Are we wise enough to refuse politicians’ offer of “free money” to spend today that was stolen from our future, and from our future generations? Probably not.

Can Social Security be saved for future generations? Many have already concluded it’s hopeless, and if the current trajectory is left untouched, that is pretty much baked in. Only a radical reform of the program’s basic purpose, design and funding mechanisms could return the program to anything resembling sustainability and fairness.

Let’s start with a thought experiment: what if Social Security (SSA) had been an authentic pension plan rather than a pay-as-you-go social welfare program? The program’s accounting artifices obscure the reality that there is no “trust fund” of cash sitting in an account somewhere; all benefits are paid out of taxes collected from workers and employers today.

An authentic pension plan deducts a percentage from workers’ earned income and deposits these into a fund that earns income. The fund is in effect a savings account that accumulates the monthly deposits and interest until the worker retires, at which point the fund starts disbursing monthly retirement payments and continues to collect interest on the fund’s remaining balance.

In contrast, the SSA “trust fund” is an accounting gimmick that makes everyone feel warm and fuzzy, but it’s nothing more than self-serving delusion. The “trust fund” holds “non-marketable securities,” a nice way of masking the truth which is when SSA payroll tax revenues don’t cover SSA expenditures, the Treasury makes up the difference by selling Treasury bonds–the same way it pays for all other deficit spending.

When Social Security was launched in the late 1930s, the benefits were modest, and many people didn’t live long enough to collect benefits at age 65. The taxes collected from employers and employees were modest. The percentage of the populace who qualified to receive SSA benefits was also modest, while the population paying SSA taxes included every formally employed worker and their employee.

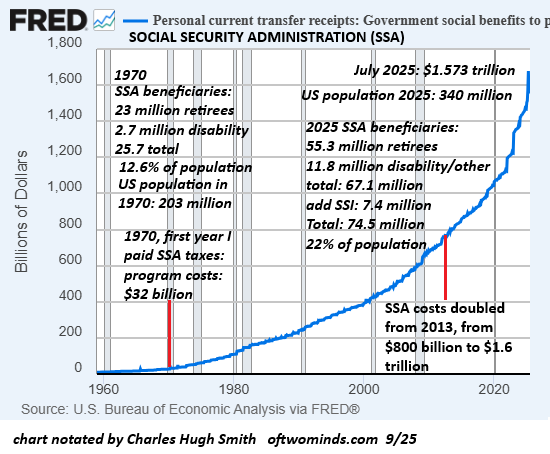

Fast-forward to 1970, the first year I paid SSA taxes as a 16-year old field worker in the summer before my senior year of high school. As the chart below notes, the US population in 1970 was 203 million, and the 25.7 million people who received SSA benefits were 12.6% of the total population. Total SSA program costs were $32 billion. For comparison’s sake, the Department of Defense (DoD) budget in 1970 was $80 billion.

In 2025, the situation has changed. The US population increased 67% to 340 million, the number of SSA beneficiaries has nearly tripled from 25.7 million to 74.5 million, and the program now costs about $1.6 trillion annually–almost double the 2025 DoD budget of $840 billion.

As noted on the chart below, SSA program costs have doubled from $800 billion in 2013, only 12 years ago, to $1.6 trillion today.

As is common when programs have essentially unlimited budgets and vast tax revenue streams, mission creep expanded those eligible to receive SSA benefits to include disability and Supplemental Security Income (SSI). These additional beneficiaries added to the program costs without increasing the tax rate collected from employers/employees, which has been unchanged at 12.4% (6.2% each from employer and employee) since 1990.

(The 2.9% Medicare payroll tax rate collected with SSA payroll taxes has been unchanged since 1986: 1.45% each for employer and employee.)

To answer this question–what if Social Security (SSA) had been an authentic pension plan rather than a pay-as-you-go social welfare program?–I did a deep dive into my own 55-year record of SSA contributions. This required some heavy lifting, as annual changes in inflation and the interest rate paid must be accounted for.

I used the BLS inflation calculator to adjust annual inflation, and the 10-year US Treasury bond yield as the benchmark for interest–in other words, as if my entire SSA payroll tax had been invested at the end of each year in 10-year US Treasury bonds. Yes, I know there are many quibbles with these benchmarks, but at least we can agree they are reasonable benchmarks.

The SSA calculates your benefit based on your highest 25 years of income, so the lowest-income 30 years of my 55 years of paying SSA and income taxes are dropped. The SSA also considers the average income of full-time workers: SSA National Average Wage Index. (On rare occasions, my income exceeded the average, but was generally sub-average.)

