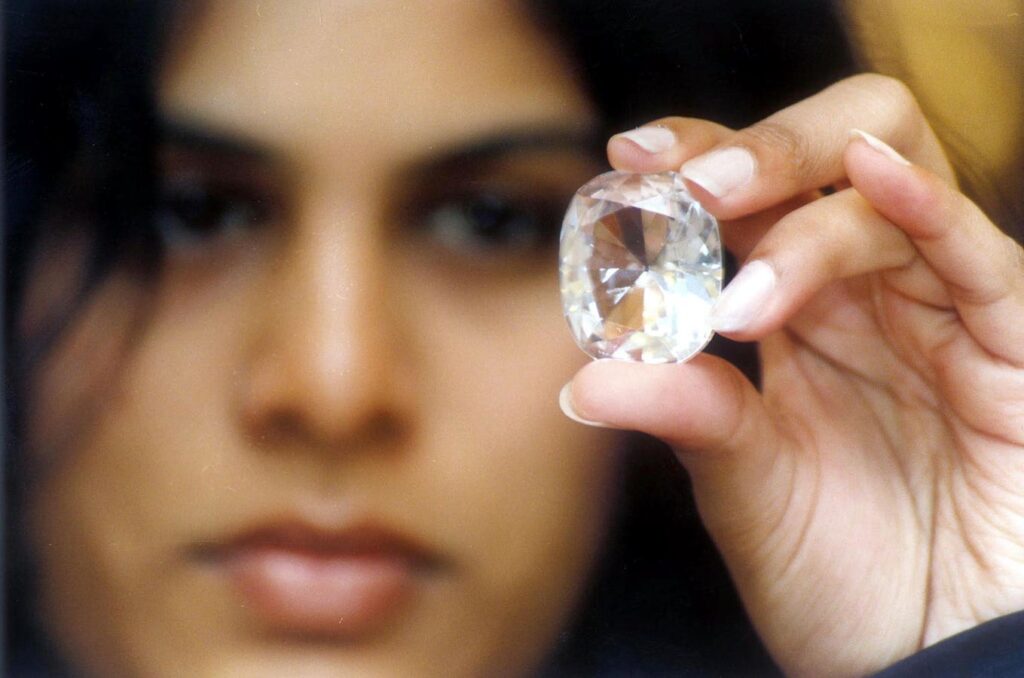

Diamonds are getting harder to sell. (STR/AFP via Getty Images)

AFP via Getty ImagesCoal mines have already been sold by Anglo American with nickel and platinum assets poised to go.

But the crown jewel in the Anglo American stable of assets collected over the last 120 years is De Beers which rose to control the diamond industry but has since lost most of its pricing power.

The latest crop of problems started for De Beers with the creation of near-perfect laboratory grown gems which are undercutting prices for natural (mined) stones which dominate the De Beers offering, compounded by the Covid pandemic which cut overall jewellery demand.

Now comes news of the stockpile which has not previously been reported but was identified in a story published yesterday by London’s Financial Times newspaper.

Too many diamonds. De Agostini via Getty Images)

De Agostini via Getty ImagesAccording to the FT the stockpiled amassed by De Beers is the biggest since the 2008 financial crisis when diamond demand dried up and De Beers stepped in as a buyer of last resort to remove excess material from the market with the objective being to support prices.

Similar moves have been made in the past by De Beers, which has long seen itself as the custodian of the diamond industry.

But the era of De Beers being big enough to dominate diamond mining, processing, and marketing, has passed with the entry of new miners such as Rio Tinto and the dramatic improvement in synthetic stones which even a skilled jeweler finds hard to tell apart from natural gems.

A slowdown in demand for diamonds in China, where conspicuous consumption runs against government policy, has added to the overall problems for the industry.

Al Cook, chief executive of De Beers, speaking on the opening day of the Investing in African Mining … [+]

© 2024 Bloomberg Finance LPThe FT quoted De Beers chief executive Al Cook saying: “It’s been a bad year for rough diamond sales”.

Tough trading conditions, and a buildup of the stockpile, will also be a problem for Anglo American as its tries to price De Beers for outright sale or a spin-off into a separate stock-exchange listed company.

Overall diamond sales by De Beers fell from $2.8 billion in the opening six months of 2023 to $2.2 billion in the first half of this year.

Anglo American chief executive Duncan Wanblad has acknowledged that the week state of the diamond market will complicate the De Beers sakes process.

More Stores

But it is understood that the disposal of De Beers, one way or another, will proceed, as will a plan to grow the retail arm of the business through the opening of more stores with the aim being to grow from 40 De Beers outlets today to 100 around the world.

Cook told the FT that as De Beers becomes an independent business it will focus as closely on marketing as it has traditionally focused on mining.

“This feels to me like the right time to be driving marketing and getting behind our brands and retail, even as we cut the capital spend on the mining side,” Cook said.

Read the full article here