The dollar is “unattractive.”

At least that’s how UBS sees it.

In a recent note, the Swiss investment bank said it is time to “reduce and hedge exposure to USD before further dollar declines.”

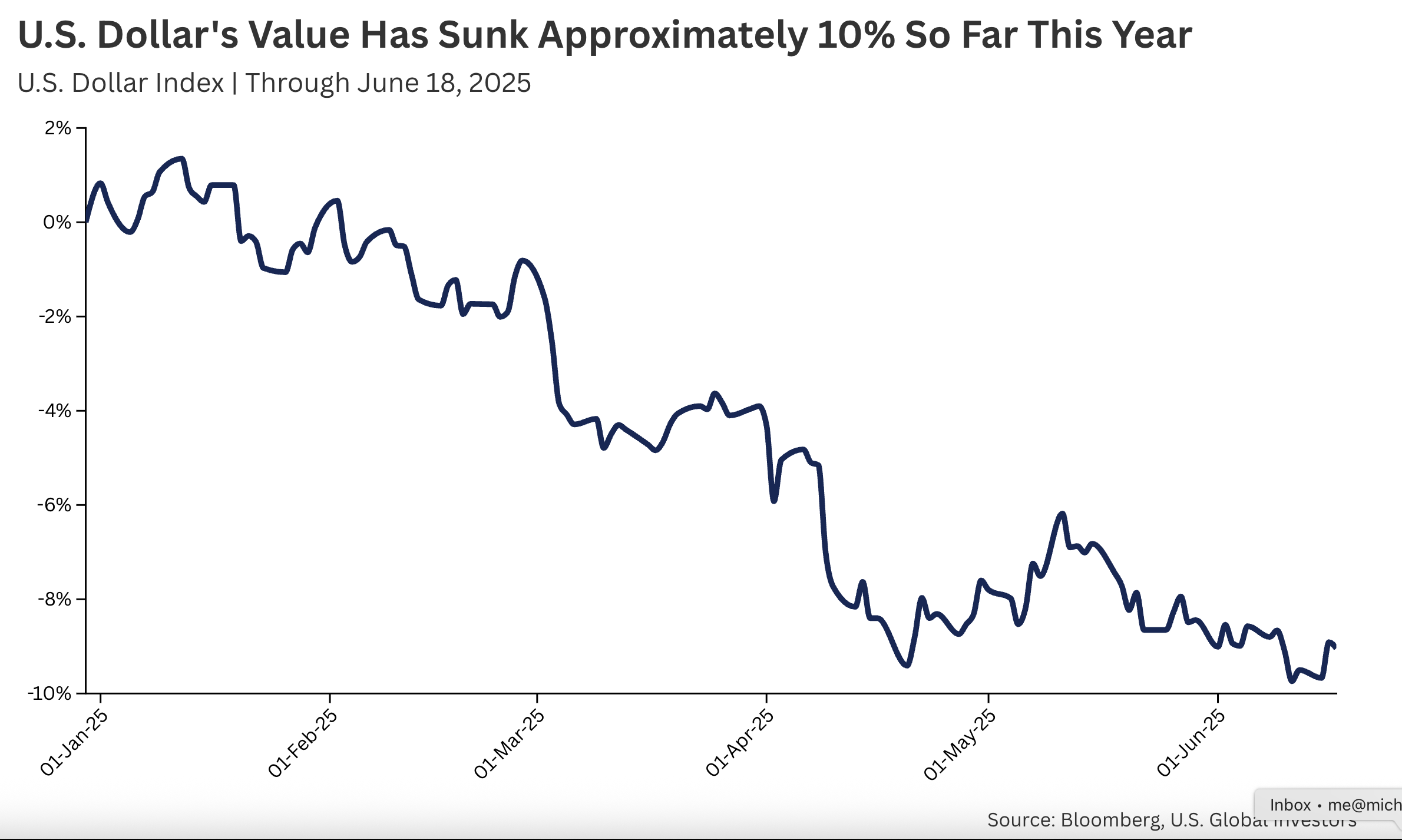

The dollar has weakened significantly over the last six months, with the dollar index (DXY) falling by over 10 percent so far in 2025.

