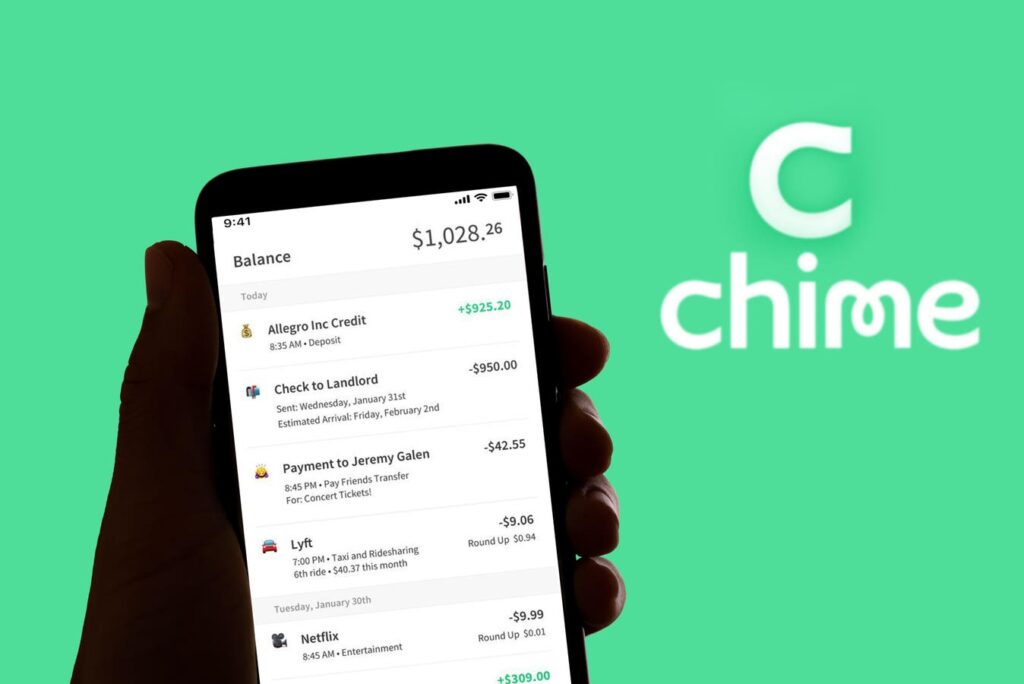

Chime caters to Americans earning less than $100,000 a year and says 8.6 million people use its banking app monthly.

Getty Images

San Francisco-based Chime, the largest digital bank in America, wants to go public at a price between $24 and $26 per share, which implies a fully diluted valuation of about $11 billion, according to a new press release and filing with the Securities and Exchange Commission (SEC). That’s down steeply from the $25 billion Chime reached in a private fundraise in August 2021, right around the peak of the fintech market bubble.

The $11 billion diluted valuation reflects what Chime would be worth after setting aside 59 million shares to compensate employees and to fund its Chime Scholars charity program. Without those issued shares, its target IPO valuation would be $9.5 billion, slightly higher than the $8 billion we valued it at a year ago.

Despite the economic uncertainty and stock market volatility brought on by President Trump’s tariffs (including those already imposed and those threatened and then delayed), 13-year-old Chime is moving ahead with its IPO plan. The fintech has grown to attract 8.6 million active customers by offering a checking account and debit card with no monthly fees, plus additional features like a secured credit card and paycheck advances of up to $500.

Chime makes most of its money on interchange–the 1% to 2% fees merchants are charged to accept debit and credit cards–and has been expanding aggressively into small-dollar lending. (It lacks a bank charter and partners with banks like Bancorp and Stride to offer banking services.)

Have a story tip? Contact Jeff Kauflin at [email protected] or on Signal at jeff.273.

Chime cofounder and CEO Chris Britt owns 5% of Chime, and cofounder Ryan King owns 4%, according to the filing, making their stakes worth about $500 million apiece. Yet combined, they control 65% of the voting power of Chime’s stock, which could rise to 75% if they hit performance targets. That control allows them “to significantly influence or determine any action requiring the approval of our stockholders,” the filing reads.

The company’s largest shareholder is venture firm DST Global, which owns about 12% of the company on a fully diluted basis. CrossLink Capital and Access Industries Management, owned by Ukranian-born billionaire Len Blavatnik, also hold large stakes in the digital bank.

Chime’s debit card was first publicly announced on the Dr. Phil show in 2014. Today, Jay McGraw, Dr. Phil’s son and a TV producer, owns 5.5 million shares of Chime, which will be worth about $140 million at its IPO. McGraw plans to sell some of those shares in Chime’s public debut, according to the SEC filing, as do other investors including Flourish Ventures, Cathay Innovation and Northwestern Mutual.

Read the full article here