The Laffer Curve and the “Lost Decade”

It’s axiomatic that if you follow a bad map, you will end up in a bad place. Such is the power of bad ideas, including the bad thinking that guided U.S. economic policymaking in the latter half of the 1960s and all through the 1970s.

In Friday’s Breitbart Business Digest, this author recalled the power of a good idea. In 1974, when Arthur Laffer first drew his famous diagram for economic growth, he was just an associate professor at the University of Chicago. Only later in the 1970s would the Laffer Curve become well known. And not until 1981, with the inauguration of President Ronald Reagan, would Laffer’s thinking begin to actually unleash growth.

Yet in the meantime, under presidents of both parties in the 1970s, the American economy was ill, sickened by bad ideas. Unemployment went above nine percent, while inflation hit double digits. Things were so bad during that decade that wits blended the words “stagnation” and “inflation” to create an unpleasant new word, “stagflation.” Others added negative indicia to create the “misery index.” Meanwhile, serious-minded economists wrote books with defeatist titles: “limits to growth,” “steady-state economy,” “zero-sum economy.”

The underlying problem was the crack-up of the old economic policy model from diminishing returns on Keynesian tax-and-spend policies left over from the New Deal. Mainstream policymakers, Republican as well as Democrat, could think of no prescription other than higher taxes and more spending—even as they piled on new layers of regulation. The result was a “lost decade.”

Doubling Down on Keynesian Dogma

In such a doleful environment, one might have hoped that incumbent politicians would have been looking for fresh answers. But instead, lacking any sort of new vision, they doubled down on old failures.

