Chinese regulators have advised the country’s biggest banks to rein in their exposure to U.S. Treasuries, citing concentration risk and market volatility, Bloomberg News reported Monday.

The guidance, delivered verbally in recent weeks, included instructions to limit purchases of U.S. government bonds and for banks with heavier exposure to pare positions, according to people familiar with the matter cited by Bloomberg. Bloomberg said the directive does not apply to China’s state holdings of Treasuries.

Officials framed the move as a market-risk diversification step rather than a geopolitical signal or a judgment on U.S. creditworthiness, Bloomberg reported. The people said regulators set no specific targets for reductions or deadlines.

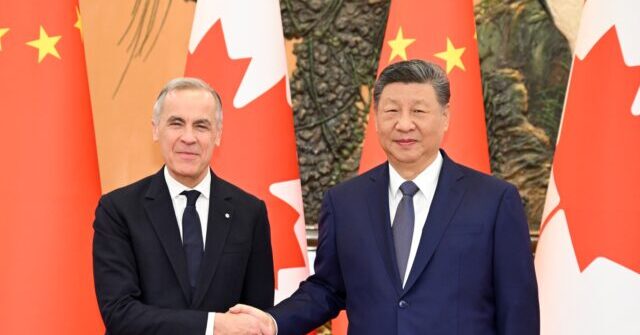

The guidance preceded last week’s call between President Donald Trump and Chinese President Xi Jinping, Bloomberg said. Trump is planning a presidential summit in Beijing as soon as April.

Chinese banks held about $298 billion in dollar-denominated bonds as of September, according to data from the State Administration of Foreign Exchange cited by Bloomberg, though it was unclear how much was in Treasuries. The People’s Bank of China and the National Financial Regulatory Administration did not immediately respond to Bloomberg requests for comment.

Treasuries slipped after the report, with yields edging higher in Asian trading, while the dollar weakened slightly against major peers.

Bloomberg noted that China’s combined state and private holdings have declined over the past decade. China was overtaken by Japan in 2019 and by the United Kingdom last year, with holdings dropping to $683 billion in November, the lowest since 2008, Bloomberg reported.

Some market analysts told Bloomberg the decline may be understated if holdings have migrated into overseas custodian accounts. Belgium’s holdings have risen sharply since 2017 to $481 billion, and analysts believe Chinese custodial accounts contribute to that figure, the report said.

Treasury Secretary Scott Bessent said last week that demand remains strong, with the market delivering its best performance since 2020 last year and seeing record foreign demand at auctions. Bloomberg cited official data showing foreign holdings of U.S. Treasuries rose to a record $9.4 trillion in November.

Read the full article here