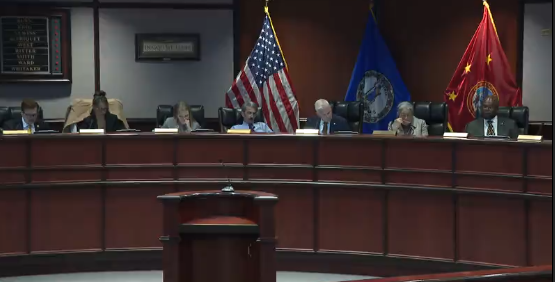

CHESAPEAKE, Va. (WAVY) — Chesapeake residents are speaking up about a possible hike in their real estate taxes, and while city officials cite the need for additional revenue, some residents feel their taxes are already too high.

Proposed Chesapeake budget could include real estate tax hike

Amid budget season across Hampton Roads localities, the possibility of an increased real estate tax rate by two cents is just one of the options being considered in Chesapeake, and even though the money would help out local fire and police, residents aren’t on board just yet.

“The priority issues facing us are public safety — we acknowledge that,” said Chesapeake Vice Mayor John De Triquet.

Technology enhancements, upgrades and more staffing for Chesapeake Fire and Police are what is needed. The challenge is finding the money to cover it, and that’s why City Council is considering raising the tax rate.

“It’s not just about additional revenue,” said Chesapeake City Manager Christopher Price. “It’s also about looking at our existing programs and services, and this is something we do every year.”

The conversation isn’t going over well with residents.

“I understand their mindset on it, how it can go to a lot of good causes, but honestly the Chesapeake city that we do live in, even coming from Virginia Beach, I feel like our taxes are just too high,” said Chesapeake resident Alisha Brunie.

One set of priorities of the enhanced public safety plans would be $4,876,170. The second set would be $,3,795,173.

Aside from increasing the real estate tax, other options include keeping real estate tax rates the same and redirecting eight cents of existing personal property tax rate from mosquito control to enhanced public safety, or reallocating utility project money to the utility fund. Another option on the list is to hear proposals from the Commissioner of Revenue.

“Tax payers and citizens of the city are not unlimited ATMs,” Triquet said.

“If we can reallocate the money that’s already in the community to do what we want so we don’t have to increase the taxes, that would be great,” Chesapeake resident Desmond Nelson said.

Council will discuss the matter again at the April 15 work session and then again at the April 22 work session. It will go up for vote in May.

If City Council approves this proposed increase, the tax rate would increase from $1.01, to $1.03 per $100 of assessed value. To learn more, click here.

Copyright 2025 Nexstar Media, Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

For the latest news, weather, sports, and streaming video, head to WAVY.com.

Read the full article here