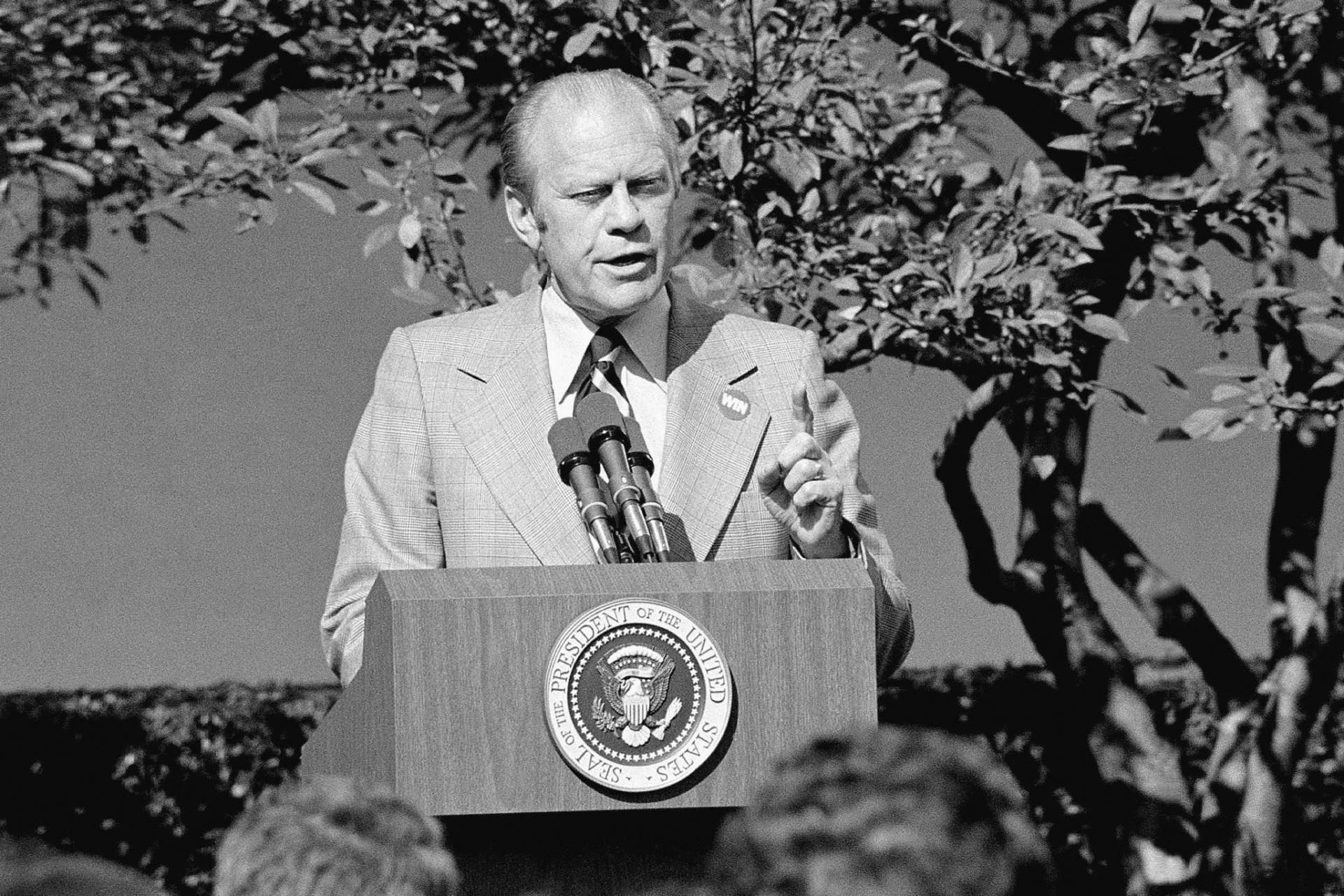

Case in point: President Gerald Ford. By all accounts, Ford, a Republican serving from 1974 to 1977, was a decent man. He was no leftist, but he was in thrall to the liberal ideas of the era. For instance, he accepted the Keynesian dogma that economic growth was a function of total spending; in the lingo, “aggregate demand.” According to this theory, the more money in circulation—especially if it was the federal government spending more—the more growth. As a critic of that idea, Ronald Reagan jibed that they believed they could “spend themselves rich.”

Missing from Keynesian thinking was any real consideration of incentives about how and why a producer actually produces. Absent thinking about incentives, politicians felt free to jack up tax rates; they thought they were striking a blow for “fairness” even as they were, they thought, generating more government revenues. In fact, the top income tax rate in the U.S. had been as high as 94 percent in the mid-20th century; in the 1970s, it was still a confiscatory 70 percent. Politicians didn’t notice that little money was actually raised at such rates for the simple reason that few wanted to work or invest if the taxman was going to take almost all of it.

Here’s where the Laffer Curve was so valuable: It helped to teach policymakers that tax rates—which determined the after-tax return from working and investing—were critical to production. Too-high rates equalled too-little production.

Economist Arthur Laffer stands before a chalkboard drawing of his famous Laffer curve, circa 1981. (AP Photo)

Moreover, if production were taxed into dwindling scarcity, adding money to the economy would not cause more output; instead, it would cause inflation, as extra dollars chased fewer goods.

Yet as we have seen, in 1974, nobody in power was listening to Laffer. That year, President Ford unveiled an economic plan so profoundly bad, so utterly wrong-headed, that it’s worth marveling over with an eye toward never making that mistake again.

Ford’s “WIN” Was a Big Loser

The most urgent economic concern in 1974 was inflation, which exceeded 11 percent. Ford and his economic team, slaves as they were to Keynesian thinking, thought they had the answer: raise income taxes.

Their idea: If there was too much money in the economy, take some of it out, thereby cooling aggregate demand. One possibility, of course, would have been to cut federal spending. But that was not on Ford’s mental menu—their economic plan actually called for federal spending increases. Instead, Ford sought to cool demand by bleeding it out of the economy through income-tax-rate increases.

Speaking to a joint session of Congress on October 8, 1974, Ford declared, “I am asking you to approve a one-year temporary tax surcharge of five percent on corporate and upper-level individual incomes.” And then, Ford continued, the additional money would be spent by the feds: “The estimated $5 billion in extra revenue to be raised by this inflation-fighting tax should pay for the new programs I have recommended in this message.”