It was the biggest dollar decline through the first half of any year since 1973. That was just two years after Nixon severed the last tie between the dollar and gold.

UBS analysts say they expect a further dollar weakness, and the U.S. economy slows, and worry about the rapidly deteriorating fiscal situation in Washington, D.C.

“We like using near-term dollar strength to reduce excess U.S. dollar cash by investing or diversifying into other currencies such as the Japanese yen, euro, British pound, and Australian dollar. We think now is the time to review strategic currency allocations in international portfolios and consider hedging U.S. dollar exposure in U.S. assets back into home currencies.”

Meanwhile, Bloomberg recently reported that many exporters “no longer want dollars,” explaining that foreign vendors are asking U.S. importers to settle invoices in euros, pesos, and yuan to avoid currency swings.

Interestingly, the UBS note forgot (left out) the most stable currency in its analysis – gold.

U.S. Global Investors Chief Investment Officer Frank Holmes didn’t forget. He called gold the “preferred reserve asset,” pointing out that “one of the surest beneficiaries of the dollar’s weakness has been gold.”

In fact, gold recently moved ahead of the euro as the second-largest reserve asset. But it’s not so much that central banks are trading in gold for euros. The EU currency’s share of global reserves has remained relatively steady.

They’re swapping dollars for gold.

Last year was the third-largest expansion of central bank gold reserves on record, coming in just 6.2 tonnes lower than in 2023 and 91 tonnes lower than the all-time high set in 2022. (1,136 tonnes). 2022 was the highest level of net purchases on record, dating back to 1950, including since the suspension of dollar convertibility into gold in 1971.

To put that into context, central bank gold reserves increased by an average of just 473 tonnes annually between 2010 and 2021.

Meanwhile, the dollar’s share of global reserve currencies slid further in 2024. As of the end of last year, dollars made up 57.8 percent of global reserves. That is the lowest level since 1994, representing a 7.3 percent decline in the last decade. In 2002, dollars accounted for about 72 percent of total reserves.

Respondents to a recent World Gold Council survey think this trend will continue, with 73 percent saying they expect their dollar reserves to decline even more in the next five years.

And they expect to buy more gold.

Of the 73 central banks that responded to the survey, 95 percent said they believe central bank gold reserves will increase over the next 12 months. A record 43 percent of the respondents indicated they expect their own gold reserves to expand. That was up from 29 percent in 2024.

That’s not to say the dollar is going away anytime soon. Holmes noted that the greenback still dominates trade and debt markets.

“But its supremacy is gradually slipping, and the evidence is mounting.”

What does that mean for investors?

Holmes said they “should think carefully about how exposed their portfolios are to a single currency.”

“Just as central banks are hedging their dollar exposure with gold and foreign assets, individuals and households may want to do the same.”

He’s right.

Even a modest de-dollarization of the global economy could be a disaster for the United States.

The U.S. depends on this global demand for dollars supported by its reserve status to underpin its massive government. The only reason Uncle Sam can borrow, spend, and run massive budget deficits to the extent that it does is the dollar’s role as the world’s reserve currency. It creates a built-in global demand for dollars and dollar-denominated assets. This absorbs the Federal Reserve’s money creation and helps maintain dollar strength despite the Federal Reserve’s inflationary policies.

So, if the world no longer needs dollars, who will absorb the inflation?

American consumers.

Again, we don’t have to have a currency collapse for there to be problems. A partial de-dollarization of the world economy would cause a dollar glut. The value of the U.S. currency would further depreciate. That translates to more price inflation at home. In the worst-case scenario, the dollar could collapse completely, leading to hyperinflation.

Read the full article here