Tax Consumption, Not Production, to Fund the Government

For years, the economic establishment has begged the United States to do one thing: tax consumption, not production. Consumption taxes don’t penalize saving. They don’t discourage work. They don’t tax the income you might reinvest in a business or use to raise a family. If you’re designing a tax system from scratch, you start with consumption.

That’s not just conservative instinct — it’s the view of the The Organisation for Economic Co-operation and Development (OECD), which found that consumption taxes are among the least harmful to economic growth, ranking far ahead of income or corporate taxes in terms of efficiency. It’s also the consensus of serious academic work, including the influential case laid out by economists Joseph Bankman and David Weisbach, who argue that a well-designed consumption tax can be both more efficient and more equitable than the income tax it replaces.

But while the theory is sound, the practice has always hit a wall. The go-to model is the value-added tax, and Americans hate it. They don’t want a new, European-style tax layered onto every grocery bill and electric bill. They don’t want a ten percent surcharge on toothpaste. And they’re right to resist it.

So, populists have revived an older American idea: the tariff.

A Tax That Pays for Growth

Tariffs aren’t just tools of trade policy — they’re consumption taxes by another name. They fall on goods brought into the country to be bought and consumed. But unlike a VAT, which hits everything from diapers to gas, tariffs in the United States primarily hit higher-end imports. We don’t import much food, housing, or essential services. Even energy is now a domestic product. We import appliances, electronics, clothes, furniture — the goods of choice for the wealthy and upper-middle class.

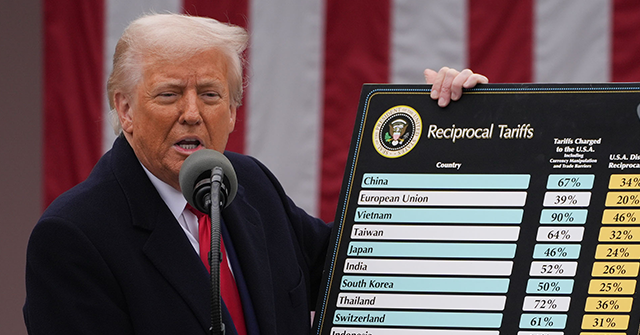

The Congressional Budget Office (CBO) recently modeled Donald Trump’s tariffs. The result: they raise hundreds of billions of dollars annually and fall more heavily on higher-income households. It’s one of the few taxes the CBO examined that raises significant revenue without increasing the burden on working-class Americans. In fact, tariffs shift the tax base toward discretionary consumption — not wages, not savings, and not small business income.

That makes tariffs more than just a revenue tool. They create fiscal space — space to extend the Trump tax cuts, to make full expensing permanent, to lower marginal rates on labor and investment — without blowing up the deficit. In short, tariffs make pro-growth tax policy affordable.

And unlike a VAT, they do it without hammering the necessities of life.

Not Distortion — Correction

The textbooks claim tariffs “distort” trade by shifting resources away from their most efficient uses. But that assumes global trade is already efficient. In reality, it’s riddled with foreign distortions.

China subsidizes exports, suppresses domestic wages, and manipulates its currency. Germany imposes trade barriers and depresses domestic consumption. Dozens of U.S. trading partners operate both tariffs and non-tariff barriers, including border-adjustable VATs that double-tax American goods and rebate their own.

The result? Global capital is misallocated — not to its most productive uses, but to the sectors most heavily subsidized or shielded by foreign governments.

Tariffs don’t create distortion — they correct it. They push capital and labor back toward domestic sectors that would be competitive if not for decades of asymmetric trade policy. They don’t penalize foreign producers; they neutralize foreign policy manipulation. And by doing so, they give American producers a fair chance to compete.

The basic case against tariffs rests on the assumption that capital and labor resources are already flowing to their most efficient uses—and therefore anything that redirects capital or labor will be a drag on growth, investment, and productivity. In the real world, capital and resources flow to where government policies direct them—creating room for productivity enhancing counter-weight tariffs. In other words, Trump’s reciprocal tariffs can enhance productivity and growth.

A Better Mix of Taxes

What makes this approach so powerful isn’t just the tariff itself — it’s what we do with the money.

Today, the Trump tax cuts are set to expire unless Congress acts in the next few months. Making them permanent — especially the lower individual rates and the bonus depreciation for business investment — would lock in incentives for work, growth, and capital formation. But that can reduce revenue, at least according to the kind of budget models employed by the Congressional Budget Office and used to calculate the long-term deficit effects of legislation.

Tariffs offer a way out. They pay for tax reform by taxing upper-income consumption of imports. That lets us reduce the taxes that matter most for long-term growth: marginal tax rates on labor, capital gains, pass-through income, and reinvested profits.

Art Laffer — the economist who helped define supply-side economics — made the case clearly in a 2005 Wall Street Journal op-ed: “A consumption tax, unlike an income tax, doesn’t penalize success or discourage capital formation. It taxes people on what they take out of the economy, not what they put in.”

And in testimony before Congress, Laffer drove the point home: “We need to move toward a tax system that encourages production, not consumption. But until we get there, the best we can do is stop taxing production and start taxing consumption instead.”

That’s precisely what tariffs do — especially in an economy where imports tend to be discretionary luxuries rather than basic needs.

And unlike VATs or carbon taxes, tariffs don’t hit the family heating bill. They hit the luxury SUV.

Not Just Populism — Policy

This is more than political rhetoric. It’s sound economics. It’s built on what the research already shows: that consumption taxes are more efficient than income taxes, that tariffs can be designed to be progressive, and that a strategic shift in the tax base can fund pro-growth reforms without burdening the middle class.

The CBO’s own analysis confirms it. The academic literature supports it. And the political momentum is growing.

Tariffs aren’t just tools of trade. They’re instruments of tax reform. And in the hands of a new generation of economic nationalists, they’re poised to become something more: a new foundation for American prosperity, built not on taxing the work of our people, but on reclaiming the wealth that’s been bleeding out through decades of bad trade deals.

Read the full article here