AI powerhouse Nvidia has announced a $5 billion investment in Intel, marking a strategic partnership aimed at accelerating advancements in artificial intelligence and personal computing. Intel shares have surged almost 24 percent at market open in response.

The Wall Street Journal reports that Nvidia, the world’s most valuable chipmaker and a central player in the ongoing AI boom, has taken a bold step by investing $5 billion in Intel, a company that has recently struggled to keep pace with its rivals.

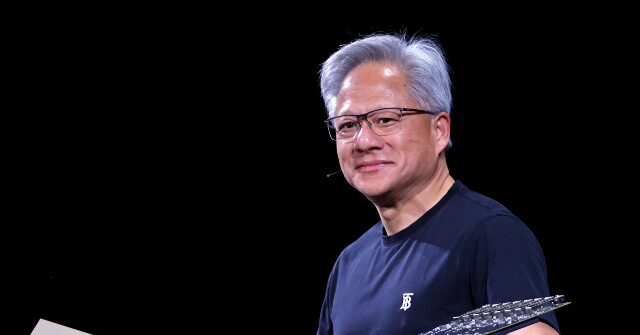

The deal is not just about capital. Nvidia and Intel have agreed to jointly develop new products for data centers and personal computing, leveraging each company’s strengths. Intel will manufacture Nvidia-custom x86 CPUs, which Nvidia will integrate into its AI infrastructure platforms. Additionally, Intel will build chip systems for Nvidia chiplets, the modular components that power next-generation PCs. This collaboration is expected to expand both companies’ ecosystems and lay the groundwork for what Nvidia CEO Jensen Huang calls “the next era of computing.”

This partnership comes at a critical time for Intel. The company has faced years of retreat and layoffs, losing ground in the fast-evolving market for AI-related chips — a space where Nvidia has excelled. However, recent moves suggest a concerted effort to reverse this decline. Just last month, Intel secured a $2 billion investment from SoftBank and received a significant boost from the Trump administration, which took a 10 percent stake in the company as part of an extraordinary intervention to support its turnaround.

As Breitbart News economic editor John Carney previously explained in the Breitbart Business Digest:

The charge that a government equity stake in a publicly traded company is, as some critics have said, a “hallmark of socialism” is deeply unserious. Socialists didn’t agitate for Washington to hold ten percent of Intel stock with no voting rights. They wanted the state to own and operate the means of production outright. A non-voting equity stake that recycles taxpayer risk into taxpayer return is not collectivization—it’s closer to what any hard-nosed investor would demand if asked to pony up billions. Calling this socialism is like calling a dividend check communism.

More concerning is the idea that the government may lose track of the national interest, chasing financial returns instead. The whole point of a sovereign wealth fund is not to maximize profit but to make viable those capital-intensive projects private finance won’t touch. The market can chase earnings quality. Government should be prepared to back ventures that might fail outright but still build capacity, deepen supply chains, and create national resilience. Sometimes we want the government to pick “losers” instead of “winners.”

The market has responded positively to the news. Intel shares surged on the announcement, up 24 percent at market open. Nvidia’s stock also saw an uptick, underscoring the market’s belief in the potential of this partnership.

Nvidia is purchasing Intel shares at a discount to the previous day’s closing price, a move that demonstrates both companies’ commitment to a long-term strategic relationship rather than a short-term financial play.

Industry observers see this as a win for both companies. For Nvidia, the partnership offers access to Intel’s manufacturing capabilities and a chance to further entrench itself in the AI and PC markets. For Intel, the deal provides not only much-needed capital but also a vote of confidence from a leading industry player, potentially accelerating its recovery and innovation efforts.

Read more at the Wall Street Journal here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.

Read the full article here