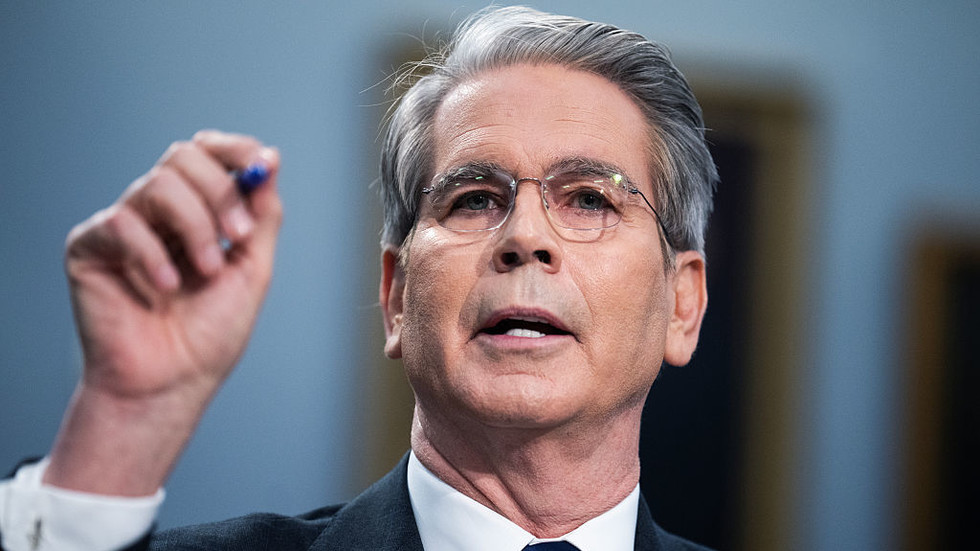

Scott Bessent has urged Congress to raise or suspend the debt ceiling to avoid running out of money to cover federal expenses

The US could default on its obligations by the end of summer, Treasury Secretary Scott Bessent has warned. In a letter to Congress on Friday, he urged lawmakers to act by either raising or suspending the debt ceiling – a cap on how much the government can borrow – to avoid running out of money to cover federal expenses.

The country hit its current statutory debt limit of $36.1 trillion in January. Once the ceiling is reached, the government can no longer borrow to meet its obligations in full and on time. By now, total US debt has risen to $36.2 trillion, according to official data. However, the Treasury has relied on ‘extraordinary measures’ – primarily accounting tactics like pausing payments into civil service retirement funds – to continue to meet its obligations and delay default.

Republicans have reportedly been working on a legislative package that would raise the limit by up to $5 trillion, largely by extending and expanding President Donald Trump’s 2017 tax cuts. However, recent reports suggest that negotiations are progressing slowly and could take months.

Bessent said there is a “reasonable probability” that the Treasury’s emergency measures will run out by August, when Congress is scheduled to recess. He called on lawmakers to finalize the package by mid-July, warning that missing the deadline could leave the government without options to stave off default.

“I respectfully urge Congress to increase or suspend the debt limit by mid-July, before its scheduled break, to protect the full faith and credit of the United States,” Bessent wrote in a letter addressed to House Speaker Mike Johnson.

“A failure to suspend or increase the debt limit would wreak havoc on our financial system and diminish America’s security and global leadership position,” he added.

Bessent went on to warn that “waiting until the last minute to suspend or increase the debt limit” could have “serious adverse consequences” for financial markets, businesses, and the federal government, harm business and consumer confidence, and raise borrowing costs for US taxpayers.

The Congressional Budget Office has projected that the emergency measures would be exhausted in August or September.

The debt ceiling was raised three times under former President Joe Biden. Trump has argued that the cap should be abolished entirely, calling it pointless if it’s routinely lifted.

READ MORE:

Moody’s issues warning on US finances

Bessent has pledged that a default will be avoided. Speaking at a House Appropriations Committee hearing last week, he said, “The US government will never default,” assuring lawmakers that the Treasury “will make sure that the debt ceiling is raised.”

You can share this story on social media:

Read the full article here