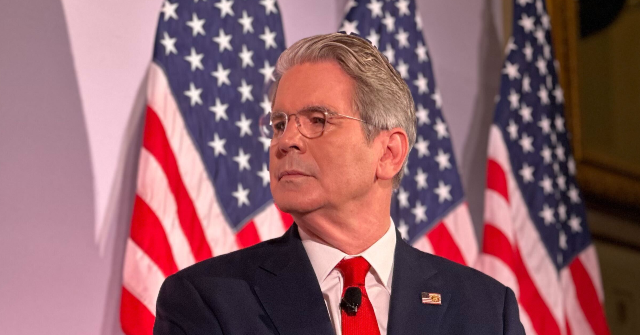

Treasury Secretary Scott Bessent, as acting commissioner of the IRS, could continue his mission to end the weaponization of the agency and unravel Biden-era policies.

Bessent visited the IRS for the first time as acting commissioner and has reiterated his three priorities for the agency: revenue collections, privacy, and customer service.

During his confirmation hearing, Bessent promised to end the politicization of the IRS:

Twenty members of the House Ways and Means Committee urged the IRS to reconsider a Biden-era guidance that created confusion for taxpayers and increased the likelihood of enforcement actions by raising questions about routine business transactions.

The Biden-era guidance, formally known as Revenue Ruling 2014-14, wrote to the IRS in July:

The result in the ruling is that the partnership tax laws are set aside to require the taxpayer to make basis adjustments that would not occur when applying the letter of the law. For so long as the ruling remains, taxpayers must guess between two mutually exclusive outcomes – basis adjustments as required by the law or basis adjustments required by the ruling. This leaves taxpayers uncertain about how and when to apply the partnership tax laws to commercial transactions.

Additionally, the ruling assumes that related-party transactions inherently lack a legitimate business purpose. This assumption is at odds with long-established tax law and the reality of how businesses operate. Related party transactions are routine in a variety of industries, including manufacturing, investment, and distribution, and are governed by provisions such as section 482 that are specifically designed to ensure fair treatment while recognizing their legitimacy.

In that same spirit, we believe that withdrawing Revenue Ruling 2024-14 and rejecting its flawed legal analysis would be an important next step toward restoring clarity and consistency in the tax code.

They added, “We are confident that under your leadership, the Department will continue its work to modernize tax administration while ensuring that enforcement efforts remain grounded in statute, fairness, and the need for taxpayer certainty.”

Sens. Marsha Blackburn (R-TN), John Barrasso (R-WY), Steve Daines (R-MT), and James Lankford (R-OK) in May called on the IRS to review Biden-era initiatives that targeted small businesses.

Reports found that Bessent’s control of the Treasury and the IRS will bring a “unified” vision to implementing the Big Beautiful Bill.

“What having one person with jurisdiction over both the operationalizing and the issuance of regulations of the bill does is eliminate the squabbling between the Treasury building and the IRS building,” David Kautter of RSM US, a former Treasury assistant secretary of tax policy, said.

He added, “Even though the IRS is a bureau of the Treasury Department, it has its own strong views at times on how things should be done.”

A Treasury Inspector General report in July found that audits of high-income Americans increased in 2024, which would fulfill the Biden administration’s 2022 agency directive.

The Small Business & Entrepreneurship Council (SBE Council) released a report in late July that found that reducing IRS tax enforcement uncertainty would boost the private sector by up to $118.8 billion every year, and employment would rise by 4.3 million jobs per year.

The SBE Council report found that small businesses are especially impact by enforcement uncertainty, as:

- 71 percent of small firms say tax enforcement uncertainty hurts their ability to compete with larger companies

- 57 percent spend at least nine percent of annual revenue on tax compliance

- 35 percent avoid claiming legitimate tax credits or incentives over fear of IRS scrutiny

“I think this is capable of streamlining issues, especially issues that are more politically sensitive,” Jorge Castro, a former counselor to the IRS commissioner, said. “But I think he’s going to walk that line in a fair and independent manner.”

Read the full article here