Fed’s Rate Cut: A Premature Misstep From A Fed Pressured By Politics and Wall Street

The Federal Reserve’s 50-basis-point rate cut in September wasn’t just premature—it was the latest in a series of significant policy mistakes that casts a shadow on the Fed’s credibility.

Last Friday’s jobs report laid bare the misjudgment. With 254,000 new jobs and unemployment falling to 4.1 percent, the labor market is gaining strength, not faltering. Wages are up four percent year-over-year, further proof that the Fed’s justification for cutting rates was flimsy at best.

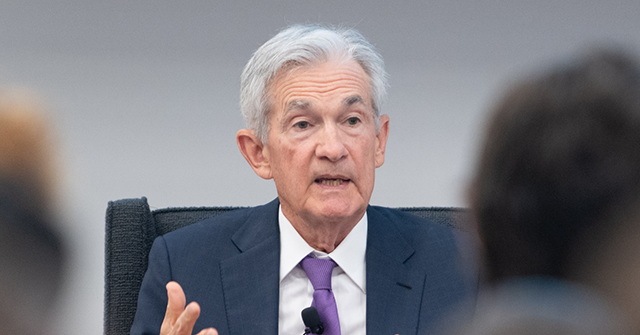

But this decision wasn’t made in isolation. It was the culmination of a political push from Democrats eager to secure a quick economic boost before the upcoming election and Wall Street’s clamoring for cuts. Top Democrats, including Senators Elizabeth Warren, Sheldon Whitehouse, and John Hickenlooper, called for an even more aggressive 75-basis-point cut, claiming that without swift action, the economy would face dire consequences. Their letter to Fed Chairman Jerome Powell pressed for “front-loaded” rate cuts to stave off what they said was a looming labor market crisis, despite mounting evidence that the labor market was stronger than they suggested.

A Misguided Political Agenda

The September jobs report makes one thing clear: the labor market isn’t collapsing, and inflation risks still persist. The economy is driven by resilient consumer demand, revised upward income data, and robust hiring. Yet, the Fed cut rates, not out of economic necessity, but under the weight of political influence and financial sector pressure. The Democrats, hoping for a sugar high to boost their election chances, wanted an even deeper cut, with Warren and others calling for 75 basis points. Their argument? That the Fed was being too cautious, risking a recession if it didn’t slash rates aggressively.

This is political opportunism at its finest. While Democrats cheered for more rate cuts, claiming they were needed to prevent a labor market collapse, Friday’s data showed the opposite: wage growth is steady, unemployment is falling, and the economy is expanding. It was a blatant misreading of the economic moment, but one that conveniently fit a political agenda. The Harris campaign, no doubt watching closely, was all too eager to position this as proof of their economic stewardship heading into the election. After all, they desperately needed a quick economic boost to distract from the underlying inflationary risks that remain unresolved.

Vice President Kamala Harris delivers remarks on August 15, 2024, in Largo, Maryland. (Official White House Photo by Lawrence Jackson)

Inflation Risks Mount, Workers Left in the Crossfire

The irony, of course, is that while the Fed’s rate cut was cheered by political leaders, it’s America’s working class who will likely pay the price. Wage growth is finally starting to outpace inflation, and workers are seeing long-overdue gains in their purchasing power. But with the Fed cutting rates prematurely, the risk of inflation creeping back into the picture grows stronger.

Democrats might claim that these rate cuts are necessary to protect workers, but in reality, these moves only make it harder for workers to hold onto the gains they’ve fought so hard to achieve. When inflation returns, it won’t be the political class or the financial elites feeling the pain—it’ll be ordinary Americans, paying more for everyday essentials as the cost of living rises faster than their wages.

The political dynamics at play here are troubling. Even before the Fed made its decision, the Democrats were lining up to push for more drastic cuts. Warren, Whitehouse, and Hickenlooper’s letter to Powell demanded that the Fed act more aggressively, warning that without significant cuts, the labor market could spiral into crisis. They conveniently ignored the fact that inflation, while moderating, is still above the Fed’s two percent target, and wage growth remains robust. The Democrats’ agenda was clear: get the economy moving faster ahead of the election, even if it means sacrificing long-term economic stability for short-term gains.

What’s more, Wall Street has been clamoring for a push almost since the Fed began raising rates. Many analysts were convinced Fed hikes would trigger a recession two years ago. More recently, they have been arguing that the Fed’s policy was highly restrictive and interest rates were too high—even though no signs of that could be seen in the real economy.

The Fed, under the weight of this political and financial sector pressure, cut rates. While Powell and other officials have tried to emphasize that the Fed remains independent, the timing and scale of this move at the very least create credible reasons to see the cut as political.

Even former President Donald Trump weighed in, warning the Fed not to make any rate adjustments ahead of the election, claiming it could interfere with the political process. Harris, predictably, framed this as an attack on the Fed’s independence, while conveniently ignoring her own party’s calls for deeper rate cuts. The political maneuvering on both sides only further illustrates how the Fed has become a pawn in a broader electoral game.

The Fed’s Premature Move Endangers Workers

At the end of the day, the Fed’s premature rate cut wasn’t about protecting the economy—it was about politics and keeping the Wall Street traders happy. Democrats, led by Warren and others, pressured Powell to make this move under the guise of safeguarding the labor market, even as the data clearly showed no such crisis.

Perhaps the Fed is innocent of politics here. It may really have become convinced by the narrative it has been hearing from Wall Street and Democrats that the “balance of risks” was now tilted toward a weakened labor market. The jobs report, however, suggests this was the wrong conclusion.

If inflation returns, it will be America’s working class that suffers. They’ve already waited too long for wages to catch up to the cost of living, and now they face the possibility of losing those gains to rising prices. The Democrats wanted more rate cuts to boost their electoral prospects, and the Fed delivered. But it’s the workers who will pay the price when inflationary pressures resurface.

What would have been the harm in waiting a few more months, until after the election, to cut interest rates? There’s no theory of monetary policy that demanded any rate cut in September, much less a 50 basis point cut. After a few months, the Fed would have had a much clearer picture of the economy than it did last month.

The bottom line is this: the Fed’s September rate cut was premature, driven by either political expediency or short-sightedness rather than economic necessity. Democrats pushed for an even deeper cut, but what the economy needed was patience, not political meddling. Workers deserve better than to be caught in the crossfire of Washington’s short-term political games.

Read the full article here