By its own Keynesian logic, the plan made no sense: You don’t take money out of the economy to cool it down, and then give it to the bureaucrats so they could heat it up again. Yet Ford was so sure he had a winner that he called it WIN for “Whip Inflation Now.” But the idea that a sloganeering acronym could defeat inflation was seen as a bad joke. WIN was an obvious loser. Most people just laughed.

President Gerald Ford, wearing a WIN (“Whip Inflation Now”) button on his lapel, discusses his anti-inflation program during a press conference in the White House Rose Garden on October 9, 1974. (AP Photo)

This was the dead end of Keynesianism, and it wasn’t all Ford’s fault. The experts around him had high IQs and advanced degrees, and yet in their blind faith in an obsolete model, they were breaking faith with common sense, including the obvious reality that you don’t raise taxes—especially tax rates that determine the after-tax reward for activity—in a weak economy.

Fortunately, Congress never acted on Ford’s plan. And what did the American people think of it? They reacted negatively in two ways:

First, they began shrinking their economic activity. Ordinary folks might not have been fluent in “advanced” economic theory, but in their practical wisdom, they could see that hard times were coming, and so they pulled back from purchases and investments. The economy slid into recession; the stock market fell by half.

Second, they punished Ford’s Republican Party big-time in the November 1974 midterm elections, and Ford himself was defeated for a second term in 1976. Voters want more prosperity, not less, and so they punished the pols who pushed less.

Winning One for the Gipper

Only after Ford was out of office did Republicans begin to assess their failure and to think anew about success. So, it was time to listen to Art Laffer, who was by now teaching at the University of Southern California, where he came into contact with another Southern Californian—Ronald Reagan.

Economist Arthur Laffer (left) and former California Governor Ronald Reagan enjoy an anecdote at a businessmen’s conference in June 1978. (Bettmann/Getty Images)

In the late 1970s, former California Gov. Reagan was gearing up for his second presidential run, and Laffer—working with others, including Rep. Jack Kemp (R-NY) and a coterie of thinkers associated with The Wall Street Journal’s editorial page—provided the inspiration for Reagan’s tax policy. It was a policy of reducing tax rates and expanding supply, which was exactly the opposite of what Ford had been touting just a few years before.

Interestingly, the president who replaced Ford, Democrat Jimmy Carter, relied on mostly the same economic policies as Ford—and they worked just as badly for him. Same as Ford, Carter couldn’t think his way out of the policy cul-de-sac. So, he too beat his head against the same stagflationary wall.

What Trump Learned from Reagan

Thus it became inevitable that the tax-rate-cutting Reagan would win a big victory, which he did. Whereas Ford had lost the 1976 election by 1.5 million votes, Reagan won four years later by 8.5 million votes.

