The Chinese Ministry of Commerce on Thursday announced more restrictions on the export of rare earth minerals, crucial for manufacturing semiconductors, electric vehicles (EVs), green energy products, and other key technologies.

The move was universally seen by analysts as preparing the battlefield for an expected trade meeting between dictator Xi Jinping and President Donald Trump.

China is the dominant worldwide supplier of most of the 17 elements known as rare earths. Mines controlled by China produce about 70 percent of the world’s supply of the minerals, and Beijing controls 90% of the world’s processing capacity.

Processing rare earths is difficult and expensive, with enormous start-up costs. China has been shrewd about using its market dominance to make it very difficult for competitors from free-market economies to challenge its position. For example, when China sees a push to open more mines or processing plants in other countries, it floods the market and drives prices down, making those competitive projects look unprofitable.

Between 2020 and 2023, China accounted for 70% of U.S. rare earth imports. This chart shows where the U.S. gets its rare earths from. Data Source: USGS. (Graphic by Visual Capitalist via Getty Images)

Also, few competing nations are willing to sustain the environmental damage necessary to open new rare earth mines – they are more comfortable subcontracting that ecological damage to China.

Beijing achieved this level of market discipline by imposing tight production quotas and export controls on the chaotic rare earth mining industry of the 1990s and 2000s, just as the true value of those minerals was becoming apparent. These controls made it very easy for China to weaponize the industry for geopolitical purposes, as a cartel of a half-dozen giant state-controlled companies now controls the worldwide supply of minerals.

The nations of the free world are well aware of the threat posed by giving Communist China near-total control over such a vital supply chain, but so far efforts to reduce that threat by “de-risking” the supply chain are moving slowly.

In April, China tried to completely cut off rare earth exports to the United States in a show of force, but later backed down to more modest restrictions. The Chinese Ministry of Commerce tightened those restrictions on Thursday, including tougher permitting requirements on the export of technology related to rare earth refinement, and more curbs on the export of battery technology to protect China’s edge on electric vehicles.

“The latest rules require ‘case-by-case approval’ on exports of rare earths for the design and production of advanced semiconductors, including logic chips with process nodes of 14 nanometer or below and memory chips with 256 layers or more, as well as related equipment and materials for these semiconductors,” the South China Morning Post (SCMP) reported.

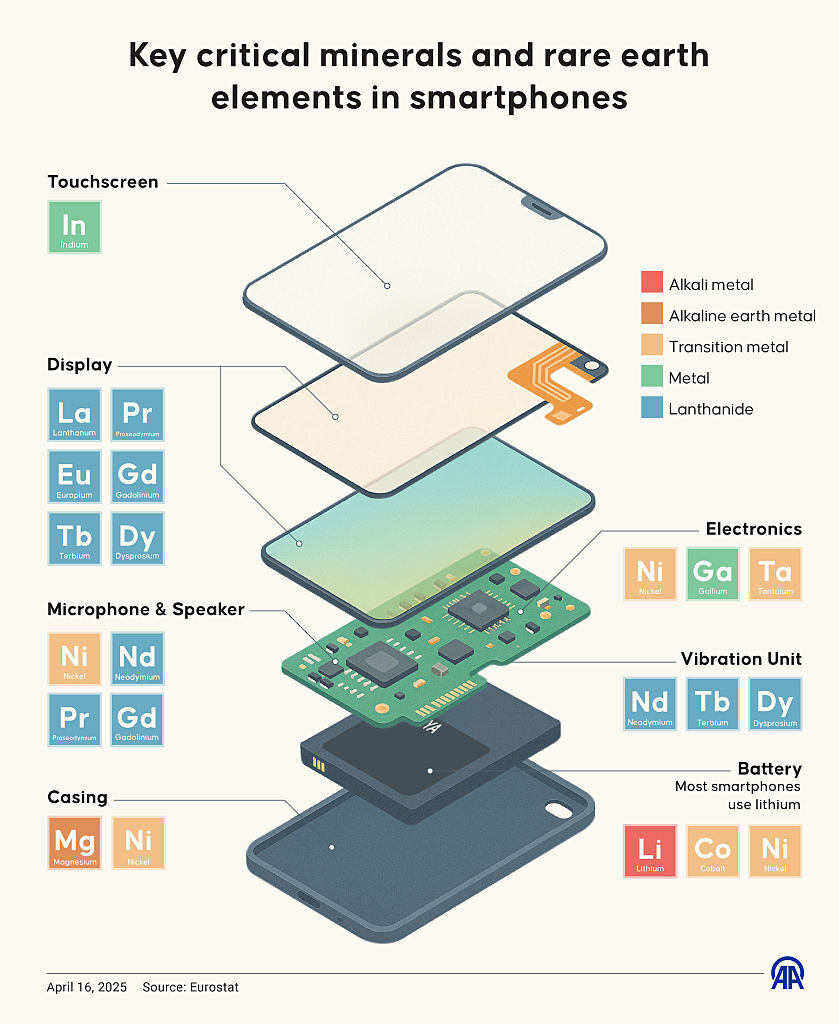

An infographic titled “Key critical minerals and rare earth elements in smartphones” created in Ankara, Turkiye on April 16, 2025. (Photo by Omar Zaghloul/Anadolu via Getty Images)

China also added five more rare earth minerals to its list of restricted exports, including holmium, erbium, thulium, europium, and ytterbium. Until now, only seven of the recognized rare earths were on the restriction list.

“From a geostrategic perspective, this helps with increasing leverage for Beijing ahead of the anticipated Trump-Xi summit in Korea later this month,” Edge Research founder Tim Zhang told Sky News.

Trump and Xi are expected to meet on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit in South Korea at the end of October.

The Chinese Commerce Ministry insisted the new restrictions were needed to “better safeguard national security” and prevent China’s rare-earth technology from being used in “sensitive fields such as the military” by certain “overseas bodies and individuals.”

China ratcheted up tensions even further on Thursday by adding 14 foreign military and technology groups to its “unreliable entities” list, limiting their ability to do business with Chinese companies. Most of the entities added to the list were American and Canadian companies that either cooperated with Taiwan or “made malicious remarks about China.”

Read the full article here