Adjusting your income for inflation and then organizing the adjusted number from highest to lowest offers interesting insights into the purchasing power of your wages over time. These reflect each decade’s broad-based standard of living, as the higher the purchasing power of one’s wages, the higher one’s standard of living.

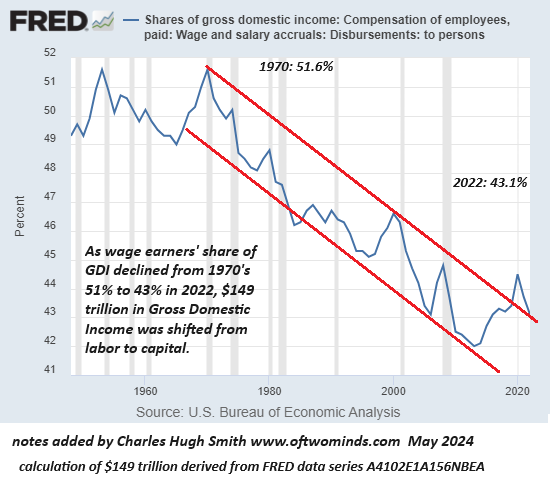

Adjusted for inflation, my highest earnings years were: 1989, 1997, 1990, 1985, 1976 and 1977. Two in the 1970s, when I was 23 and 24 years old, two in the 1980s, and two in the 1990s, decades in which more of the economic expansion “trickled down” to wages, a trend that ceased by the turn of the century when the dot-com bubble burst.

It is a sobering reflection on the US economy that the purchasing power of my wages as an apprentice carpenter at age 23 were rarely equaled in the five decades since. In terms of what my wages could buy, my earnings have never gone as far as they did in the mid-1970s, which is close to the peak of labor’s share of the national income (chart below).

By pure happenstance, my monthly Social Security retirement benefit is within a few dollars of the national average, so my record happens to reflect the national average. (I started drawing my benefit at full retirement age 67. I continue to pay both employee and employer SSA payroll taxes on my self-employed income as a scribbler, ahem, “content creator.”)

By age 67, the total nestegg of my SSA payroll taxes (not Medicare, only SSA) collecting whatever yield was paid by 10-year Treasury bonds reached $382,000 at age 67. Assuming the bond yields stay around where they are today–which are historically rather average–my nestegg would fund my retirement benefits until age 87, which significantly exceeds the current average life expectancy of American males (78 years).

I understand that many would say investing the payroll taxes in Treasuries is effectively tossing the money on a bonfire, but consider the possibility that if the entire working populace had a stake in Treasuries surviving a financial bubble collapse, then they might start electing (and re-electing) politicians who wouldn’t stripmine everything within reach to get re-elected. That change in values and voting would change the course of the system.

The point of this exercise is to show that if SSA were converted to a true pension plan system, the average wage earner could accumulate a self-funding pension plan just by investing the payroll taxes in Treasury bonds. Yes, I know many would prefer to invest in gold or bitcoin or stocks, but nobody would be stopping anyone from investing their non-SSA savings however they wished.

Can Social Security be saved for future generations? Let’s re-phrase the question in two ways.

1. Could money pile up for decades without politicians finding an excuse to drain that pool to win re-election by distributing “free money”? Not unless every politician who even suggested draining the pool for an “emergency” were voted out of office in the next election, without exception.

2. Are we wise enough to refuse politicians’ offer of “free money” to spend today that was stolen from our future, and from our future generations? Probably not. And that’s why Social Security is doomed to insolvency, and why we’ll never muster the political will to replace pay-as-you-go with a real pension plan for America’s wage earners. Short-term expediencies are the order of the day, as the Prime Directive is do whatever it takes to get re-elected every two years.

Wages share of gross domestic income: in a free-fall since 1970, and a cumulative total of $149 trillion shifted from labor to capital.

SSA tax rates 1937 to 2025

Check out my new book Ultra-Processed Life and my updated Books and Films.

Become a $3/month patron of my work via patreon.com

Subscribe to my Substack for free

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Ultra-Processed Life print $16, (Kindle $7.95, Hardcover $20 (129 pages, 2025) audiobook Read the Introduction and first chapter for free (PDF)

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $16, (Kindle $6.95, audiobook, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $15, (Kindle $6.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal $15 print, $6.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $6.95, print $16, audiobook) Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $6.95, print $15, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $3.95, print $12, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $3.95 Kindle, $12 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

Read the full article here