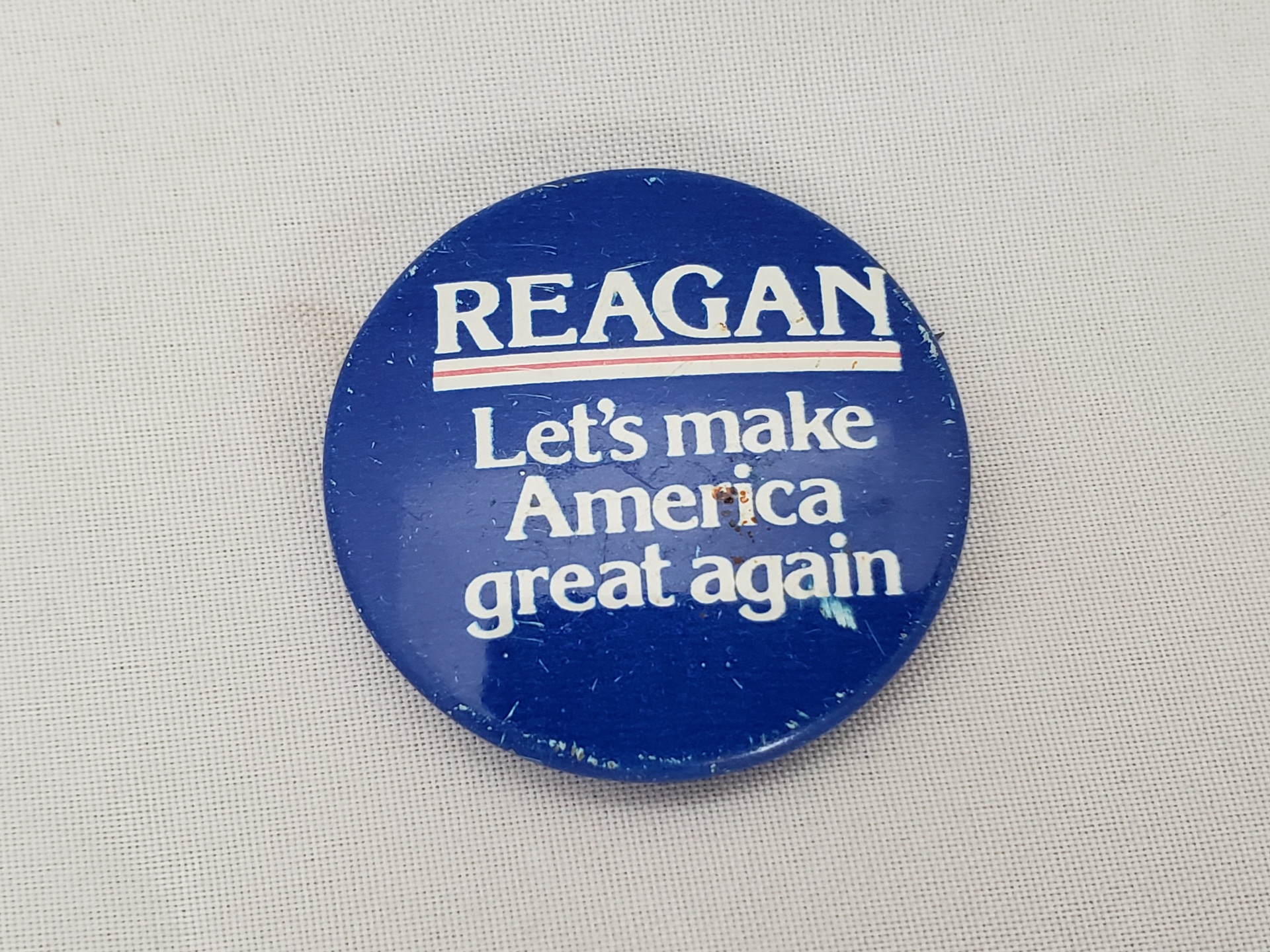

Then came the first iteration of “Make America Great Again,” inspiring a young Reagan fan, Donald Trump, to start thinking about electoral politics.

Close-up of a pinback button from Ronald Reagan’s 1980 presidential election campaign. (Smith Collection/Gado/Getty Images)

President Ronald Reagan shakes hands with real estate developer Donald Trump in a reception line at the White House on November 3, 1987. (White House Photo Office via Getty Images)

President Donald Trump speaks underneath a portrait of former President Ronald Reagan in the Oval Office on April 22, 2025, in Washington, DC. (Chip Somodevilla/Getty Images)

Now, of course, we’re in another era of MAGA, and Trump—who has installed a large portrait of Reagan near his desk in the Oval Office—is guided by the same tax-rate-cutting ideas, as well as his own unique deal-making skills.

Yes, good new days are here again. But we should never forget the bad old days. The Ford administration’s economic policies should stay with us as a good example of what not to do.

—Today’s Breitbart Business Digest was written by James P. Pinkerton.

Read the full article here