By Anup Roy, Bloomberg markets live reporter and strategist

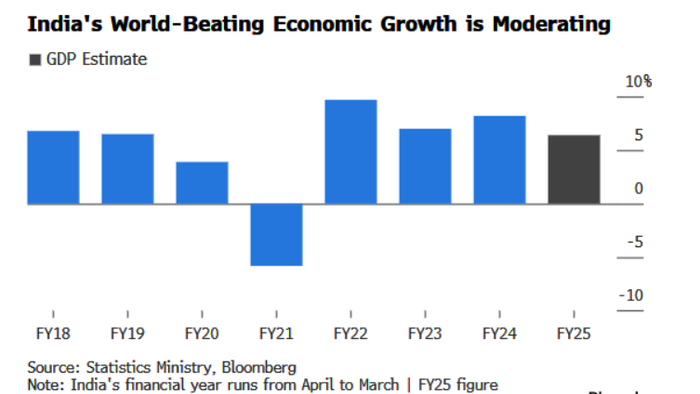

For years, India’s booming economy fueled exuberance that the South Asian nation had entered a new era of faster growth, powering its markets to new heights and raising expectations it would exit the trenches of developing-nation status in a few decades. Now, a deepening slowdown is raising concerns that a three-year boom wasn’t the start of a new era but a blip. The latest government figures show the economy will expand at a four-year low of 6.4% in the current fiscal year, a return to a slower pre-Covid norm.Moreover, analysts say growth in the coming years will likely remain well below the 8% average of the past three years — and the pace Prime Minister Narendra Modi needs to meet his ambitious economic goals.

Concerns about the world’s fifth-largest economy had been mounting for weeks. Business spending has slowed, consumers have cut back as inflation remained high and wages slid, while corporate profits have taken a hit. Investors have already turned bearish, with the S&P BSE Sensex Index falling nearly 9% from its peak in less than a month and the rupee hitting a record low of 85.8725 per dollar on Wednesday.

Loading…

Read the full article here